Bonds in a New Cold War: Navigating the Intersection of Geopolitics and Markets

Government bonds, once the bedrock of safety, now teeter on uncertainty in a world upended by geopolitical chaos and economic upheaval.

Investing in government bonds has long been the safe haven of financial orthodoxy. Yet, in a world defined by geopolitical upheaval and shifting economic paradigms, safety is no longer a static condition. The real question isn’t whether bonds are safe; it’s whether the world they exist in is stable enough to sustain that safety.

This report, crafted by Macrowise, explores the frameworks and forecasting models essential for navigating this new reality. The goal isn’t just to offer tools but to challenge the assumption that government bonds are universally secure. In a fractured, Cold War-like world, context isn’t just important—it’s decisive.

And bonds are only the beginning. In upcoming posts, we will explore equity markets in the context of a New Cold War, diving into how geopolitical shifts, technological disruptions, and fiscal priorities reshape equity opportunities and risks. But first, let’s decode the dynamics of government bonds in this evolving landscape.

The Framework: Bonds in a World of Change

Step 1: Geopolitical Reality

The first and most pivotal question is simple but profound: Are we in a world that’s globalized and stable, or one that’s fragmented and adversarial?

High Geopolitical Risk (New Cold War):

Governments no longer focus on efficiency; they focus on dominance. This means higher fiscal spending on defense, subsidies, and infrastructure—fueling deficits and driving interest rates higher. Bonds in this environment are not long-term shelters but potential casualties of volatility.Globalized Stability:

Interconnected trade and institutional trust lead to fiscal discipline. Lower interest rates prevail, making bonds attractive for long-term wealth preservation.

Step 2: Inflation—The Invisible Tax

Inflation is the silent destroyer of fixed-income investments. In a high-inflation environment, central banks tighten monetary policies, driving down bond prices. Conversely, during deflationary periods, bonds become the fortress of the risk-averse.

Step 3: Credit Default Risk—The Underrated Threat

Governments rarely default, but when they do, it’s catastrophic. Rising geopolitical tensions and unchecked fiscal imbalances heighten this risk, forcing bondholders to demand higher yields—an implicit admission of instability.

Step 4: Economic Cycles

Economic booms make bonds unattractive as growth assets dominate. But in recessions, as central banks ease monetary policy, bonds regain their luster as a safe haven. Timing here is everything.

From Framework to Action: When to Hold, When to Fold

New Cold War (High Geopolitical Risk): Avoid structural bond positions; trade tactically.

Globalized Stability: Build long-term bond portfolios for predictable returns.

Rising Inflation: Shift away from bonds or short them.

Recessionary Lows: Overweight long-term bonds for stability.

The Forecast: Reading the Interest Rate Terrain

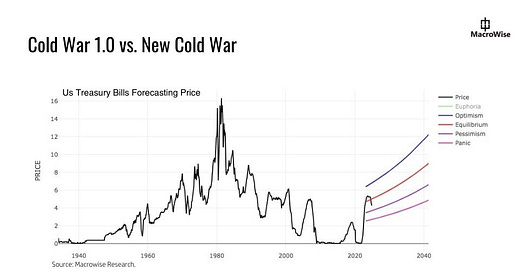

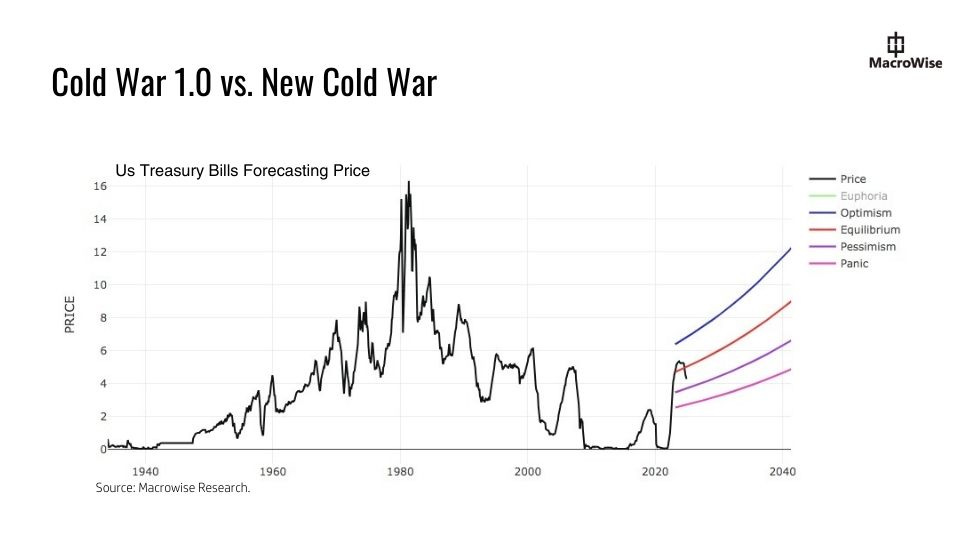

A decision-making framework is only as good as its ability to anticipate trends. Using Macrowise’s forecasting model, we chart historical and potential trajectories for U.S. interest rates, spanning 80 years of data and three scenarios:

Equilibrium (Baseline Stability): Rates hover around 4-5%, sustained by modest economic growth and controlled inflation.

Deflationary Shocks (Temporary Dips): Rates drop to 2%, driven by structural disruptions like industrial slowdowns or geopolitical black swans.

Inflationary Pressures (War Economy): Rates surge to 8% as fragmented supply chains, high energy costs, and industrial policy spending dominate.

Euphoria and Optimism: Charting Bullish Economic Scenarios

The green and blue lines in our model illustrate the potential for upward trajectories in interest rates during periods of economic expansion and optimism. These bullish scenarios, driven by technological innovation, robust growth, and fiscal stimulus, reflect the optimism markets often display when momentum builds. However, the reality of long-term trends lies in the tension between two opposing forces, reflected in the significant spread between 2% and 8% in long-term interest rates.

Explaining the Spread (2% to 8%)

Our forecasting tool highlights this range to capture the complex interplay between deflationary and inflationary pressures in today’s volatile macroeconomic environment.

Deflationary Forces: Temporary Dips to 2%

In the short term, we could see rates plummet to 2%, driven by structural deflationary pressures. These typically arise during economic disruptions that compel companies and countries to undergo significant restructuring. A prime example is the disruption in Germany’s car industry, where traditional automakers struggle to compete with global challengers like BYD in China and Tesla in the U.S.Such disruptions act as catalysts for deflationary periods, forcing monetary policymakers to slash rates to stabilize economies and encourage investment in the face of structural realignment.

Inflationary Forces: Sustained Pressures Toward 8%

In the long term, however, structural inflationary pressures dominate. A fragmented global economy—characterized by decoupled supply chains, high transaction costs, and persistently expensive energy—forms the backbone of a "war economy." This environment creates an enduring demand for higher rates as governments spend heavily on defense, energy independence, and supply chain security.This inflationary world mirrors the challenges of the Cold War, where fiscal spending was not just an economic necessity but a strategic imperative. Persistent uncertainty and high costs ripple through economies, resulting in upward pressure on interest rates over extended periods.

The Rise of Industrial Policy: A New Driver of Rates

Governments are no longer neutral observers of the economy; they are architects of industrial policy. The U.S., China, and Europe are pouring billions into sectors like semiconductors, green energy, and infrastructure. This isn’t just spending—it’s a reshaping of economic incentives.

Fiscal Burden: Higher deficits mean rising yields.

Supply Chain Costs: Resilience replaces efficiency, driving inflationary pressures.

Winners and Losers: Companies aligned with these policies thrive, while those outside face existential threats.

Opportunities Amid the Chaos

This bifurcated world—defined by simultaneous deflationary shocks and inflationary pressures—offers fertile ground for bond traders. Tactical positioning becomes key: short bonds during inflationary surges, overweight them in recessionary dips. For those who understand the narrative behind the numbers, this environment isn’t chaos—it’s opportunity.

The Big Picture: Bonds as a Reflection of the World

Bonds are not just financial instruments; they are mirrors of the world’s political and economic structure. During the Cold War, interest rates climbed alongside defense budgets and ideological brinkmanship. In the globalization era, they fell as trade expanded and efficiencies grew. Today, we stand on the edge of a new Cold War, with bonds poised to reflect which direction the scales tip.

Looking Ahead: Equity Markets in a New Cold War

This isn’t just about government bonds. The interplay of geopolitical shifts, inflationary forces, and industrial policy programs has profound implications for equity markets as well. In upcoming posts, Macrowise will dive into how these forces are reshaping equity investment strategies, uncovering opportunities and risks in this new era.

Stay tuned to discover how this paradigm shift transforms sectors, defines winners, and forces a reevaluation of long-held assumptions about equity markets.

Conclusion: A Dynamic Playbook for a Dynamic World

The question is not whether to invest in bonds but when—and under what conditions. The decision-making framework and forecasting tools from Macrowise equip investors with the clarity to navigate these complexities. Markets, like geopolitics, are in constant motion. The winners will not be those who wait for certainty but those who adapt to uncertainty with conviction and strategy.

This isn’t just about finance. It’s about understanding the forces shaping our future—and positioning yourself at the heart of the action.

Thanks for reading,

Guillermo Valencia A

Cofounder Macrowise

January 12th , 2025