A New Cold War Emerges: Challenging the Larry Summers Stagflation Paradigm

The Larry Summers' stagflation prophecy, while captivating, pales before the unfolding saga of the New Cold War.

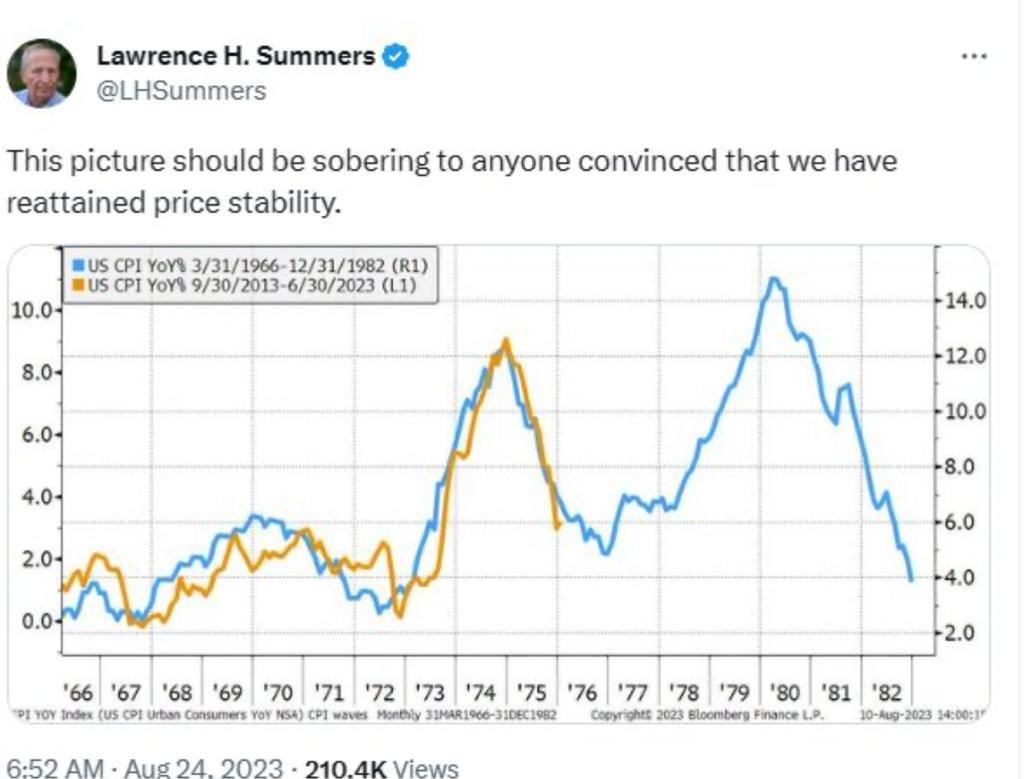

As I step into the intricate corridors of the global financial labyrinth, my mind echoes with the methods of deduction akin to a modern-day Sherlock Holmes. The current narrative is draped in the chilling specter of history's shadows, summoned by the cryptic predictions of none other than Larry Summers. His specter, like a ghost of financial past, conjures the ghastly image of stagflation, a word that sends shivers down investors' spines as they tread these perilous waters.

But let us delve into the depths of reason and sift through the financial evidence before us. The Federal Reserve and the market at large seem to dance to Summers' dirge, their movements mirroring the stagflationary symphony of the '70s. Yet, appearances can be deceiving. History reveals other facets of inflation, morphing like a chameleon across the ages.

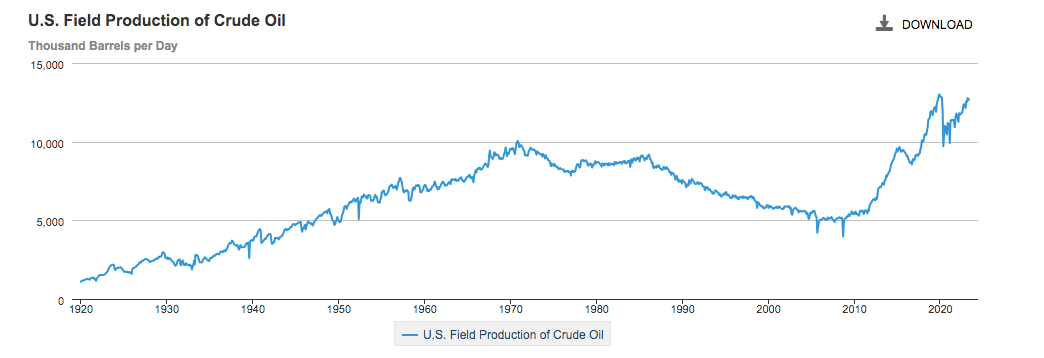

Amidst this financial puzzle, a counterpoint emerges: the enigmatic Production Price Index. Its whispers hint at a different tale, one painted in the hues of deflationary tendencies. As the echoes of pre-pandemic cargo costs and U.S. oil production reverberate, the tableau takes on a hue unfamiliar to the tumultuous '70s.

Production Price Index. Source: St Louis Federal Reserve

Global Container Shipping Rates 2023. Source: Statistics.

US crude oil production. Source: EIA.

Ah, but what of the titans that braved the storms of yore? Coca-Cola and Procter & Gamble, stalwarts of eras past, stand today in a different light. Their financial profiles deviate from the pages of history, the lines of their drawdowns sketching a narrative that diverges from the well-worn script.

Drawdowns Coca-Cola and Procter and Gamble.

And now, cast your gaze upon high yield bonds and emerging markets—realms tinged with a bearish overtone. The pieces may seem disjointed, but consider them as notes in a symphony that echoes the larger narrative—a world echoing shades of a bygone era, perhaps.

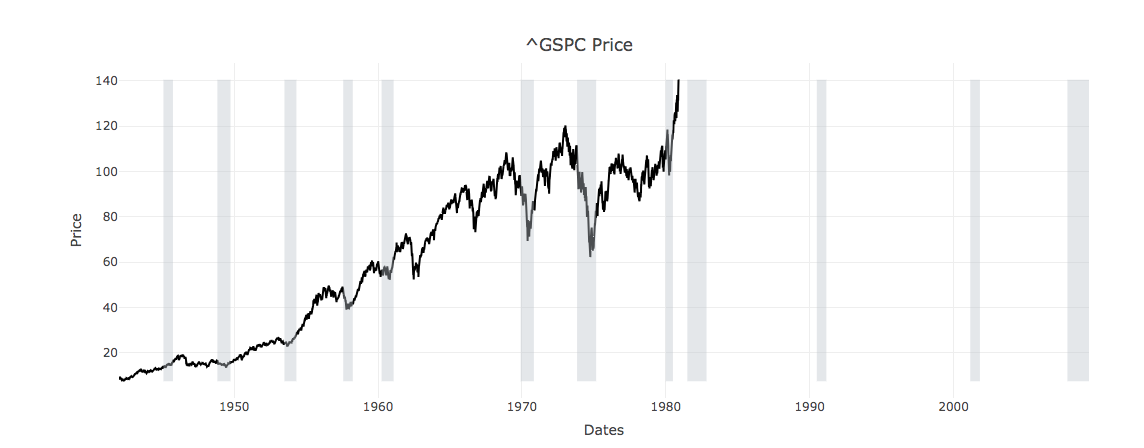

Yet, the heart of this mystery rests within the bonds market. The passage of time reverberates through the annals, etching its mark on treasuries. Equities and commodities, in contrast, offer fleeting glimpses of opportunity amid their perpetual dances.

The puzzle pieces align further as the S&P50 takes center stage, carving a trail through the icy terrain of the Cold War's embrace. Its resolute ascent stands in stark contrast to the trials faced by U.S. treasuries—a realm that endured a multi-decade bearish odyssey.

S&P500 : 1942 - 1980. Source: Robert Shiller database.

Therefore, as I methodically dissect the intricate threads woven by history's hands, a conclusion emerges. The Larry Summers' stagflation prophecy, while captivating, pales before the unfolding saga of the New Cold War. A narrative emerges—one that beckons me, to chart a course beyond the echoes of the past and decipher the enigma of the present.

US treasuries index from 1942-1980. Source: Robert Shiller database.

For, just as Sherlock navigated through smoke and mirrors to reveal the truth, I traverse the financial haze, piecing together evidence to solve this intricate financial puzzle. And it is not the specter of stagflation that looms largest, but a resolute conviction that the global stage is set for a new era—an era where financial tides shift in response to the whispers of geopolitical recalibrations.

Guillermo Valencia A

Florianópolis, Brasil.