A Tale of Economic Metamorphosis

Are we in a Cold War 2.0 with US-China tensions that might instead spur US growth through domestic investment and innovation, lifting the stock market further?

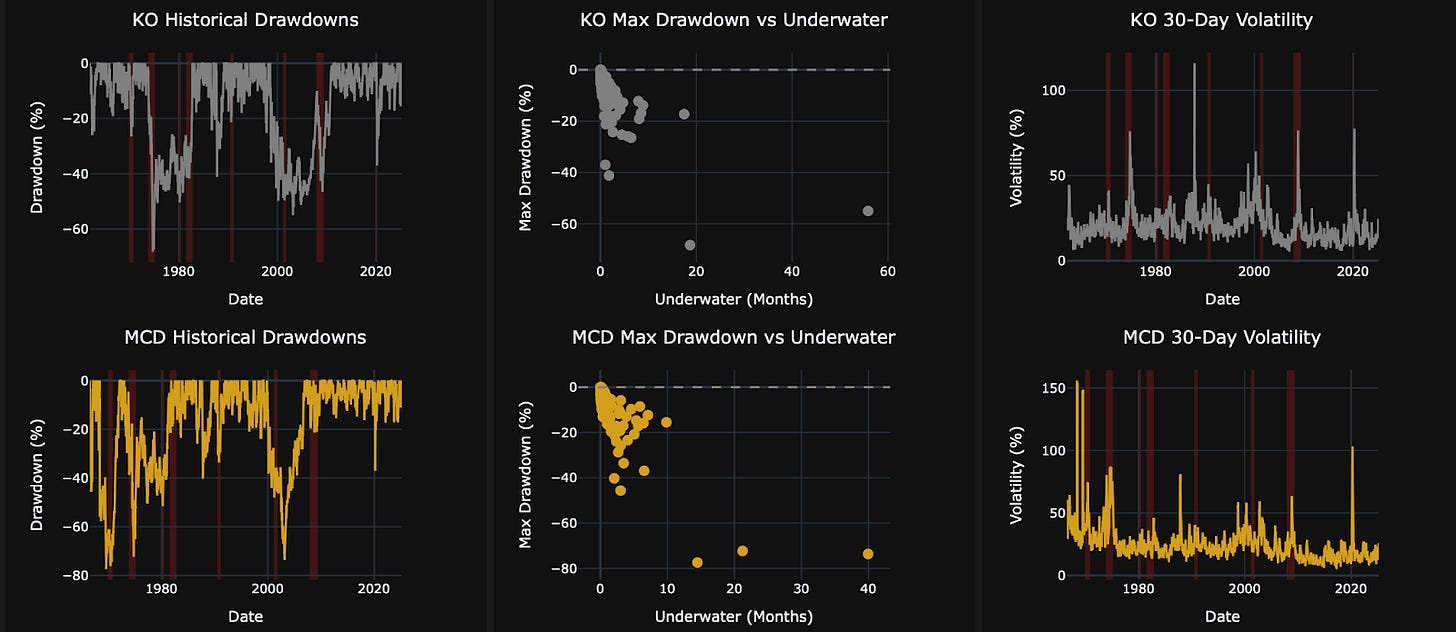

Amid the noise of Twitter threads and news headlines—where contradictory opinions hijack our attention—Coca-Cola and McDonald’s stock prices offer a steady signal of the economy’s health, cutting through the clutter. Using the dragonfly metaphor, their drawdowns reveal three states of economic metamorphosis: the nymph stage of struggle, the emergence of wings in transformation, and the steady flight of prosperity.

The Nymph Stage: 1970s and 2000-2009

Zombie periods signal stagnation. In the 1970s, Coca-Cola’s 68.22% drawdown (1970-1985) and McDonald’s 50% drop (1973-1974) reflected the oil crisis and stagflation, with US inflation at 11.1% (1974) and global trade disruptions. From 2000-2009, Coca-Cola’s 41.67% drawdown (2000-2005) and McDonald’s 60% drop (2000-2007) were driven by the dot-com crash and 2007-2009 financial crisis, with global GDP contracting 0.1% in 2009.

The Transformation State: 1980s, 1970s, and 2000s Recovery

Dragonfly moments mark recovery. Post-1970s, Coca-Cola transformed in 1985 (GDP growth 4.2%) and McDonald’s in 1976 (GDP 5.4%), with global trade liberalization aiding growth. Post-2000-2009, Coca-Cola emerged in 2004-2005 (GDP 3.5%) and McDonald’s in 2006-2007 (unemployment 4.6%), driven by rate cuts and a housing boom.

The Dragonfly in Steady Flight: 1980s, 1990s, Post-2009, and Trump Trade Wars

Rockstar moments show prosperity with small drawdowns (<15%). Coca-Cola thrived from 1985-2000 and post-2009, McDonald’s from 1976-1987 and post-2009, with GDP growth averaging 3.5% (1990s) and global trade up 6% annually. The 2018-2019 Trump trade wars caused minor volatility (5-7% drawdowns) but no lasting impact or recession—GDP grew 2.5% (2018) and 2.3% (2019), and both stocks recovered quickly, up 1.4% (Coca-Cola) and 6.2% (McDonald’s) in 2018.

The Dragonfly Today: A Healthy Economy

As of March 2025, Coca-Cola and McDonald’s show small drawdowns (<10%), with the US economy growing at 2.8%, unemployment at 4.1%, and global trade up 3%. They signal a healthy economy in a rockstar state, a clearer indicator than social media noise. But what could trigger a stagnation like the 1970s or 2000-2009? Supply chain disruptions, a full-scale war, or are we in a Cold War 2.0 with US-China tensions that might instead spur US growth through domestic investment and innovation, lifting the stock market further? Only time will tell—but for now, invest in the signal, filter the noise.

Thanks for reading,

Guillermo Valencia A

Cofounder MacroWise

March 29th, 2025