7 Points to Profit From

Current volatility is wreaking havoc across virtually every market, but we see the greatest risks being located in the retail industry and emerging markets.

We believe that while the current volatility is in the S&P 500 and the Nasdaq is troublesome, the real, larger risk is in emerging markets. Reminiscent of the VIX in the late 90s, where despite the increased volatility in the Nasdaq, the trade was shorting emerging markets. With disruption in global supply chains, EM will feel the brunt of the impact reverberate through their economies.

Source: Tradingview. Emerging Market Index (EMF) vs. Volatility Index (VIX) .

We continue with our thesis of shorting the old economy versus remaining long the new one. Following our thesis, some companies we recommend shorting include: Simon Property Group (SPG), 3M (MMM), Alcoa (AA), Exxon Mobil (XOM), Chevron (CVX) and the S&P Energy ETF (XLE).

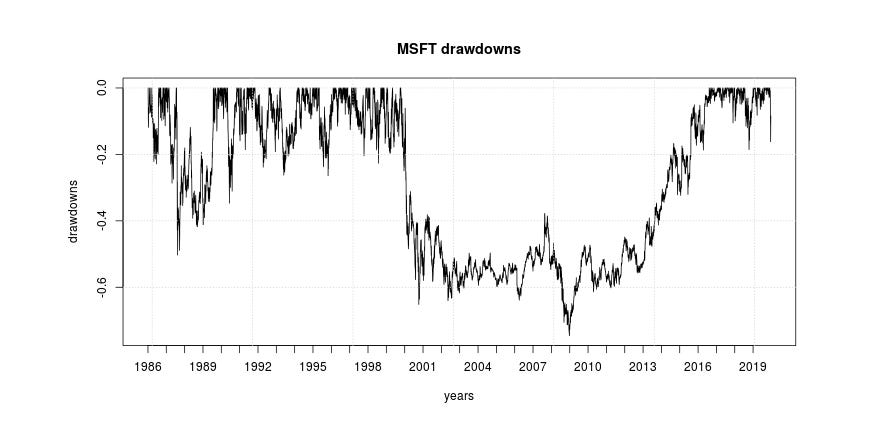

Microsoft (MSFT) remains one of our favorites as part of the new economy. MSFT is a Rockstar and this turmoil in the market could provide a cheaper entry point for the long run. When we see the dynamics of the drawdowns still at the level of late 90s — the signal is to buy.

One of the industries that was most disrupted by the internet was the shopping mall industry. Amazon has completely changed the buying behavior of consumers and diminished the need for shopping malls. Since 2017 there have been massive bankruptcies throughout retail. Once giant staples, the likes of Sears, Toys R Us and Barney’s among others have gone under. Brick and mortar stores are seemingly less and less essential to consumers. Simon Property Group (SPG) isn’t ready to give up on the old economy yet as the company has been investing heavily in the retail space as evident through their recent dive into the bankrupt Forever 21 and the $3.6 billion acquisition of Taubman Realty Group, which owns, manages and leases 26 malls in the United States and Asia. SPG is a clear short in our opinion.

Source: tradingview. SPG share price

Globalization also represents the old economy. The reconfiguration of the global supply chains due to trade wars and the coronavirus is strangling companies' abilities to execute around the globe. On top of this problem, massive conglomerates like 3M (MMM) have strayed from their core business functions that promote organic growth and innovation. 3M quite literally attempted to put a band-aid over their problems by acquiring Acelity, Inc, a company specializing in wound-care, for $6.7 billion. There has also been a clear decoupling between MMM drawdowns compared to SPY drawdowns since February 2018. These are just a couple reasons that make it one of our favorite short plays.

S&P500 vs. 3M

The old economy has plenty of zombies and the credit market is not reflecting the level of stress adequately across many sectors. The insensitivity of the high yield market to the recent volatility is a warning flag that the potential for a high degree of credit stress could be on the horizon. The Fed has added liquidity, but copper and oil are signaling that the real problem is in the underlying demand.

Source: Tradingview. High Yield Bond ETF (HYG) vs. Copper.

Macrowise’s suggestions are based on our proprietary tool - Kafka. This tool classifies stocks into four categories: Rockstars, Icarus, Zombies and Seedlings. ETF type of diversification is not sufficient during high volatility environments. If you would like access to our tool, please reply to the newsletter.

Guillermo Valencia A

Head of Global Macro Research

March 3, 2020.

Brazil