COVID-19 is not a black swan, but a fragility built inside globalization

Smart Cities - Technopolis - Decentralization - Digital Cold War - Crypto - Gold

Long Rockstars and Seedlings

MSFT, BTC, GLD, INTC, UNH, VZ, TXN.

Short Icarus and Zombies:

EEM, EWY, XOM, XLE , NFLX, NVDA, FB.

It is easy to classify a pandemic as a black swan. The coronavirus has brought about an abrupt drop in global gdp; it has put airlines and cruise liners on the verge of bankruptcy; restaurants, hotels, retailers and even oil companies are suddenly against the ropes. Emerging markets are perhaps the most uncertain as the global markets struggle for stability in the midst of a pandemic that could last weeks to months and maybe even years. The jolt to the global ecosystem will reverberate far and wide.

Everyone is focusing on the pandemic, but it is merely a catalyst to the underlying problem — THE FRAGILITY INSIDE GLOBALIZATION. The underlying properties of the global financial system are succumbing to the pressure, opening the gates of risk and flooding the stress on the already fragile legs that hold up the market. The global economy is at a breaking point.

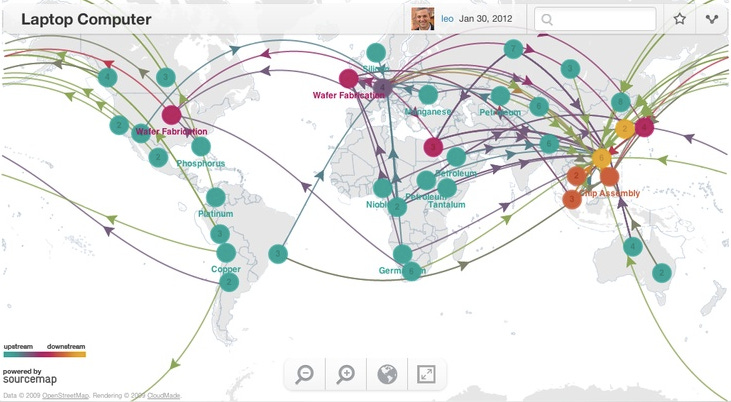

Source: Sourcemap.

Globalization created a massive centralization of the global supply chain with the international monetary system built on the liquidity of the USD. If one part breaks in this highly centralized system, the whole structure could topple over. The pandemic has cast light on the cracks that were already in place. The disruption of the supply chain and subsequent liquidity crisis have been brought to the forefront by this new pandemic. A full blown catastrophe is now all too real of a possibility.

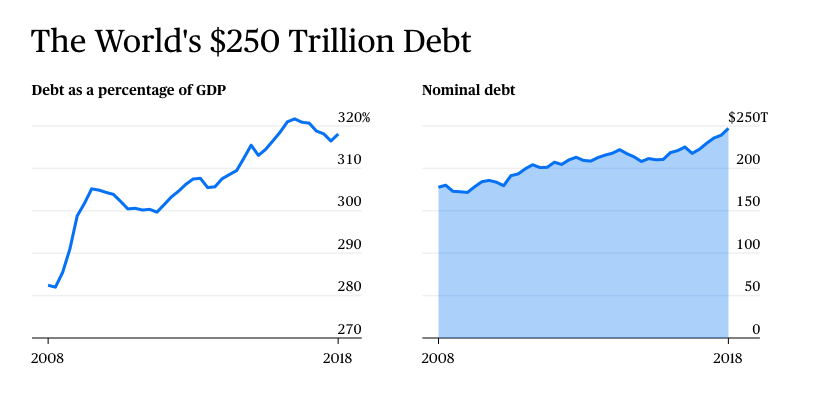

Globalization was not boosting productivity. Economic growth has been simply a product of cheap debt. Since 2000, global growth has been dependent on extraordinary debt expansion. The only way of maintaining the status quo has been by piling more and more debt on top of each other, not through robust global productivity.

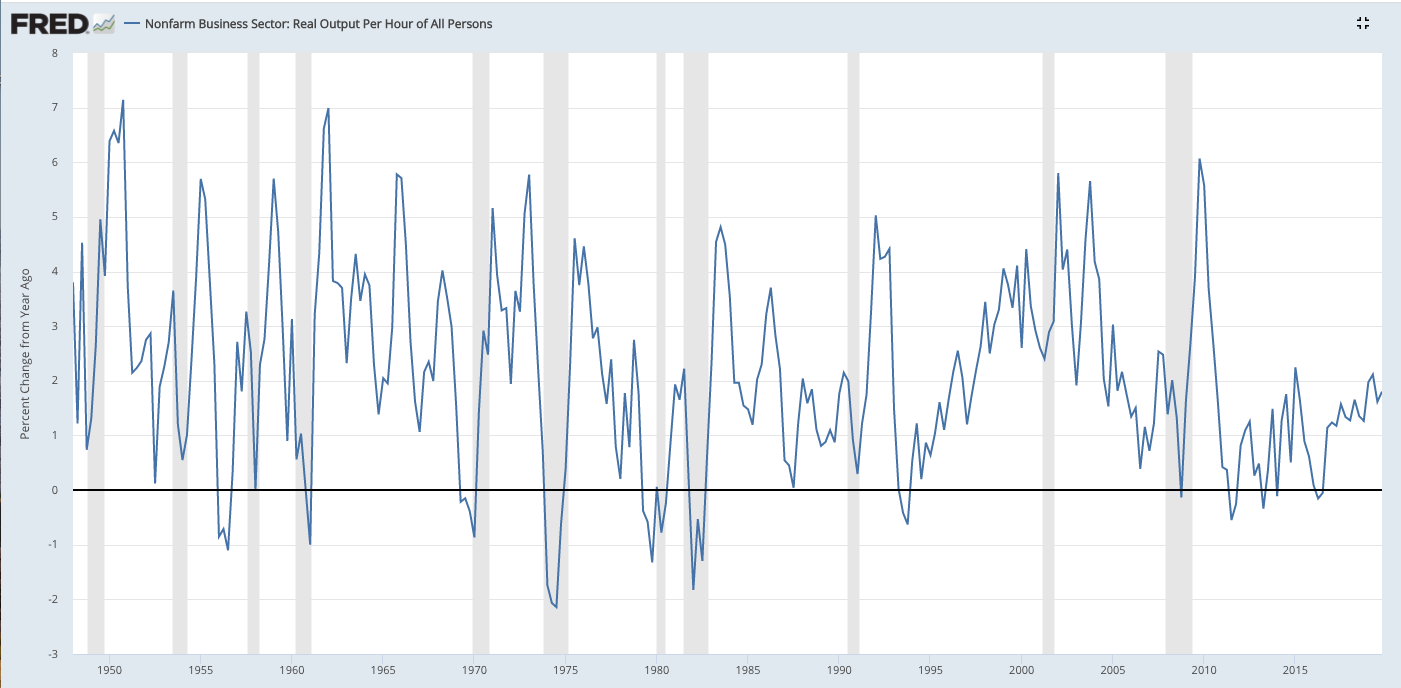

Source: St Louis Federal Reserve.

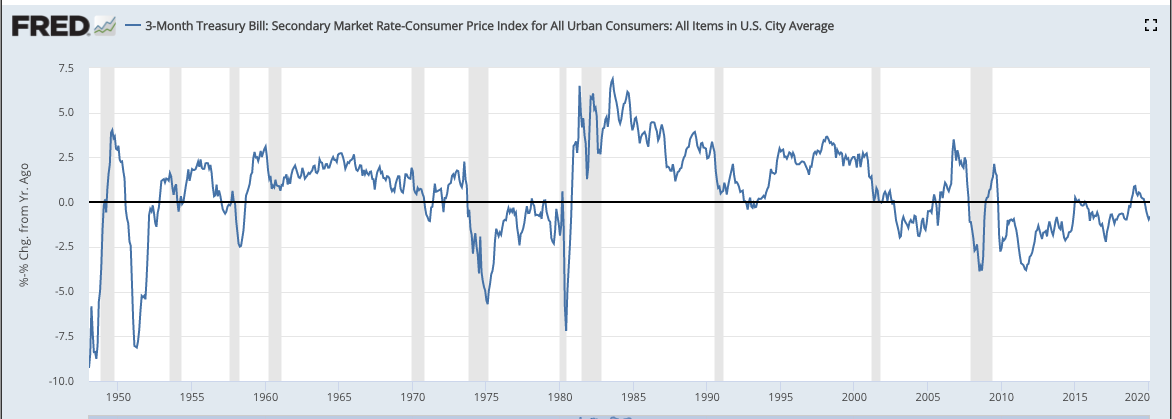

During the 1990s, global productivity increased by an average of 3% annually. Since 2000, the average is below 1%! The only way to sustain such an increase in debt is to have negative real interest rates.

Source: St Louis Federal Reserve

The fragility of globalization has been magnified by the added stress of the pandemic and thus the disruption of supply chains. The system was already tremendously fragile. Now with one-third of the population in social isolation, the damage is clear.

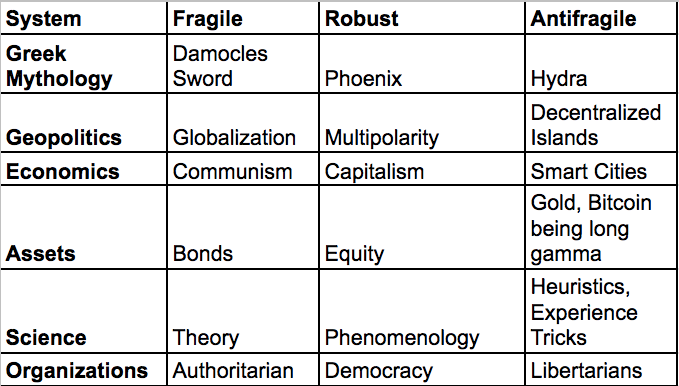

Fragile vs Antifragile System

In his book, Antifragile, Nassim Taleb talks about three types of systems:

Fragile things exposed to volatility.

Robust things resist it.

Antifragile things benefit from it.

Here some examples of these three categories:

Adapted from the book Antifragile.

While the focus of many investors is on the recovery shape - (V) shape or (L) shape, we focus more on what is happening in the global supply chain that could lead to the new configuration of the global economy. Who are the winners and losers? How can we profit from the metamorphosis of the system?

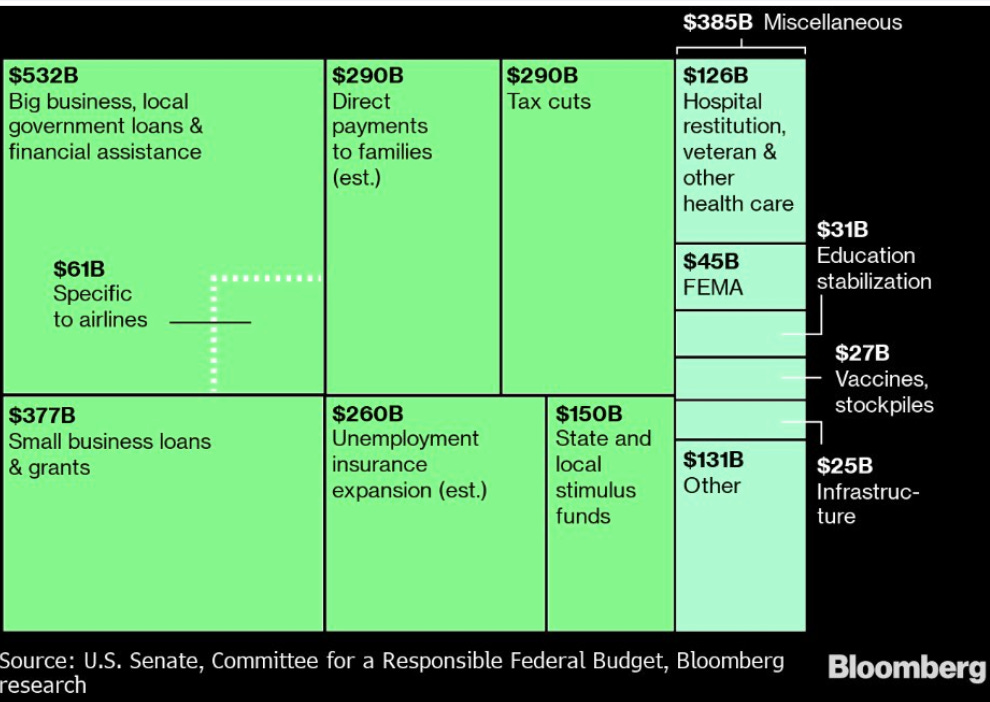

Source: Bloomberg.

Pandemics will disappear at some point when the S-Curve of diffusion saturates, but the fiscal response will forever change the structure of the global economy.

FORGET ABOUT ETFs

Capitalism, like the phoenix, is a robust system. It will reinvent itself and instigate a lot of social pain. Through the reconfiguration process, a handful of today’s companies will be the dominant players in the next decade, flexible enough to adapt to the new capitalistic model. How will this new capitalism approach look? If capitalism is reinventing itself, it makes no sense to invest in the average!

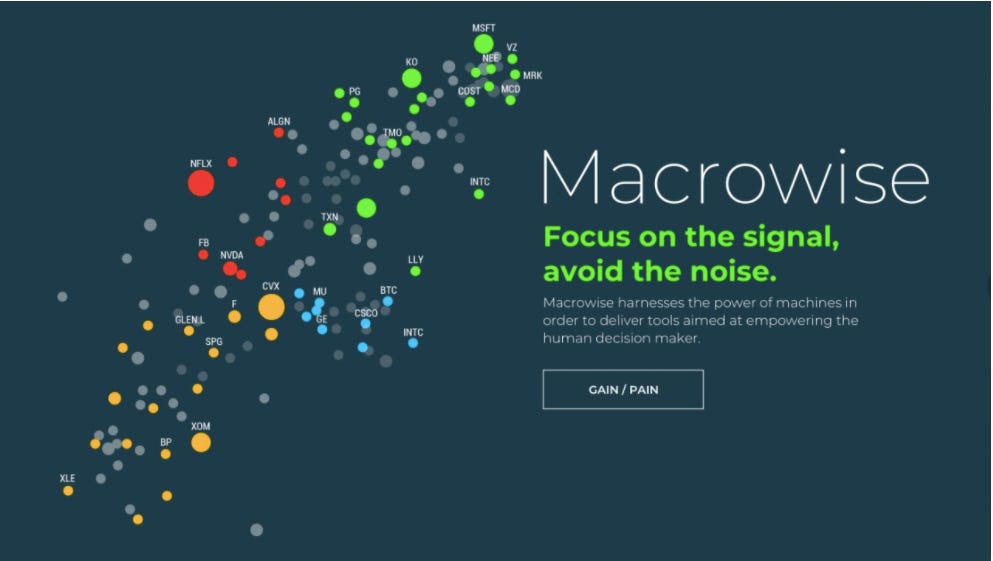

Macrowise Kafka Dashboard

The response of governments around the globe has been massive — the biggest fiscal stimulus since the Marshall plan. The global financial liquidity will no longer be dictated by the dominance of USD liquidity. The digital version of the USD, the Yuan and the Euro will compete to provide citizens, companies and nations with alternative channels for credit and liquidity. Bitcoin will prove to be the digital ‘ESC button’ of non-nation state’s controlled entrepreneurship. While this happens, the USD will remain abundantly strong against any single emerging market currency.

So let’s take a look at what we have created with KAFKA - an algorithmic dashboard that classifies assets into 4 categories - Zombies, Gems, Rockstars and Icarus.

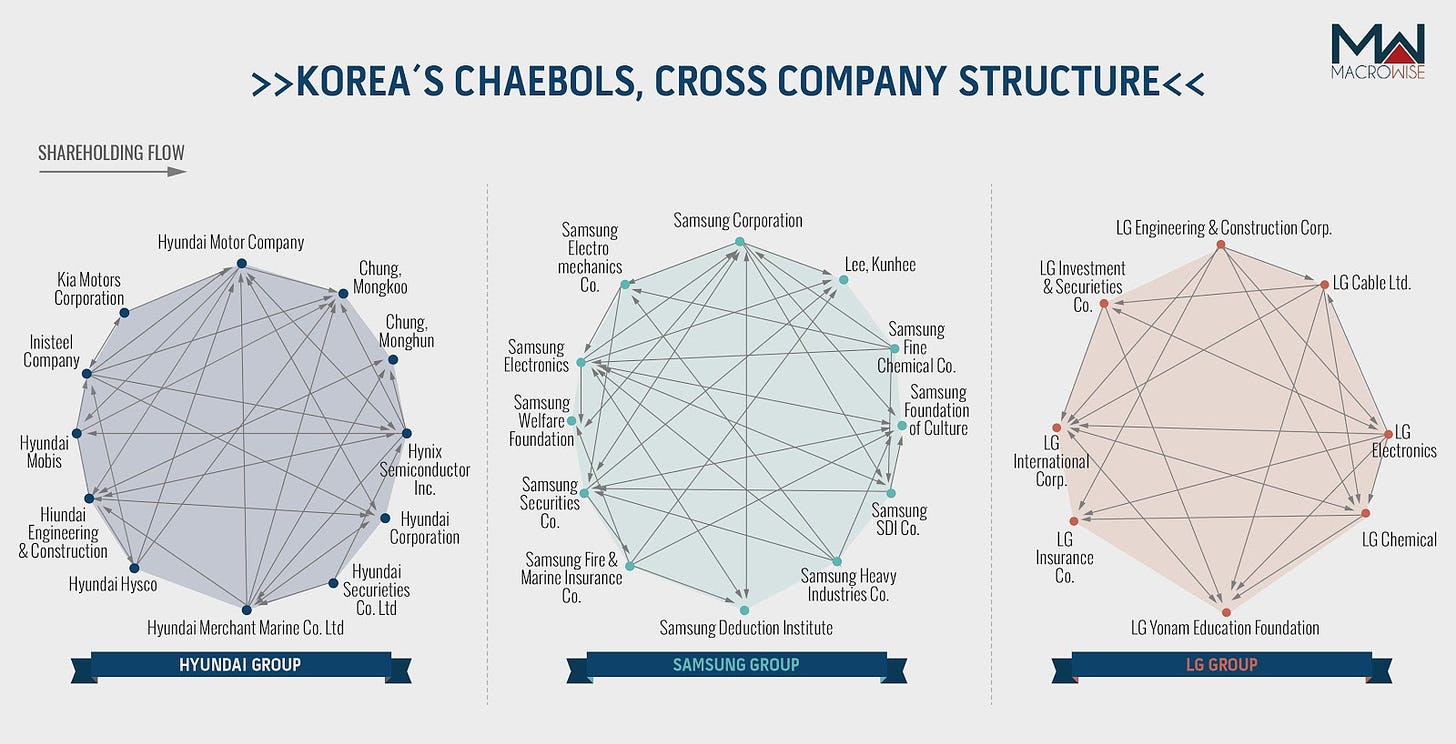

Zombies are the companies that are dependent on debt and government help to survive. The energy and retail industries are good examples: Companies like ExxonMobil (XOM) and Chevron (CVX) and commercial developers such as Simon Property Group (SPG) seem to be caught in a dying spiral. The automotive industry and many Korean companies such as Chaebol depend on corporate debt. Latin American economies dependent on commodities are also zombies.

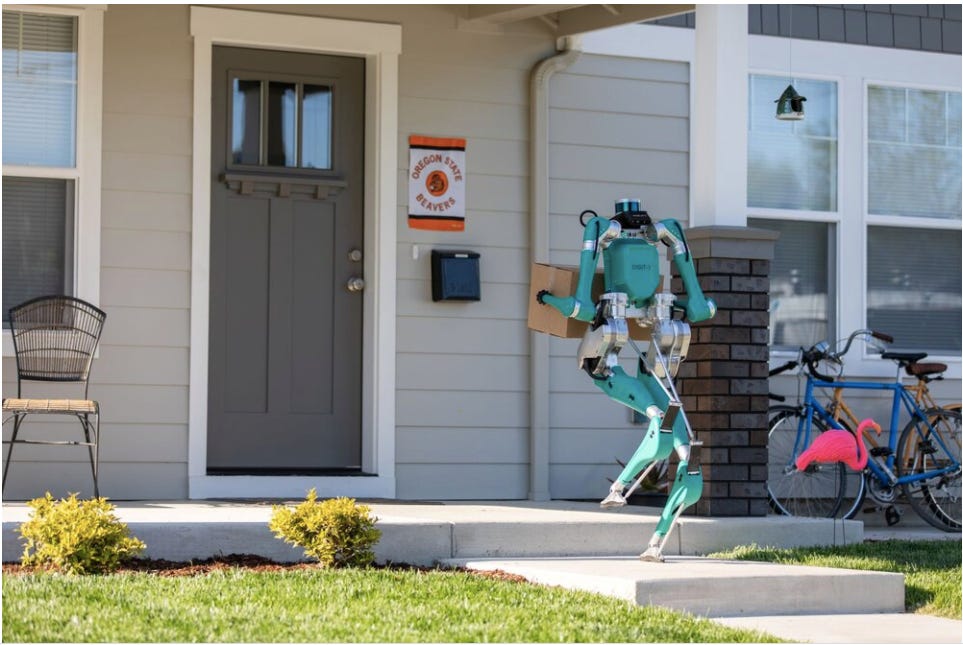

Gems are companies or assets that are influenced by game changing situations that create a tremendous gain-pain investment profile. We think the most interesting investments right now are in companies that are able to provide the infrastructure needed in the advancement of smart cities. The game changer is the transition from globalization to a more decentralized model. COVID-19 is making us aware of the need for smaller, more independent and decentralized, smart cities. Companies that will help these smart cities grow and provide the needed infrastructure for 5G networks include: Cisco, Hitachi, Siemens, Ericsson, Toshiba, Toyota, Schneider Electric and Oracle, Companies in Robotics and Automatized Labor.

From Agility Robotics web page.

Gems improve incrementally their knowledge and success, transforming into Rockstars that serve as global leaders and investment stalwarts.

Rockstar: Robust companies that prove buying the deep strategy is very profitable. Think of Microsoft (MSFT) as our favorite Rockstar. Their smartphone strategy in the early 2000s was terrible, but their cloud and gaming strategies have been brilliant, making them one of the Rockstars of the internet. Being among the best of the best, they are able to increase prices while still gaining market share until the point of the hubris, where they are destined to fade as they drift towards the sun.

Icarus: In general they have spectacular parabolic moves in price, but also are prone to crash as risk is embedded inside their business model.

Think Netflix, once the only streaming game in the town. Now, saddled with $50 billion of corporate debt and fierce competition from the likes of Amazon, Google, Disney and HBO, the playing field is much more treacherous. Other alternatives such as gaming platforms like Fortis, Xbox and Nintendo, combined with streaming entertainment disruptors like the Tencent child QQ, will compete for our attention and leisure time.

When everybody is fully pessimistic, taking risk is the most antifragile strategy. Being long the new, decentralized economy and short the old, globalized economy will continue to be the best global macro trade.

Guillermo Valencia

Co-founder of Macrowise

March 30, 2020.

Brazil