In 2019 the dominant narrative was that inflation was dead

In June 2022, the dominant narrative is the opposite. Deflation seems to be dead in the world when US inflation surges to a new 41- year high of 8.6%

The drawdowns of equity price & treasuries are pricing like 1974. Is the global economy really in a stagflationary environment?

What happens with the $83 trillion of corporate debt if the FED raises the interest rate to 5% in order to contain inflation.

The strongest evidence that we are not in the 70s is a strong dollar (DXY)

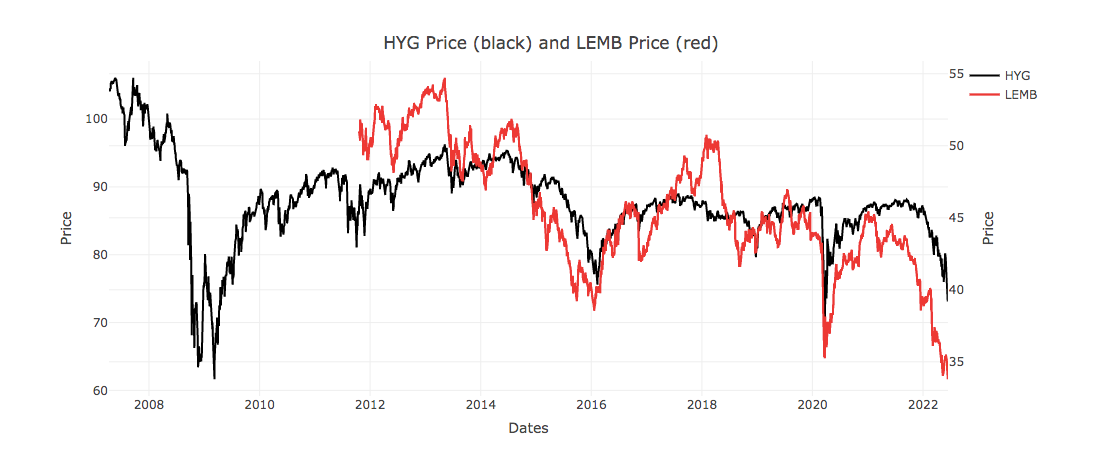

The High Yield and Emerging debt reminds us that deflation is not dead.

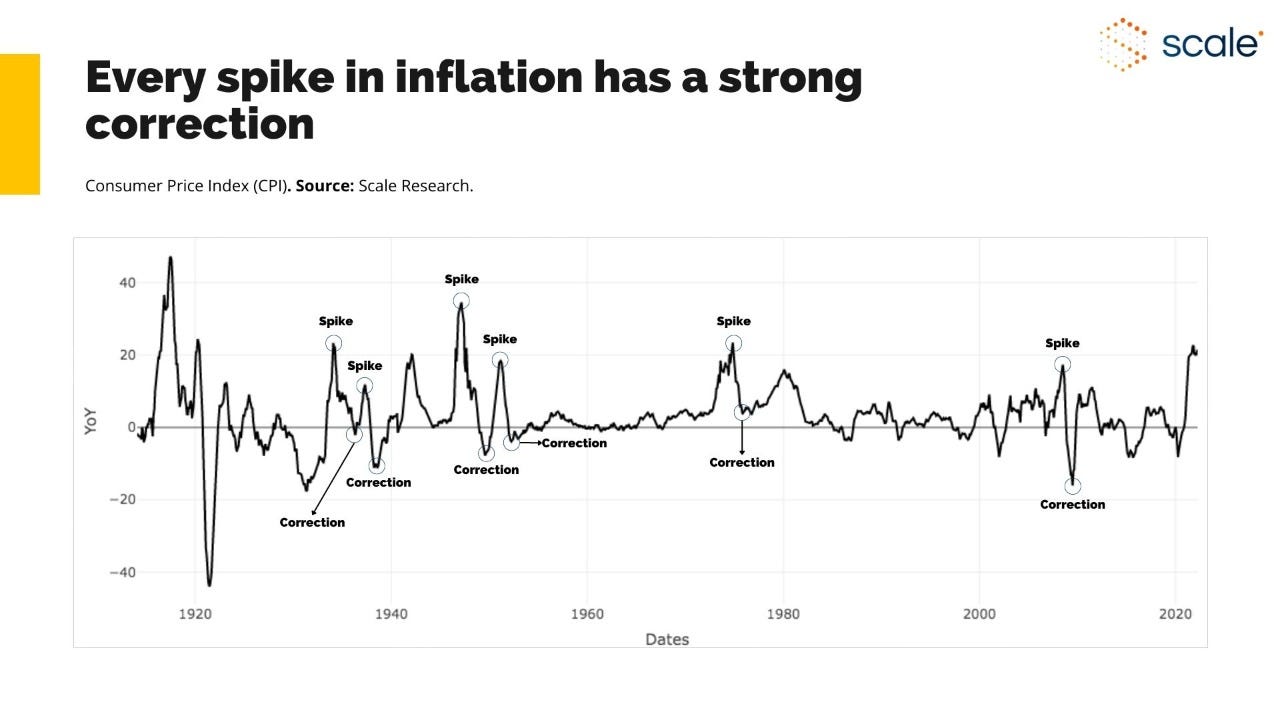

Every spike in inflation has a strong correction

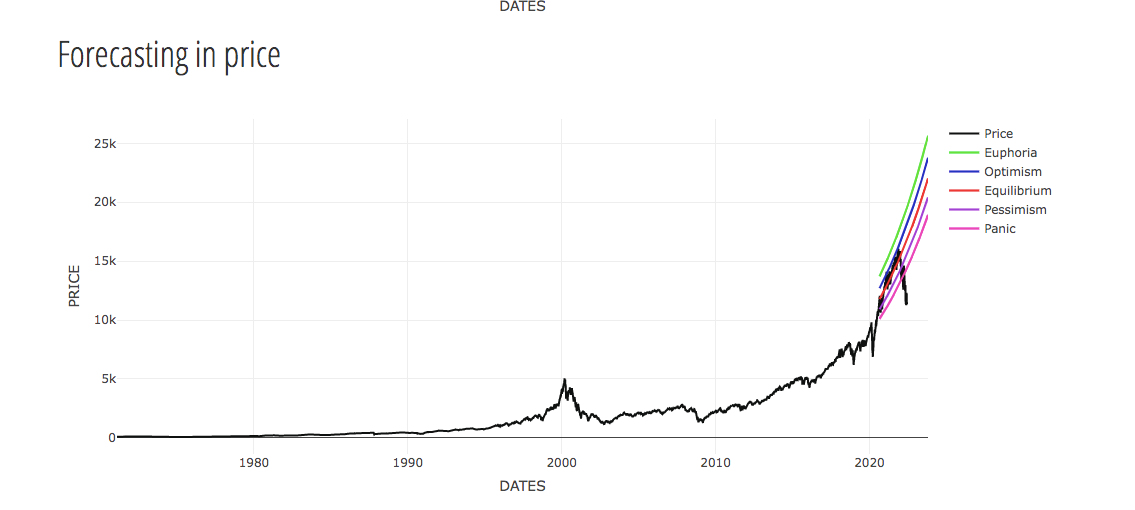

In the transition from inflation to deflation, tech stocks will come back until the risk of a recession in Nov 2023 is evident.

Bitcoin is trading like a high beta tech stock. Currently, the gain/pain ratio in btc is massive.

US Long Term Treasuries (TLT) looks also very attractive.

Guillermo Valencia A

Co- founder Macrowise & Scale

June 15th, 2022