Demanding the Price of Oil

Since 2013, we have seen two structural changes in the oil industry:

US shale oil has radically reduced the United States energy dependence on OPEC.

China has become the leading importer of oil.

However, prices have fluctuated between two dominant beliefs:

A bullish belief based on the OPEC cuts and supply disruptions in Venezuela and the Middle East.

A bearish belief that is based on record US oil production and deterioration of the demand in Emerging Markets.

Price signals

Oil is highly oligopolistic where the pricing power fluctuates between the actor who controls the supply to the actor who controls the demand. So oil markets fluctuate when a few suppliers control the price, as well as when large importers seek out deals with cheaper more trustworthy suppliers.

The key question is: Who dictates the price in the oil markets?

In trying to capture this pricing power dynamic, we examine the exporters vs. the importers.

Start in Europe, where Norway is one of the predominant suppliers of oil to the EU. The NOK/EUR has served as an indicator of oil price movements; trending downward in recent cases, foreshadowing crashes.

Source: Stockcharts.com

Another indicator that has shown itself and makes a lot of sense is to look at the RUB/CNY trendline against oil. Again here, the movement between the Russian Ruble (heavy exporter) to the Chinese Yuan (big importer) has coincided with the price of oil.

Source: Tradingview.com

Both of these suggest that oil is still overpriced and the U.S. shale companies are still pumping away at US$60, US$50, even US$40 per barrel.

Analyzing the ratio between Exxon Mobil (XOM) and Brent Crude Oil yields further insight.

The graph below shows just how well XOM has outperformed Brent since this structural shift began. It also shows the opposite trend when OPEC production cuts dominate the sentiment of oil investors.

Source: stockcharts.com

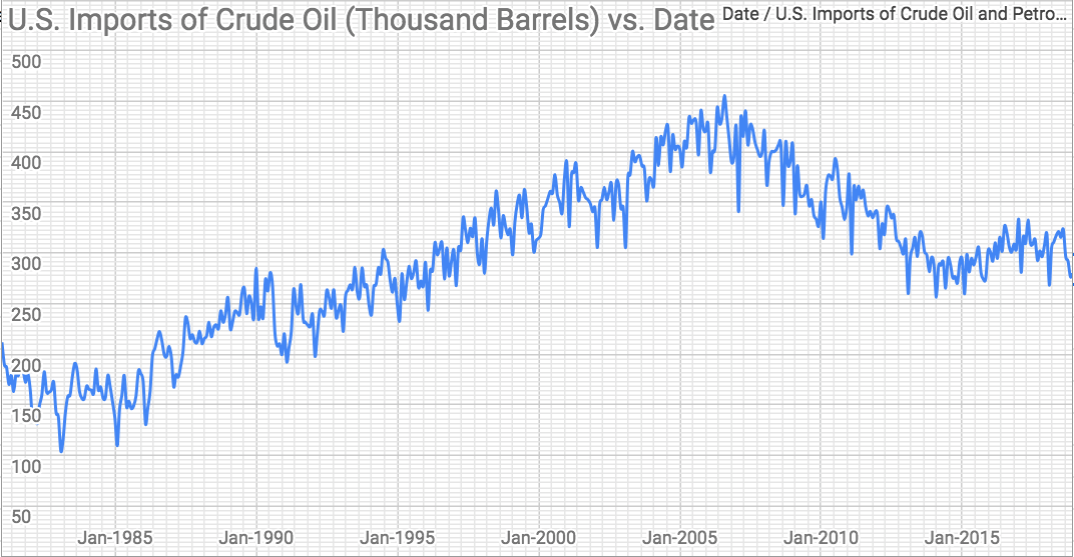

Finally, this graph of US net oil imports shows the independence on OPEC oil.

Source: www.eia.gov

Conclusion

Source: macrotrends.net

Price determination is no longer dominated by oligopolistic suppliers like was the case from 1998-2013, but rather now by the demand actors. OPEC is transitioning from price making to price taking, as China, the demand leader, will greatly influence prices.

This set of signals suggests Brent Crude Oil prices falling to US$50 or below.

Guillermo Valencia A. Bogotá, Colombia