Decoding Semiconductors: A Game Theory Guide to Monopolies, Shifts, and Strategic Bets

The era of merely building tech companies is over—it's now about fostering self-evolving tech ecosystems.

Markets aren't just numbers on a screen—they're stories of human ambition, unexpected turns, and the quiet psychology that drives it all. Think about John D. Rockefeller, who built an oil empire in the late 1800s by controlling nearly every drop. He thought he had a lock on energy forever. Then came Thomas Edison with his light bulb, and suddenly oil's dominance flickered. Semiconductors today feel a bit like that: A handful of giants hold the keys to the AI revolution, but beneath the surface, shifts in technology, geopolitics, and plain old incentives are rewriting the script.

In this piece, we'll explore the semiconductor world not as a technical manual, but through the lens of game theory—where players cooperate until they don't—and the timeless behaviors that make markets so unpredictable. Drawing from mid-2025 data, with AI surging and global tensions adding spice, we'll map the landscape, spot the cracks, and consider where smart bets might lie. No crystal balls here, just patterns from history applied to tomorrow's tech.

The Players: Why Some Oases in the Desert Seem Unassailable (Until They're Not)

Picture the semiconductor industry as a vast desert, where water—critical chips—flows from a few oases controlled by giants. These aren't accidental monopolies; they're built on what Peter Thiel calls "secrets"—proprietary edges like software ecosystems or manufacturing wizardry that keep rivals thirsty. But as any desert traveler knows, oases can dry up if the sands shift.

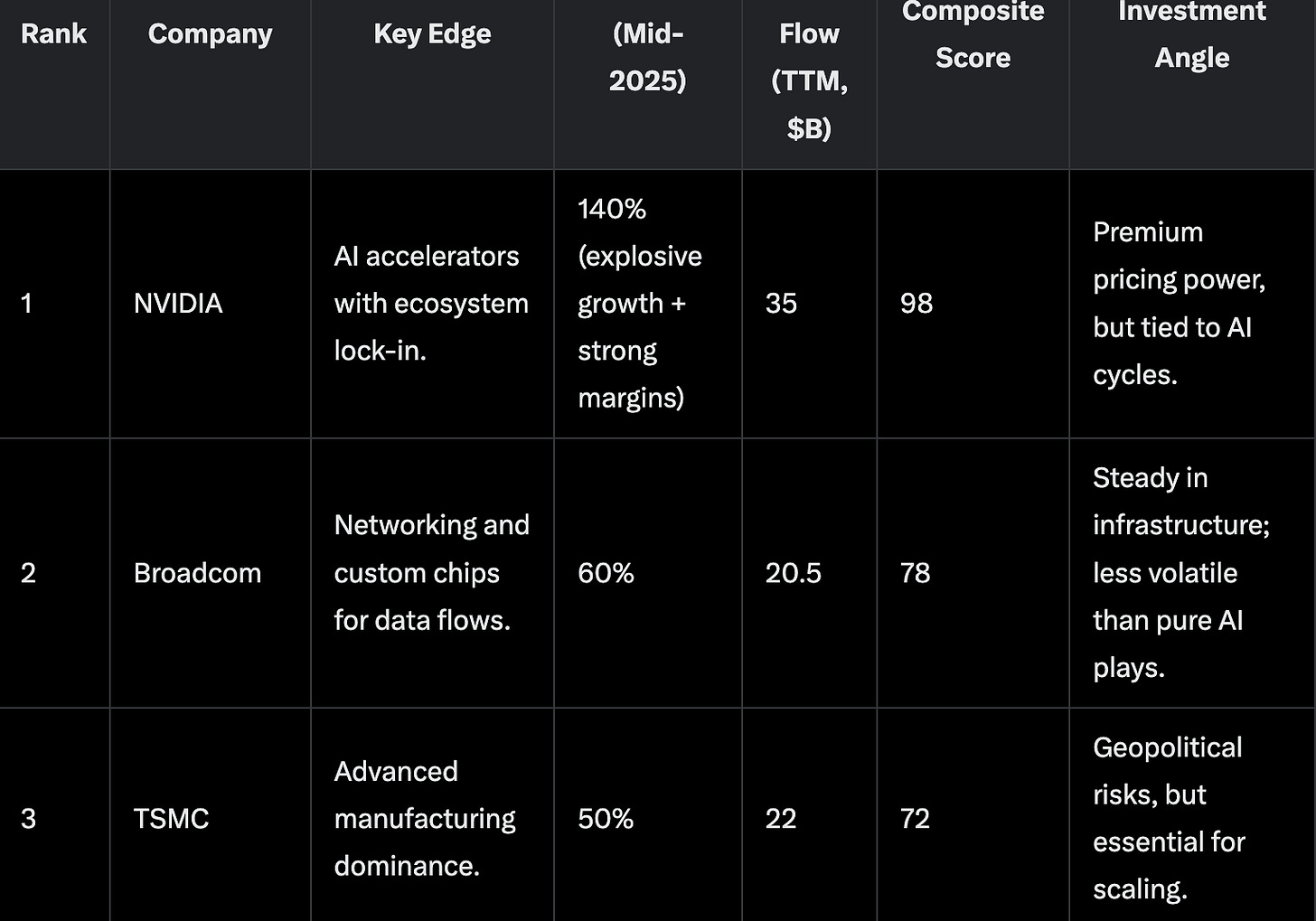

To gauge who's thriving, look at the "Rule of 40"—a simple yardstick where a company's revenue growth plus its profit margin should hit at least 40%. Pair it with free cash flow, the lifeblood for reinvesting in defenses. Global chip sales hit $59.0 billion in May 2025, up 19.8% from last year, fueled by AI hunger. Here's a snapshot from Q2 2025 financials, showing who holds the high ground today.

NVIDIA towers over the pack, much like Rockefeller once did. But history whispers: Dominance invites disruption, often from those you least expect—your own customers.

The Cracks: When Cooperation Turns to Competition

Markets thrive on trust, but they're fragile because people are wired for self-preservation. In game theory, it's the prisoner's dilemma: Two parties benefit from cooperating, but the temptation to defect—for a quick gain—often wins out. NVIDIA's story fits this perfectly. Its chips power the AI boom, with markets eyed at $244 billion in 2025 ballooning to $800 billion or more by 2030. Yet, its biggest buyers—Google, Amazon, Meta, Microsoft—are now crafting their own chips, like Google's TPUs or Amazon's Trainium, to cut costs and control their fate.

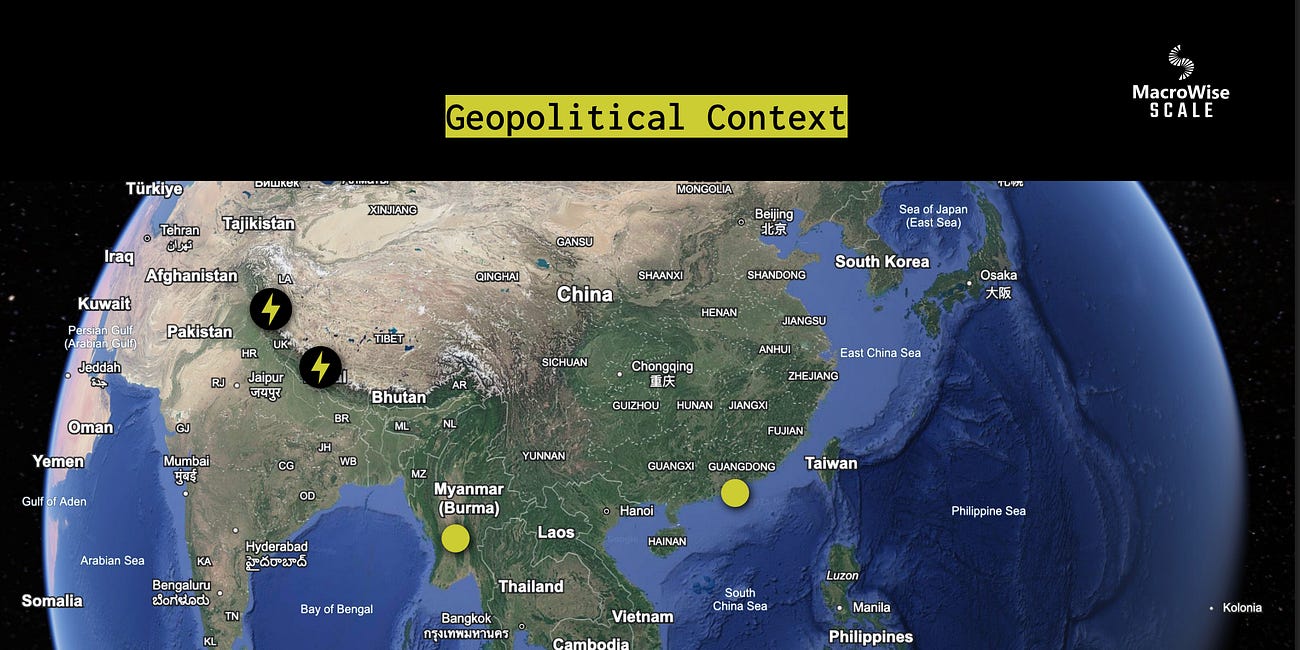

It's like farmers relying on a single well, then digging their own. Alibaba's push for homegrown silicon echoes China's broader quest for independence amid U.S. export curbs. For investors, this isn't doom—AI's sprawl into factories (trillions in play) cushions blows—but it reminds us: Monopolies erode not from weakness, but from the incentives of those who depend on them. Geopolitics adds the twist: Trade walls turn economic games into national ones.

The Shifting Sands: How New Tech Reshapes the Game

Innovation isn't linear; it's like evolution—slow until a mutation sparks a leap. Chip design once plodded along, human-led and error-prone. Now, AI like Google's AlphaChip scans billions of options in hours, birthing better chips that, in turn, supercharge AI. It's a feedback loop, accelerating beyond Moore's Law.

Add new materials: Silicon carbide for EVs that sip power, 3D stacks packing more punch, or photonic chips zipping data with light instead of electrons. These "topologies" aren't just tweaks—they lower walls, letting startups flood in. Economically, it's a boon for efficiency; geopolitically, it scatters supply chains, easing chokepoints like Taiwan. However, progress favors the adaptable, not the entrenched.

The Flip: Oil's Lesson for Chips

History rhymes: Oil barons (OPEC+) once dictated prices by squeezing supply, until U.S. shale flooded the market around 2014, handing power to demanders like China—who then pivoted to renewables. Semis mirror this: Suppliers like NVIDIA set the terms, but hyperscalers are now "shale-drilling" their own chips.

From Oil to Electricity.

Imagine this: it's 1911, and a young and ambitious Winston Churchill, as First Lord of the Admiralty, faces a puzzle that could decide the fate of the British Empire. The Royal Navy, the most powerful in the world, relies on coal to power its battleships. But coal has a fatal flaw, one that any sailor could spot from miles away: the chimneys belch out t…

Game theory calls it repeated play—cooperate for stability, or defect for advantage, risking chaos. Taiwan's vulnerability spurs China's self-reliance, much like oil straits did. For bets, favor those mastering demand dynamics: Ecosystems that evolve, not empires that extract.

The Pivot: Steering Through Storms

Great leaders don't fight waves; they ride them. Jensen Huang turned NVIDIA from gaming cards to AI juggernaut by seeing parallels in computing. Now, he's eyeing robotics, quantum, and biotech—envisioning data centers as "AI factories" churning intelligence like utilities, worth $3-4 trillion by 2030.

Omniverse simulates factories; partnerships with Siemens for AI manufacturing, Mistral AI for models, and Foxconn/Tesla for bots amplify this. In biotech, AI speeds drug hunts; nanotech via molecular sims. New U.S. fabs for Blackwell chips hedge geopolitics. It's forward induction: Anticipate, adapt. Economically, high cash flows fund it; investment-wise, agility trumps size.

The Wake-Up: Sparks That Ignite Change

Finally, China's DeepSeek—its R1 in January 2025, V3 successor accelerating—dubbed a "Sputnik moment" by Andreessen, highlights AI's zero-sum side. Embedded in cars and policing, it shows China's push amid bans. But the real Sputnik in this Cold War 2.0 isn't just software—it's hardware reinvention. China is surging in alternative chip topologies, like photonic chips that process data with light for massive speed gains (up to 2,560 TOPS at 50 GHz) and energy savings. They've launched production lines for thin-film lithium niobate chips, eyeing AI, 6G, and quantum leaps, with multiplexer tech hitting 38 Tbps.

Neuromorphic advances, mimicking brains for efficient computing, and even brain-computer interfaces show a "changing lanes" strategy—bypassing U.S. curbs on traditional silicon to lead in next-gen frontiers. This isn't catch-up; it's a potential overtake, turning tech rivalry into a full-spectrum contest.

AI optimizes everything—yields, grids, chains—like self-improving organisms.

By 2030, markets fragment but flourish.

Thanks for reading ,

Guillermo Valencia A

CoFounder of MacroWise

Este game theory está genial! Puro “Brain Power” Guillermo!!!

Gracias crack !