Diversification Overstated: Unveiling the 400% Opportunity and the Strategic Asset Shift Each Decade

Long Japan, AI, Crypto, Uranium , avoid Treasuries.

In the vast landscape of finance, the commonly advocated strategy of diversification warrants a fresh perspective. Contrary to the prevailing notion that spreading investments across various sectors mitigates risk, we posit an alternative viewpoint:

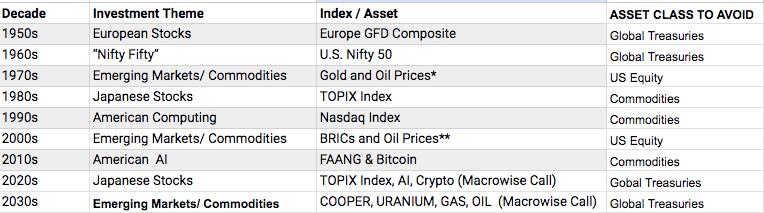

Each decade unfolds a singular investment theme, presenting a substantial 400% opportunity, coupled with a corresponding asset class to tactfully sidestep. Our unwavering conviction for the next decade is clear: Japan embodies the burgeoning opportunity, while global treasuries emerge as the asset to carefully avoid.

Source: Macrowise Research

Nikkei, almost reaching the 1990 levels. Source: Yahoo Finance.

While conventional financial wisdom places a premium on diversification, there exists a crucial need to discern the unique investment narrative that each decade unveils. While the pursuit of lucrative opportunities often takes center stage, the aspect of identifying potential pitfalls is frequently overlooked. This viewpoint prompts a thoughtful reassessment of traditional safe havens, particularly treasuries and bonds, which may prove suboptimal in the years to come.

If you are a family office or a high-net-worth individual, do not hesitate to contact us to fortify and strengthen your investment process. We specialize in providing tailored insights and strategic advice to discerning investors like yourself. Our unique perspective on the unfolding investment themes and asset shifts in each decade, coupled with a keen understanding of the current financial landscape, can contribute significantly to building a resilient portfolio. Let us partner with you to navigate the complexities of the market and identify opportunities that enhance the resilience of your investments while minimizing exposure to potential risks. Your financial success is our priority, and we look forward to collaborating with you on fortifying your wealth management journey.

Source: Visual Capitalist.

1950-1980:

Each passing decade introduces pivotal themes that shape the investment landscape. Post-World War II in the 1950s spotlighted Europe's resurgence, fueled by the Marshall Plan and the ascent of European stocks. The 1960s, amidst Cold War tensions, witnessed the dominance of the large-cap US market. The inflation-ridden 1970s ushered in a boon for commodities like gold and oil. Notably, from 1950 to 1981, treasuries and bonds were assets to avoid in a world marked by a new geopolitical power structure and a lack of trust between nations, breeding skepticism in debt backed by governments and institutions.

1980:

The 1980s marked the Cold War's endgame, with Mexico emerging as a new actor in the energy game due to record-high oil prices. The crash in oil prices made it challenging for the Soviet Union to fund the Cold War against the United States, setting the stage for its eventual dissolution. Amidst the struggle between the US and the Soviet Union, Japan emerged as a new star in the 1980s, marking the peak of a 30-year Japanese equity bull market that began in the 1950s and reached its zenith in the 1990s bubble.

1990:

The 1990s witnessed the restoration of trust in the United States. Under Mr. Volcker's leadership at the central bank, bonds rebounded. This era, characterized by the rise of the internet, mirrored the golden era of the preceding personal computer megatrend from the 1970s. Gold, oil, and commodities fell out of favor from 1980 to 2000.

2000:

The early 2000s witnessed the burst of the internet bubble, yet an unnoticed bull market since 1980 was unfolding—the rise of China. Now intertwined with China's ascent to World Trade Organization, it enjoyed its golden decade and with China the BRICS (Brazil, Russia, India, China and South Africa)

2010:

The post-2008 transformative era was marked by the unnoticed emergence of high-performance computing, catalyzed by Steve Jobs' launch of the iPhone. This paved the way for unprecedented connectivity, setting the stage for a new epoch dominated by the world of bits. The dominance of digital property has given rise to a need for crypto, like Bitcoin and Ethereum, acting as digital walls against technology oligopolies and autocratical governments.

2020:

Since 2020, post-pandemic disruptions have triggered a radical shift in the global production model. Artificial intelligence (AI), as the primary driver of this digitized world, holds the potential to reshape the physical world of atoms, particularly within megacities. The rewiring of global supply chains and the renewed geopolitical rivalry between China and the US echo the dynamics of a second Cold War, reminiscent of the 1950s, 1960s, and 1970s. Much like the strategic focus on Europe in the 1950s, today's priority lies in resurrecting the Japanese economy to counterbalance China's influence.

Considering Japan as merely a country with an aging population where innovation is challenging oversimplifies its potential. We view Japan as an archipelago of megacities, including Tokyo, Yokohama, Nagoya, Kyoto, Nara, Osaka, and Kobe, acting together as a serendipity engine for a new production system catering to more than 100 million people. This unique perspective positions Japan as a dynamic and interconnected force in the global economic landscape. Megacities are the convergence of automation, Electric Cars, the internet of things, AI, Biotechnology, Crypto, and Modular Nuclear Reactors.

If you are a family office or a high-net-worth individual, do not hesitate to contact us to fortify and strengthen your investment process. We specialize in providing tailored insights and strategic advice to discerning investors like yourself. Our unique perspective on the unfolding investment themes and asset shifts in each decade, coupled with a keen understanding of the current financial landscape, can contribute significantly to building a resilient portfolio. Let us partner with you to navigate the complexities of the market and identify opportunities that enhance the resilience of your investments while minimizing exposure to potential risks. Your financial success is our priority, and we look forward to collaborating with you on fortifying your wealth management journey.

Warm regards,

Guillermo Valencia A

Cofounder Macrowise

21st November , 2023