From climate change to inequality, lack of education access to corruption of democracy - the world is witnessing a wave of mass protests. Hong Kong demands freedom, Chilean protests rage in the streets of Santiago, Venezuelans are fleeing Maduro’s kleptocracy, Colombia covets a country free of corruption and everyone, humanity. Does Democracy Evolve Because of the Threat of Revolutions?

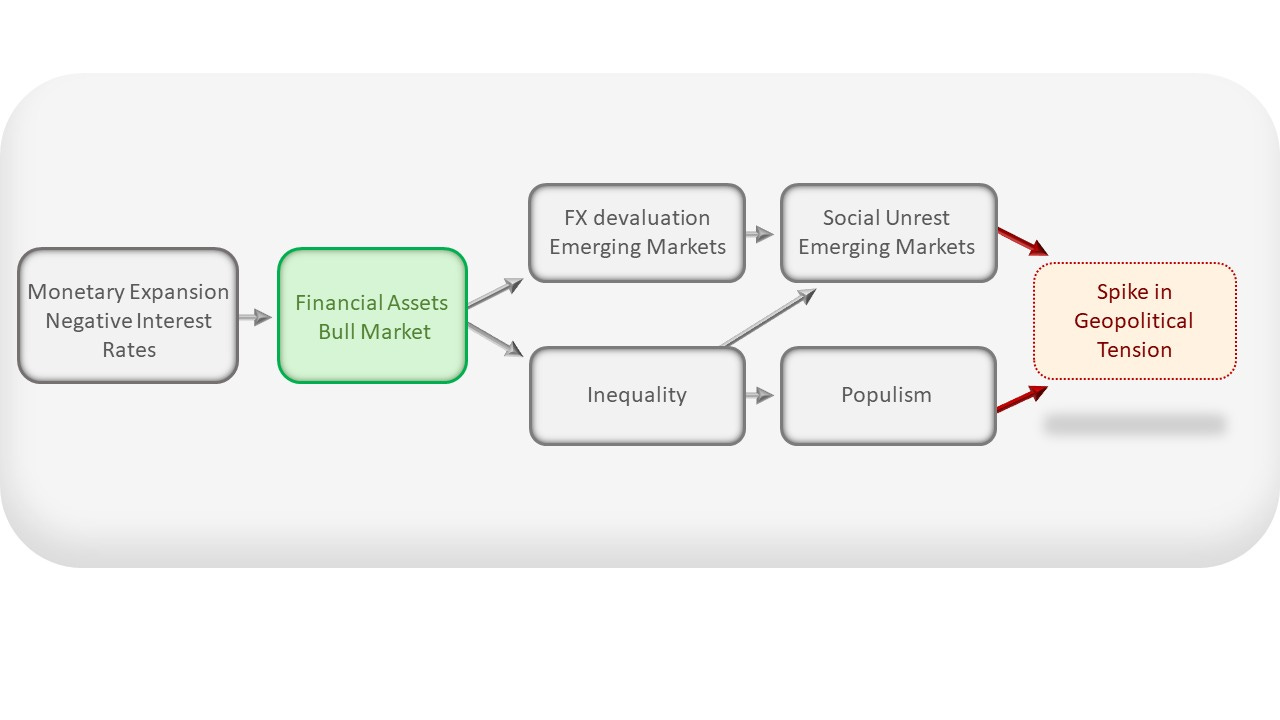

Current social unrest around the world may seem like isolated political events, but we connect this turmoil back to the source, the monetary stimulus.

The monetary stimulus created a bull market in US equity, however, this strategy has had a price:

Inequality: people holding financial assets will be better of that people without.

FX instability: Printing money - those who have assets are flush with cheap US Dollars, the most important reserve currency, which is diluting the reserves (USD) of countries without a reserve currency.

Debasement of purchasing power for EM citizen adds to inequality and social tension.

Social unrest opens opportunities for populists or calls for increased fiscal spending to try to hold the status quo.

Social unrest also increases the probability of military confrontations. Autocratic leaders in power see military escalation as a tool to remain in power.

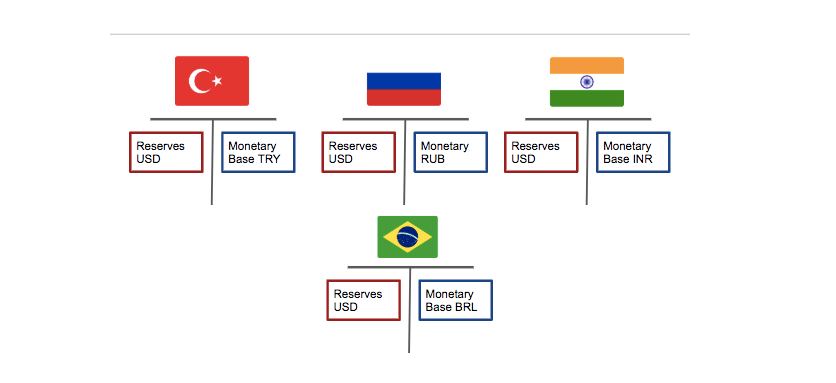

The reserve currency is a common pool resource

The United States is the provider of this common pool resource necessary for international trade and finance. Basically, all countries without a reserve currency must hold their reserves in US Dollars.

Let’s think of this as a club where the US is the leader and controls a major part of the shares. The world members have some shares proportional to their foreign reserves.

Source: St Louis Federal Reserve.

The monetary policy of the US is to optimize their national interest. It’s not the stability of a global currency. In times of crisis, the US will control inflation expectations, supporting economic growth and attempting to avoid high levels of unemployment.

We saw such a crisis in 2008. The monetary base (M2) in the US has increased from $10 trillion at that time to $16 trillion in 2019. So, the USD is being diluted for all of the members in the club. Suddenly, their representation in the global monetary system is lower because of the US policy.

The vicious Latam cycle

Currencies are ultimately the representation of the social contract between the government and its citizens. When this contract is in distress, currencies experience a wave of devaluations, decreasing wealth and purchasing power. This can result in an amazing opportunity to embrace new, inspiring leadership, but it can also be the perfect environment for populists.

The promise of Latin American socialism has failed in Venezuela, Bolivia and Argentina.

Venezuela Exports 2017. MIT Economic Complexity Map.

Venezuela is failed state where a kleptocrat has stolen the future of his citizens.

Chile and Colombia despite having far better institutions and decent economies, have failed to create any real technological progress or economic development. Dating back to the Pinochet military dictatorship in Chile (1973-1990), the Neoliberal model of the Chicago Boys also failed to inspire the youth to create real development or spark technological advancements.

Chile Exports 2017. MIT Economic Complexity Map.

While emerging market currencies will probably continue to face pressure in the FX market, we believe the beginning of a new bull market in Brazilian equities could be very near.

EWZ/SPX. Source: Tradingview.

Guillermo Valencia A

Head of Global Macro Research

Florianópolis, Brazil.

November 21st, 2019