Between Grandmasters and Game Changers

Not taking risks in life is the most certain path for failure.

Risk is a challenge

When we think about risk we think immediately about danger, failure, loss. But this is just one part of the picture.

Risk is a situation where the market invites us to play a game, either gently or abruptly. There are always two possible outcomes- you solve the problem and win; or you don't and you lose. However, everytime you lose, some information about the structure of the game is revealed.

So, how to win the game? The first step is to understand the game. If you don't understand the rules of the game, then a loss is all but a certainty. The second step is to play many games, try different strategies and keep a detailed record of your improvements. Along the way, spot the patterns that decrease the probability of losing and adjust accordingly.

One common strategy is imitating the lessons from grandmasters and hopefully after 10,000 hours of training, you will manage to be better than 80% of your competitors. At that moment, you yourself become a grandmaster!

In investing there are many types of grandmasters: value, quant, growth, quantmental, event driven, the big shorters, the global macro, and the venturers.

If you don't want to follow the path of a grandmaster or your skills are better used in other activities, the best way of winning the game of investing is to find an early grandmaster, build a relationship with them and structure a win-win deal.

However, there is one little secret … Just about every 40 years, the majority of the great masters eventually lose the game at the same time. By this moment, the game most likely looks vastly different than how it began. It's often strange, convoluted, it might not appear to make any sense. The council of masters claim that it is madness! However, there is a small group of grandmasters (global macro-venturers) that know a new game is emerging. They know the game changers are in town and it is all about understanding the rules of the new game.

The game changers range from technological disruptions to unexpected events that trigger deep changes in our social structures. The game changers are radical and force every single habitant of Earth to play a new game!

A Grandmaster faces the Game Changers

Let me introduce Mr. Ossip Bernstein. He was born in Ukraine, to a wealthy family in 1882. He was a grandmaster in many of the ventures in his life. He managed to become an excellent lawyer and at the same time a fantastic chess player who was able to challenge other masters like Capablanca and Lasker.

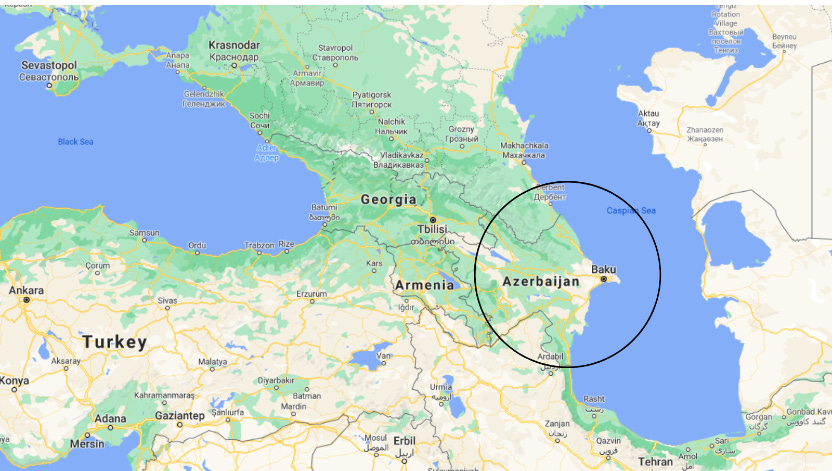

Very early on he amassed a small fortune for himself. He was in the right game at the exact moment. It was a fantastic period of industrialization in Tsarist, Russia. Robert Nobel, the brother of Alfred, the inventor of dynamite and the Nobel prizes, was born decades before Ossip and saw an amazing opportunity in replacing the oil coming from whales with Kerosene coming from the Caspian Sea in Baku. The oil whale lamps were a thing of the past. The new game was Kerosene, and the one controlling kerosene would control the world.

The legendary Nobel brothers were not alone in this venture. John Rockefeller spotted the same game. However, Rockefeller understood the game was not only about oil drilling but also about distribution. The control of the railroads was a key element of this game.

Robert was not aware of that. A geographic problem arose as Azerbaijan and Turkey were not blessed with the flat planes and easily navigable rivers like the United States. Although, the Nobels were blessed with the super power of creativity. They pretty much invented the oil pipelines. They also partnered with the Rothschild banks in France to ensure maritime transportation. Ships from British Petroleum and Royal Dutch Petroleum would distribute the Russian oil.

Baku, today Azerbaijan.

The business was prosperous! Game changers were in town. Kerosene, the T- Model, Electricity, the Telegraph, the Electric Lamps, the Airplane... For some, the Belle Époque, for others the Gilded Age. The truth was that humankind was at the tipping point of a tremendous transformation.

“Beautiful credit! The foundation of modern society. Who shall say that this is not the golden age of mutual trust, of unlimited reliance upon human promises? That is a peculiar condition of society which enables a whole nation to instantly recognize point and meaning in the familiar newspaper anecdote, which puts into the mouth of a distinguished speculator in lands and mines this remark: 'I wasn't worth a cent two years ago, and now I owe two millions of dollars.”

― Mark Twain, The Gilded Age

In 1914, World War I began when the Tsarist Army partnered with the British and the French to fight against the Austro Hungarians, Prussians, Italians and the Ottomans. War was a price the Russian people did not want to pay. Bolchevique overthrew the Tsar. The Nobel Family exited their venture in Baku. The Rothschilds quickly sold part of their business to Standard Oil.

Ossip was in front of the Square of the Dead when suddenly, the captain of the firing squad asked loudly - Are you Ossip Bernstein, the famous chess player?

If you win in a chess game, you can escape, if you draw or lose, you are a dead man. Of course he won, he was grandmaster! He escaped to France where he quickly managed to recover and build a new fortune. Unfortunately for him, it was only 20 years until the country was occupied by the Nazis. He was bankrupt and running for his life again.

After all, risk is the fuel of life, fortune and intelligence.

Thanks for reading,

Guillermo Valencia

July 23th , 2021

Florianópolis, Brazil.