Argentina: The Milei Opportunity in a Menem Echo

A 10-Fold Opportunity in the Next 5 Years? Opportunity in Banco Macro (BMA) and Mercado Libre (MELI)

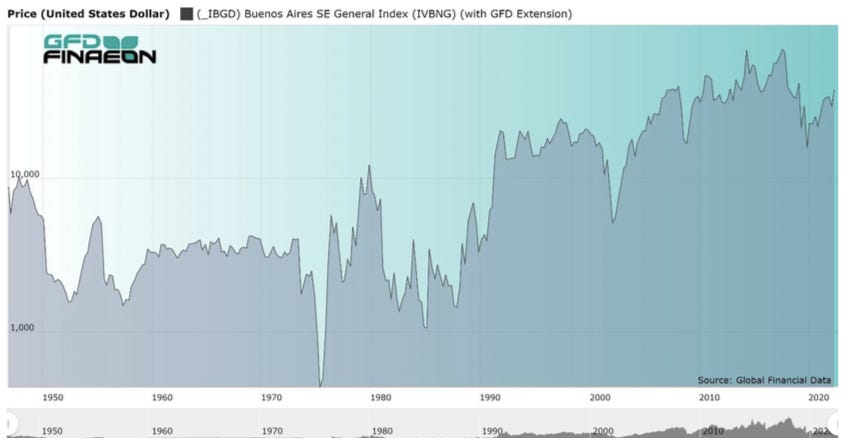

In the unpredictable currents of Latin America's economic landscape, a fresh narrative is unfurling, hinting at transformative possibilities for Argentina. As we prepare for potential storms, a historical cautionary tale reverberates—a tale that mirrors the Menem era's rise and fall, with annual returns soaring to 99% before plunging into economic collapse.

Menem's Symphony and Discord:

Argentina Index. 1947-2022. Source: Global Financial Data.

The Menem era unfolded against the backdrop of great expectations, fueled by the transition from the hyperinflated Peso to the stable Dollar. However, the envisioned economic shift post-1991 remained elusive, leaving investors grappling with unmet growth projections.

Long-Term Consequences:

Over time, the fixed exchange rate and associated policies cultivated structural issues—lack of competitiveness, trade imbalances, and an excessive reliance on the U.S. dollar.

Corruption Allegations and Political Controversies:

Menem's presidency resonated with discordant notes, marked by corruption scandals involving illegal arms sales, embezzlement, and financial irregularities. Political maneuvering, including controversial decisions, further fueled a polarized political environment.

Social Inequality and Unemployment:

Economic growth failed to harmonize with widespread social development. High income inequality and persistent poverty rates marred the rosy economic picture.

Failure to Address Structural Issues:

Menem's government neglected crucial structural reforms, failing to address underlying economic issues and the imperative for diversification.

Dependency on External Factors and Convertibility Plan:

Economic stability teetered on the precipice of external factors. The fixed exchange rate became unsustainable, culminating in the 2001 crisis and the abandonment of the Convertibility Plan.

Milei's Symphony in the Making:

Drawdowns Banco Macro (BMC) and Mercado Libre (MELI)

In the unfolding narrative, newly elected President Javier Gerardo Milei proposes a symphony of reforms that bears both similarities and departures from Menem's discordant era.

President's Reform Agenda:

Milei envisions a comprehensive reform plan spanning 35 years, promising a transformation in three successive stages.

Liberal Ideology and Phases of Reform:

'La Libertad Avanza' defines liberalism as boundless respect for lives and property rights, even embracing Bitcoin. The initial phase involves substantial cuts in government spending, tax reform, and enhanced labor flexibility, accompanied by financial reforms promoting free banking and foreign exchange competition.

Immediate Economic Policies and Privatization:

Swift actions include eliminating ineffective government spending, optimizing staffing, and a promised 15% reduction in government spending. Privatization becomes a focal point, targeting unprofitable state-owned enterprises and proposing special treatment for agriculture and fisheries.

Security Measures, Firearms Ownership, and Labor Reforms:

Milei advocates for correctional institutions based on public-private partnerships, exploration of a lower criminal responsibility age, and a unified National Security System. He supports lawful firearms ownership and proposes labor reforms, including a new law on employment contracts and reduced taxes for employers and workers.

Conclusion:

As Argentina navigates the economic seas, the echoes of Menem's era serve as a compass, guiding us through potential pitfalls and promising waters. Milei's symphony, while composed with a different melody, draws parallels and diverges strategically. The coming years will unveil whether this new narrative will lead Argentina to harmony or discord in its economic evolution.

Guillermo Valencia A

Co-founder Macrowise

Brazil, 29th November 2023