From Bonds to Bots: Navigating the New Financial and Manufacturing Landscape

This bond market tumble isn't just another market hiccup. It's symptomatic of a seismic shift: the age of globalization is waning.

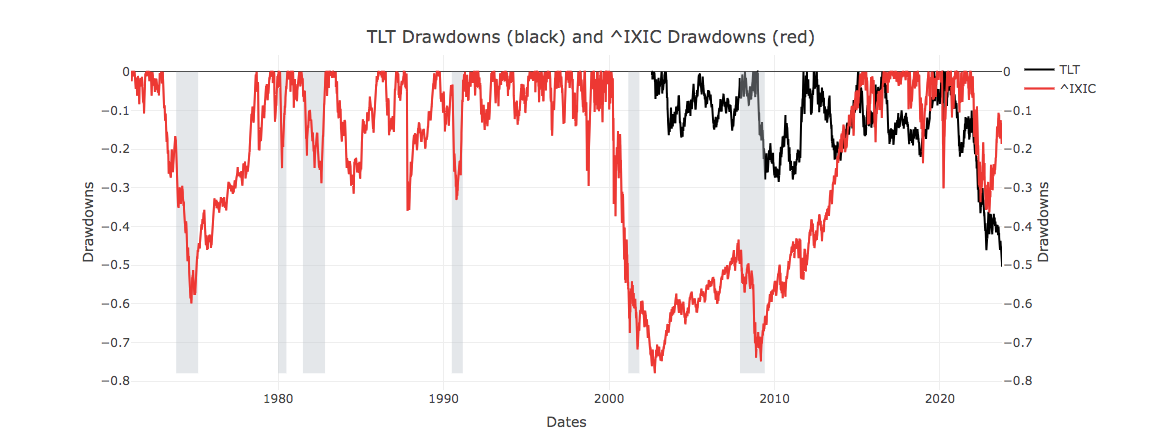

The Treasury market has changed, and not for the better. It’s plummeted, a stark drop of over 50%, now jostling for attention with speculative assets like Bitcoin. But let's be serious—are we truly drawing parallels here? U.S. Treasuries command a market capitalization of $23.9 trillion, whereas Bitcoin—despite being the town's buzz—is at a mere $500 billion. And let’s not downplay the pivotal role of Treasuries: they set the tone for mid to long-term interest rates, shaping the behemoth $133 trillion global bond market. And while we're throwing numbers around, let’s not forget the staggering $502 trillion interest rate derivatives market.

The dwindling fortunes of Treasuries spell out a grim message: the age-old financial playbook is being rewritten. In this brave new financial world, “risk-free” is becoming an outdated concept. Everything is volatile. The real gamble is discerning which assets are the genuine goldmines and which are ticking time bombs.

Pension funds, once a symbol of unyielding stability, are at a crossroads. Millions staked their futures on these funds, and their assurance is now on shaky ground. Fund managers are faced with a monumental choice: will they pivot more heavily to equities, defying conventional wisdom?

TLT drawdowns , Vs Nasdaq (RED). Source: YahooFinance.

This bond market tumble isn't just another market hiccup. It's symptomatic of a seismic shift: the age of globalization is waning. Trust is dwindling, and every nation, every major player, is charting its own course to success.

Is long-term investment a relic of the past? If so, all eyes might shift to short-term bets, cash is KING (DXY)

Dollar Index. Source: YahooFinance.

Yet, within chaos, there’s opportunity. Debt-ridden nations lacking manufacturing prowess are staring into an uncertain horizon. But while some might see impending doom, I see a fresh order rising. China, in its relentless metamorphosis, is channeling its might toward emerging markets. In tandem, the competition with the Asian giant is stirring a manufacturing renaissance in places like the U.S., Japan, and Europe. The future might just be a throwback, with manufacturing at its heart, but injected with the modernity of automation.

And let's not forget, this resurgence in manufacturing is intrinsically tied to the lifeblood of electricity.

Price of Uranium. Source: Tradingeconomics.

Sincerely yours,

Guillermo Valencia