Bitcoin and the Age of the Electricity Standard

Now, we are entering a new era where the backbone of the global economy is not gold or oil, but electricity.

The history of emerging markets is one of recurring crises:

1982: The Latin American debt collapse.

1995: The Asian financial crisis.

1998: The Russian default.

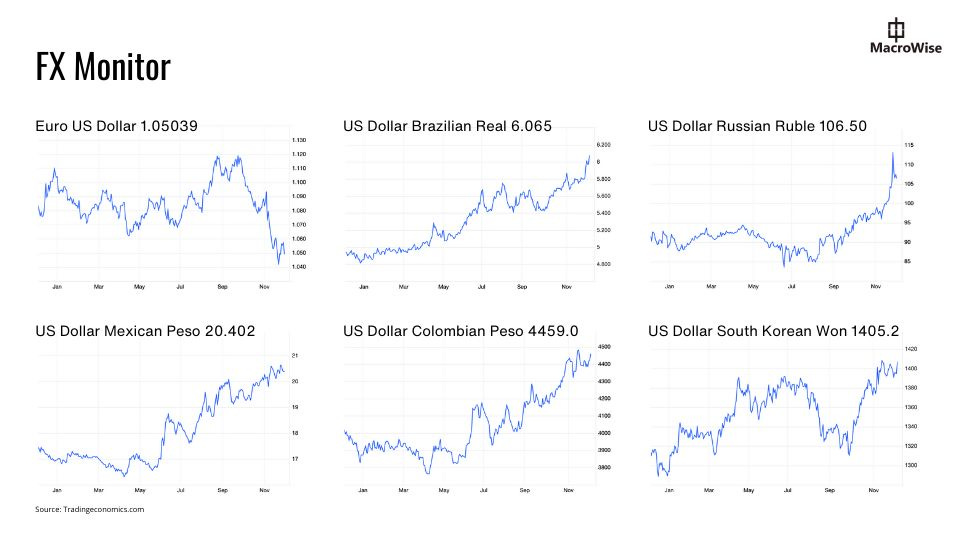

Each event left economies vulnerable and their citizens with nowhere to turn. Today, a familiar story unfolds as the Real brasileño, Won koreano, and Rublo ruso test new lows. But this time, something has changed. For the first time in history, there is an alternative—Bitcoin.

Bitcoin is more than a currency; it is the monetary layer of the internet. It provides a decentralized refuge, unbound by governments or failing systems, offering individuals the possibility of financial sovereignty. Yet, Bitcoin’s significance extends far beyond finance.

Critics of Bitcoin often ask: what backs it? The answer is as transformative as it is simple. At one time, it was the gold standard. Then came the petrodollar, tethering global value to oil. Now, we are entering a new era where the backbone of the global economy is not gold or oil, but electricity.

Bitcoin represents the birth of the Electricity Standard.

A New Axis of Value

Electricity has become the foundation of the modern economy, and Bitcoin is its most remarkable application. It turns energy into value—literally. Bitcoin miners like Bitfarms, Riot, and Hive are racing to secure access to hydroelectric power in Paraguay and alternative energy sources in Argentina, while centralized internet giants such as Google, Microsoft, and Amazon compete for dominance in nuclear energy.

This shift is not incidental; it reflects a deeper truth. The global production model is being rewritten, and at its core lies energy. Bitcoin, as a decentralized system, aligns seamlessly with this evolution, bridging the gap between energy and value creation in ways that no financial system ever has.

Echoes of 1998

In 1998, the world saw emerging markets crumble under the weight of collapsing currencies. Yet, even in the chaos, the internet quietly laid the groundwork for a structural bull market, one that would redefine the global economy.

Today, a similar inflection point has arrived. AI is transforming productivity, while Bitcoin is challenging the traditional financial system. Unlike 1998, when the internet needed years to mature, these technologies are advancing in tandem, accelerating the pace of change and the rise of a new production model.

The New Cycle

We are at the dawn of a new cycle—one defined by the convergence of energy, technology, and value. Bitcoin, still in the early stages of adoption, offers something unprecedented: a financial system designed for an era where electricity is the ultimate currency.

This is more than a shift in how we transact; it’s a reimagining of how we build resilient economies. The Electricity Standard is not just about powering Bitcoin—it’s about powering a world where individuals, not institutions, hold the keys to value.

The question is no longer whether Bitcoin will play a role in this future—it’s how far we are willing to let it take us.

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

December 8th , 2024