Creative Destruction: The Reckoning of the Zombie Economy and the Rise of a New Model of Production

Creative destruction is not an end; it is a beginning. The global economy is being reshaped before our eyes. The only question that remains: Will you adapt to this new reality?

The economy is always a reflection of the times we live in. For years, near-zero interest rates fueled a system where cheap credit allowed companies to borrow endlessly without concern for efficiency or meaningful returns. It was a world where the cost of making mistakes barely existed.

That world is gone.

Since 2021, we have entered an era of high-interest rates. Today, U.S. 10-year Treasury yields hover around 4.7%, levels not seen since before the Great Recession. This rise in capital costs is placing unprecedented pressure on heavily indebted companies and shaking the foundations of the so-called zombie economy.

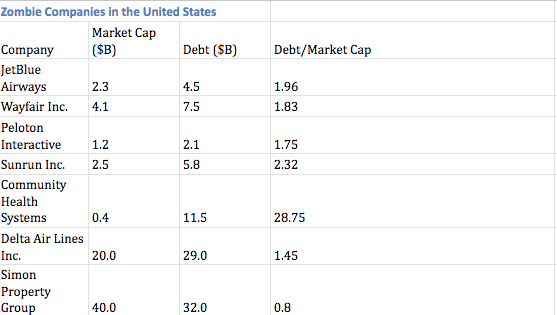

Zombie companies—entities unable to generate enough profit to cover interest payments—represent a mounting systemic risk. In the United States alone, these firms carry over $2 trillion in corporate debt. In Europe, the figure exceeds €500 billion, and in emerging markets, the combined debt of such companies is estimated at $1 trillion. These numbers reflect a corporate crisis, but they also highlight a deeper issue: many governments are treading an unsustainable fiscal path, with mounting deficits and soaring sovereign debt levels.

January 20: A Pivotal Moment

The upcoming January 20 marks a significant turning point for U.S. economic policy. Behind the Trump administration lie two competing factions with distinct visions for America’s future:

1. The Renaissance of American Technology: This group, deeply tied to emerging technologies, seeks to position the U.S. as a leader in innovation. Their agenda prioritizes policies that boost productivity, accelerate technological adoption, and raise the natural rate of economic growth. A successful shift toward this vision could justify higher interest rates as a reflection of a dynamic and growing economy.

2. Nationalist Fiscal Spending: The second group emphasizes national champions and large-scale fiscal programs to drive domestic manufacturing. While this path also leads to higher interest rates, it comes with increased risks of supply chain disruptions and geopolitical conflicts.

The probability of the first group gaining influence is estimated at 60% or higher, but both scenarios signify a moment of creative destruction for global markets. Higher interest rates—whether driven by productivity gains or nationalism—will exert immense pressure on companies and nations that fail to adapt to the emerging economic order.

The Reckoning of the Zombie Economy

For more than a decade, zombie companies thrived in an environment of low interest rates. Now, with over $3.5 trillion in global corporate debt tied to such entities, the reckoning is here. Some will reform; others will fall into obsolescence. This is the Schumpeterian force of creative destruction in action.

The following tables highlight examples of zombie companies across the United States, Europe, and emerging markets. These firms are heavily indebted and struggling to adapt to a high-interest rate environment, making them susceptible to financial instability or collapse.

A New Economic Model

The world is witnessing the birth of a new economic paradigm. Companies and countries that embrace reforms, invest in sustainable production models, and leverage technological advancements will thrive. Those that cling to outdated practices will fade away.

Creative destruction is not an end; it is a beginning. The global economy is being reshaped before our eyes. The only question that remains: Will you adapt to this new reality?

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

Disclaimer: Macrowise provides insights for informational purposes only and does not offer financial, investment, legal, or tax advice. Any financial decisions should be based on individual analysis or consultation with a qualified professional advisor. The opinions expressed here are general and not tailored to specific investment goals or situations.