Evergrande is the noise, developing the developed world is the signal.

Productivity, Deglobalization, Common-Pool Resources, Crypto, Metaverse, Genomics.

Before Lehman, systemic risk was totally underestimated. After 2008, every panic is now called a Lehman moment. That is how we are wired. We have a cognitive bias to assign higher probabilities to recent events. This cognitive bias is known as base rate fallacy.

Always discount monetary policy distortion

Panic is the climax of noise, so it is a good opportunity to think about what is the real signal. Since 2014, the world of atoms (retailers, real estate, energy) has been in trouble and growth has been mostly confined to the world of bits. Extremely lax monetary policies have created a false correlation between many sectors and asset classes. Here is a graph of the Nasdaq compared to materials, energy and Latinamerican equity. All the indexes are divided by M2 to discount monetary policy distortion.

Every panic moment has been a great opportunity to buy the Nasdaq. On the other hand, there has not been a positive trend for the other sectors. That is the signal!

Why is that?

The COVID and Evergrande crisis are two faces of the same problem: Globalization is in trouble.

Globalization has been based on three axioms:

China has the lowest cost factories for production in the world.

The huge demand for commodities based on Chinese Urbanization.

Global trade is ensured by American geopolitical hegemony.

Nowadays, all these three axioms are false:

After the Covid crisis, there was a rewiring of global supply chains. Being dependent on Chinese manufacturing is a major geopolitical risk for western countries.

Evergrande is the second symptom of the Chinese real estate overcapacity problem. The bankruptcy of HNA was the first symptom of a big problem in Chinese real estate.

The Pax American is over. The world is more multipolar than ever and there is massive technological competition between the US, China and Europe.

In a world that is globalized, the most important competitive advantage is COST! China had the cheapest labor in the world. Now, the situation is different. In this world, which is caught up in a race for technological supremacy, PRODUCTIVE KNOWLEDGE is the most important competitive advantage.

How to measure productive knowledge?

Cesar Hidalgo from the MIT Media Lab and Ricardo Haussman from Harvard University's Kennedy School of Government created the economic complexity index as a holistic measure of the productive capabilities of large economic systems, usually cities, regions, or countries.

Productivity will be in countries like Japan, Taiwan, Switzerland, Germany, South Korea, Singapore and the Czech Republic. They look like very interesting equity plays for us.

Japan will be back!

Japanese economic stagnation has been a puzzle for many economists. Many blame demographics, debt and corporate governance. However, the biggest problem for Japan's growth was globalization. First, the Asian Tigers, and later China had better cost structure than Japanese production. Now in a race for technological hegemony, Japan has an advantage.

Japan has been in a bear market since the Collapse of the Berlin Wall (beginning of globalization). We think that 2018 (beginning US-China Trade Wars) was the beginning of a very big bull market in Japanese equities.

The world of bits continues as one of our most important trade ideas

There are many skeptics of technology stocks because they think FAANGMs (Facebook, Amazon, Netflix, Google, Microsoft) are in a bubble, yet they miss that the internet has had different waves of transformations. The web 1.0 content was created by corporations (AOL, Netscape, Yahoo), but in the web 2.0, users created content by having free access to the infrastructure provided by companies like Facebook, Google and Amazon. In the web 2.0, every user has a digital image that represents his data, as well as their creative production. However, the control over this digital property is centralized in just a few hands.

Crypto is about solving the tragedy of the commons

The internet is a common pool resource susceptible to the tragedy of the commons. Some recommend that the common is administered by the state, others argue that most be private. The Chinese Communist Party is taking control over the internet, while in the US, it remains private.

Eleonor Ostrom, Nobel Prize winner, showed theoretically how it is possible to manage the commons in a polycentric format where different stakeholders have a part of this resource.

Crypto is the implementation of these solutions. Crypto builders like the pseudonym Satoshi Nakamoto from Bitcoin, Vitalik Buterin from Ethereum, Gavin Wood from Polkadot, Charles Hoskinson from Cardano, and Anatoly Yakovenko from Solana implemented a technological infrastructure able to solve this tragedy of commons! It happens that a reserve currency is also a common-pool resource. I see a lot of room for the coexistence of the Central Banks Digital Currencies and the best crypto projects.

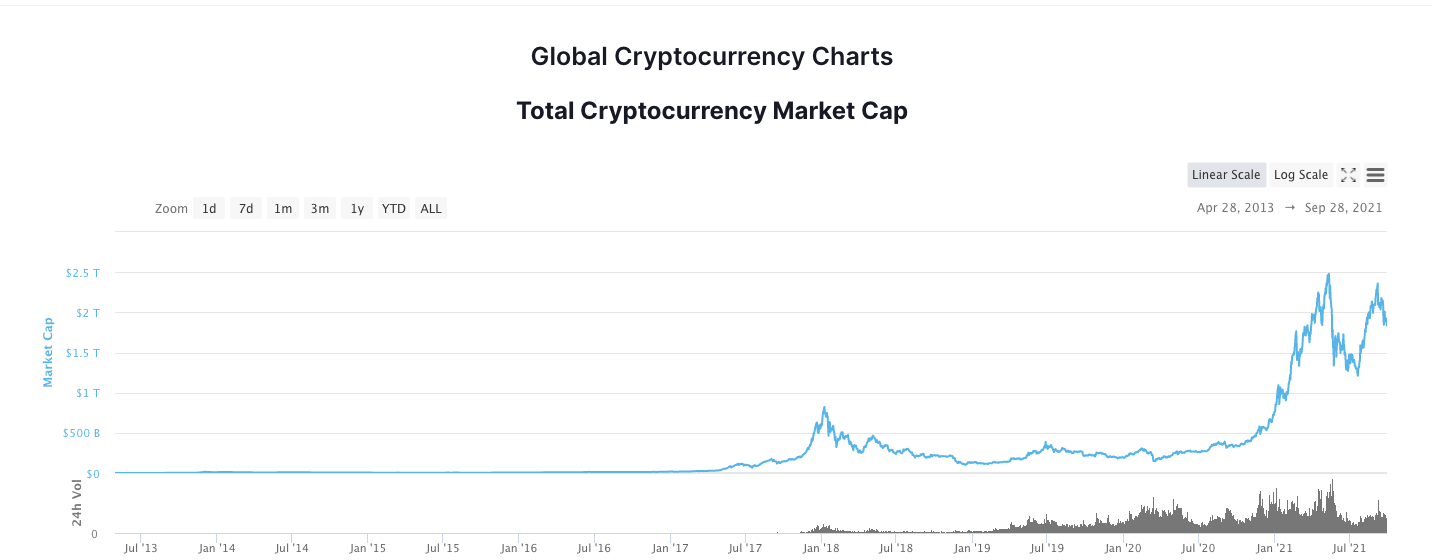

The decentralized version of the internet could reach $9 trillion of the FAANGS. The crypto market cap is still far behind, below the $2 trillion mark. That is a massive trade opportunity.

Star Atlas the decentralized metaverse in the solana blockchain

A video game is a great example of decentralized governance infrastructure. How do you monetize your ability as a gamer or a designer? Or your ability to pick the right gamers? How do you monetize your imagination? Star Atlas is a decentralized version of Facebook’s centralized metaverse.

Genes are out of style

Biotechnology in the 21st Century has ushered in an era of innovation in CRISPR, TALON, and Base gene editing technologies. According to Verified Market Research, the TAM of this market is projected to reach $14B by 2028 from $4.7B in 2020. Gene editing will have pervasive effects in more traditional oncology and rare disease applications, but also in agriculture. The future of agriculture includes cattle with more muscle mass produced by the alteration of a single gene or potatoes that don’t sweeten in storage.

The biggest players in this market today include Crispr Therapeutics (CRSP), Intellia Therapeutics (NTLA), Editas Medicine (EDIT), and Beam Therapeutics (BEAM). Covid-19 served as a major catalyst for institutional and retail investment in these companies; over the past year NTLA is up almost 600%.

However, the current, extended valuations in these companies have cooled investor excitement. Biotechnology investing is definitely not to be confused with value, fundamental-driven investing, as these 4 companies do not generate positive earnings and trade at well over 50x EV/Sales. So where is the next opportunity in the Biotechnology sector? Enter synthetic biology.

Synthetic biology (SynBio) quite literally synthetic construction of enzymes, genetic circuits, cells, or existing biological systems. Think of biology in terms of code - A’s, C’s, G’s, and T’s representing the nucleotide bases adenine, cytosine, guanine, and thymine found in the DNA strand. When Waclaw Szybalski coined the term “synthetic biology” in 1974, he could not have imagined the industry today, given the advances in Genome Sequencing, which have defied Moore’s Law. The ability to efficiently read and write billions of pairs of DNA Bases within organisms, has enabled synthetic biologists to program cellular and molecular machinery like never before.

Verified Market Research projects the synthetic biology market to reach $11B by 2028 from $6B today. While it is not quite the growth of Gene Editing, the companies within this sector will grow at greater magnitude. Why? Synthetic biology is going to permeate through various sectors and industries including pharmaceuticals, life science, household & personal products, food & beverage, and materials.

Today, we see these “platform” biotechnology companies coming to the public markets and few are worth investing in. What if you had an easier way of getting exposure to gene editing and therapy, immuno-oncology, rare diseases, pharmaceuticals, and SynBio with one company? We believe Ginkgo Bioworks is this opportunity.

Ginkgo Bioworks (NYSE: DNA) went public via the Soaring Eagle Acquisition SPAC this past summer, in a $15B SPAC Deal , and went relatively unnoticed before Cathie Wood started gobbling up shares. The company was started by Thomas Knight, an MIT computer engineer, in 2008. The CEO today, Jason Kelly, was one of four graduate students to get involved in the company with a $150,000 grant and a U-Haul. 13 years later, Ginkgo is building one of the most diverse customer bases across various industries with support from DARPA and SBIR.

Ginkgo generates an upfront fee for their Foundry business, which is where cells and organisms are engineered inside of factories utilizing robotics, software, and Ginkgo Codebase. Ginkgo Codebase is essentially a database of cells, enzymes, genetic programs, and DNA sequences. Additionally, Ginkgo earns either royalties or equity stakes in the companies utilizing Ginkgo’s Foundry and Codebase for R&D.

With companies like Moderna, Bayer, Roche, and Twist Bioscience all outsourcing R&D to Ginkgo for vaccines (Ex: Moderna’s mRNA Covid-19 Vaccine) , therapies, organisms, cells, and even materials, Ginkgo appears to be an attractive bet on the entire Biotechnology industry with stable, future cash flows.

'Real Tech' Built in Boston, Not Silicon Valley: Ginkgo Bioworks

I hope you enjoy this piece of research and will share it with anyone that you think will find it interesting.

Thanks for reading,

Guillermo Valencia

Derek Centineo

October 1st , 2021

NO INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer here or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto.