Forging the Future: Beyond Predictions to Building Strategic ARKs

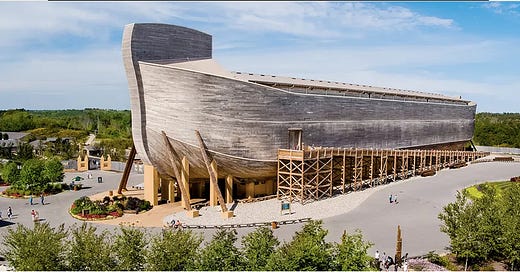

Making sense of rain is futile; building ARKs is the real game-changer.Long Technology, Small Caps, Commodities and Japan.

In the wake of December 2022's narratives, the world was forecasted to be in the grips of stagflation, with inverted yield curves ominously signaling recession. The echoes of pessimism resonated through Silicon Valley Bank, Credit Suisse, and regional banks, exacerbated by alarming narratives predicting the collapse of the Chinese real estate complex.

However, as reality unfolded in 2023, predictions proved erroneous. The S&P 500 roared to life akin to the 1950s, the Nasdaq surged to new heights, and even the once-muted crypto market showed signs of resurrection. This unexpected optimism caught money markets off guard, amassing over $6 trillion.

Source: BoFA Global Research

Warren Buffett's wisdom echoes in this unpredictability: making sense of rain is futile; building ARKs is the real game-changer.

The era of monetary dominance, a remnant from the Volcker era, has given way. The extremes of negative interest rates define the past, with the pandemic heralding the age of fiscal dominance, where industrial policy takes center stage. Silicon Valley Bank's bankruptcy was mere noise; the real signal was the Biden Antiflation Act. It extends beyond the U.S., with Japan renewing its commitment to industrial innovation, and China allocating significant funds to "Made in China 2025."

The questions that arise are profound—identifying the next national champions, discerning strategic commodities, and understanding the potential benefits for small caps in this world of fiscal dominance. In this transformed landscape, the conventional wisdom of treasuries as the risk-free asset is being questioned, as gold attains new highs.

Gold Prices. Source: Tradingview.

The crux of history reveals that while industrial policy is indispensable, it alone falls short. True innovation demands the freedom for experimentation, the embrace of craziness, the celebration of heterogeneity, and the crucible of geopolitical competition.

Looking to the next decade, what will be the ARKs that shape our future? Will it be the Japanese revival of industrial policy, the disruptive forces in crypto, biotech, and electric cars epitomized by Cathie Wood's ARKK funds, or the untapped potential of the Russell 3000 Small Caps Index?

Nikkei compared with the Russell 3000 and ARKK funds

In the spirit of forging the future, let us transcend predictions and actively engage in building the strategic ARKs that will navigate the uncertainties of tomorrow.

Guillermo Valencia A

Navigator of the world in perpetual motion