From the Order of Globalization to the New Paradigm of Networks

The old world was understood in averages: GDP as a nation's average.Stock indices as the market's average.Real growth occurs in specific nodes that solve critical problems and scale globally.

In 1989, the world shifted gears. What began as the collapse of old barriers evolved into a profound transformation of global systems. This essay explores that journey—from the triumph of globalization to the cracks that exposed its flaws, and ultimately to a new era defined by networks, innovation hubs, and adaptive intelligence. Let's dive in.

1. The Birth of a New Order (1989)

In 1989, a new model of thinking began to take shape, which, two decades later, would transform the planet.

In 1989, the fall of the Berlin Wall marks the end of the Cold War.

The United States emerges as the great winner and consolidates Pax Americana: a globalization system where its dominance over maritime routes ensures international trade and capital flow.

2. Energy in Dollars: The Heart of the System

For this model to function, it needed a stable energy supply, and the central source was oil.

Controlling oil and ensuring it was traded in dollars was fundamental to sustaining the entire financial system.

This led to U.S. military expansion in the Middle East and agreements with OPEC, which in exchange for dollars received security for their production.

Three sectors became the big winners of this order:

International banking

Oil industry

Automotive industry (based on internal combustion engines)

3. 1989: The Digital Leap

That same year, Tim Berners-Lee creates the HTTP protocol, the foundation of the World Wide Web.

The personal computer already had its dominant design; the challenge was to make it cheaper and mass-produce it.

Internet became the most powerful innovation highway in history.

4. New Economic Paradigms

Globalization reduced transaction costs and paved the way for an era of declining interest rates.

From the peaks of the late 80s, monetary policies began to lower rates, establishing the risk-free rate paradigm.

At the same time, the idea that the best way to manage risk was diversification became popular.

5. The Era of Diversification and the Average

This thinking drove:

ETFs

Pension funds

Insurance industry

Shadow banking system

The notion that "the average represents us" also permeated the way economic growth was measured: a country's GDP as an average of its activity, an abstraction typical of the 20th century.

6. The Paradigm of the Specialist

Globalization not only sought to optimize costs, but also to optimize knowledge.

Extreme specialization was rewarded: doctorates in increasingly specific fields.

The polymath ceased to be strategic; the system preferred niche experts who fit into predefined gears.

7. First Cracks: 2001

On September 11, 2001, a small group struck the financial heart of the U.S. with minimal resources.

This raised the question:

Are nation-states the best structure to face global threats?

Terrorism demonstrated that it could challenge superpowers without armies or territories.

8. 2008: The Financial Collapse

The shadow banking system and mortgage-backed securities concentrated risks and distributed them throughout the system.

When Lehman Brothers failed, the contagion threatened a new Great Depression.

Central banks responded with massive monetary expansion and large-scale bailouts.

Collapse was avoided, but zombie companies incapable of generating sufficient margins to survive without debt were also saved.

This blocked the essential cycle of creative destruction for the system to learn and evolve.

9. The Seed of a New Financial System

In 2008, Satoshi Nakamoto publishes the Bitcoin whitepaper, proposing a decentralized system independent of banking control.

At the time it was marginal, but it planted the seed of an alternative financial infrastructure.

10. 2014: Shale Oil, Electric Mobility, and Geopolitical Change

The shale oil and shale gas revolution reduced U.S. energy dependence and positioned gas as a relevant competitor.

In parallel, Tesla launched the Model S (2012), opening the era of electric mobility.

That year, Russia annexed Crimea, securing strategic points vital for an energy-exporting country with a nuclear arsenal.

11. 2020: Pandemic and Excess Interconnection

COVID-19 demonstrated that global interconnection also multiplies vulnerability:

What were once supply chains or capital flows became biological super-spreaders.

Central banks responded as in 2008, but on a much larger scale, accelerating money printing.

This shifted us from a deflationary paradigm to one of structural inflation and rising rates.

12. The Fallacy of Diversification

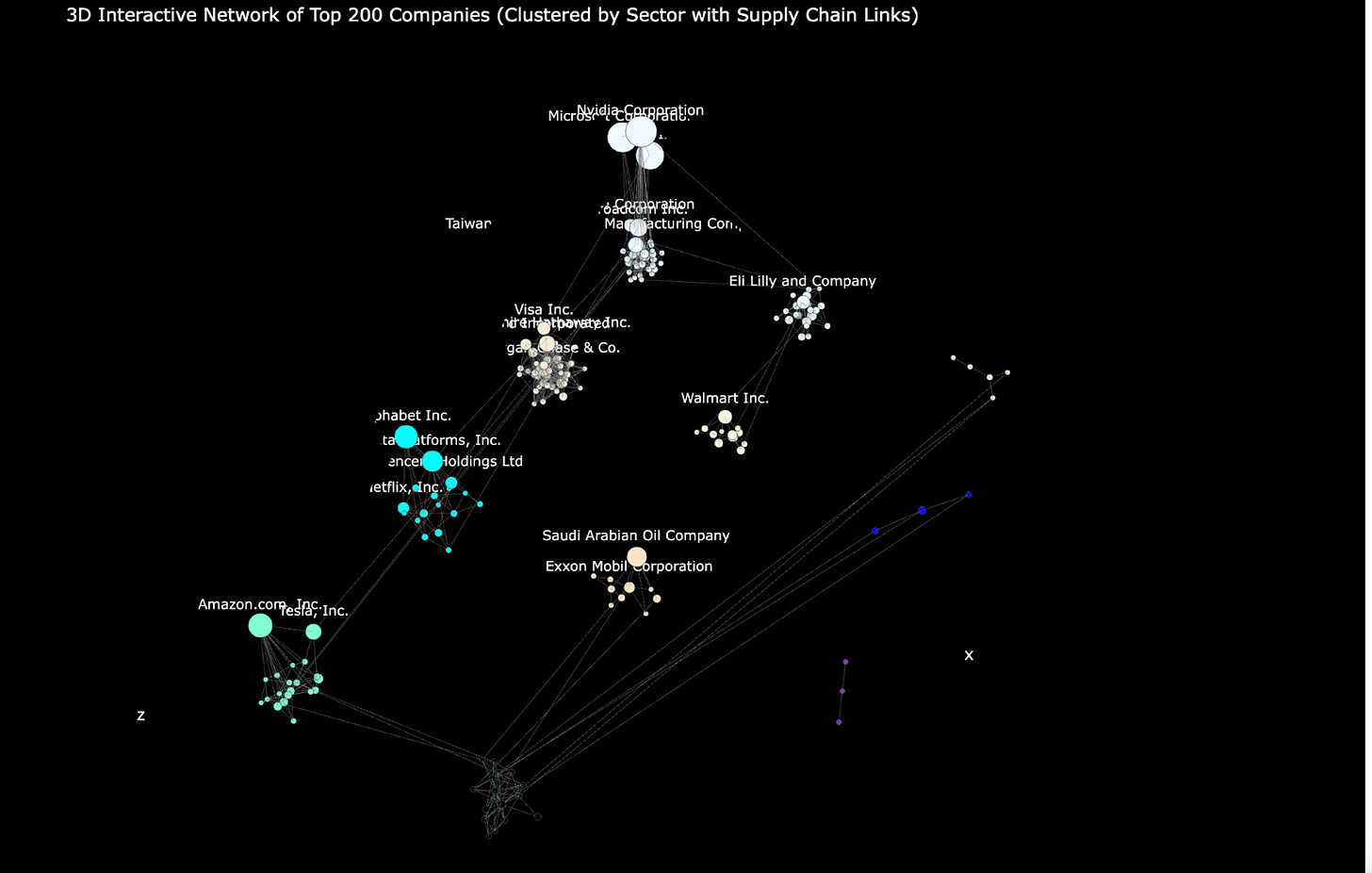

Indiscriminate diversification denies the reality of hubs:

The nodes where innovation, talent, and capital concentrate.

In a scale-free network, a few nodes generate the system's learning and adaptation.

Diluting capital in low-innovation zones reduces evolutionary potential.

13. Equality, Homogeneity, and the Risk of Killing Hubs

The political paradigm of the welfare state seeks homogeneity and justice, but in systemic terms, this can stifle hubs.

If resources are redistributed to sustain inefficient nodes, the network fills with zombie systems, incapable of adapting.

14. Intervened Capitalism: Disguised Communism

Post-2008 capitalism, by preventing the natural replacement of hubs, repeated the structural error of communism:

Avoiding the network's learning and renewal to protect obsolete actors.

The consequence: stagnation and accumulation of inefficiencies.

15. Artificial Intelligence and the End of the Specialist

With the arrival of models like GPT (2022), the extreme specialist loses strategic advantage.

AI can absorb the technical knowledge of a field in seconds.

Power shifts toward generalists capable of connecting disciplines, generating meaning, and creating original solutions.

16. The New Paradigm: Networks, Electricity, and Automation

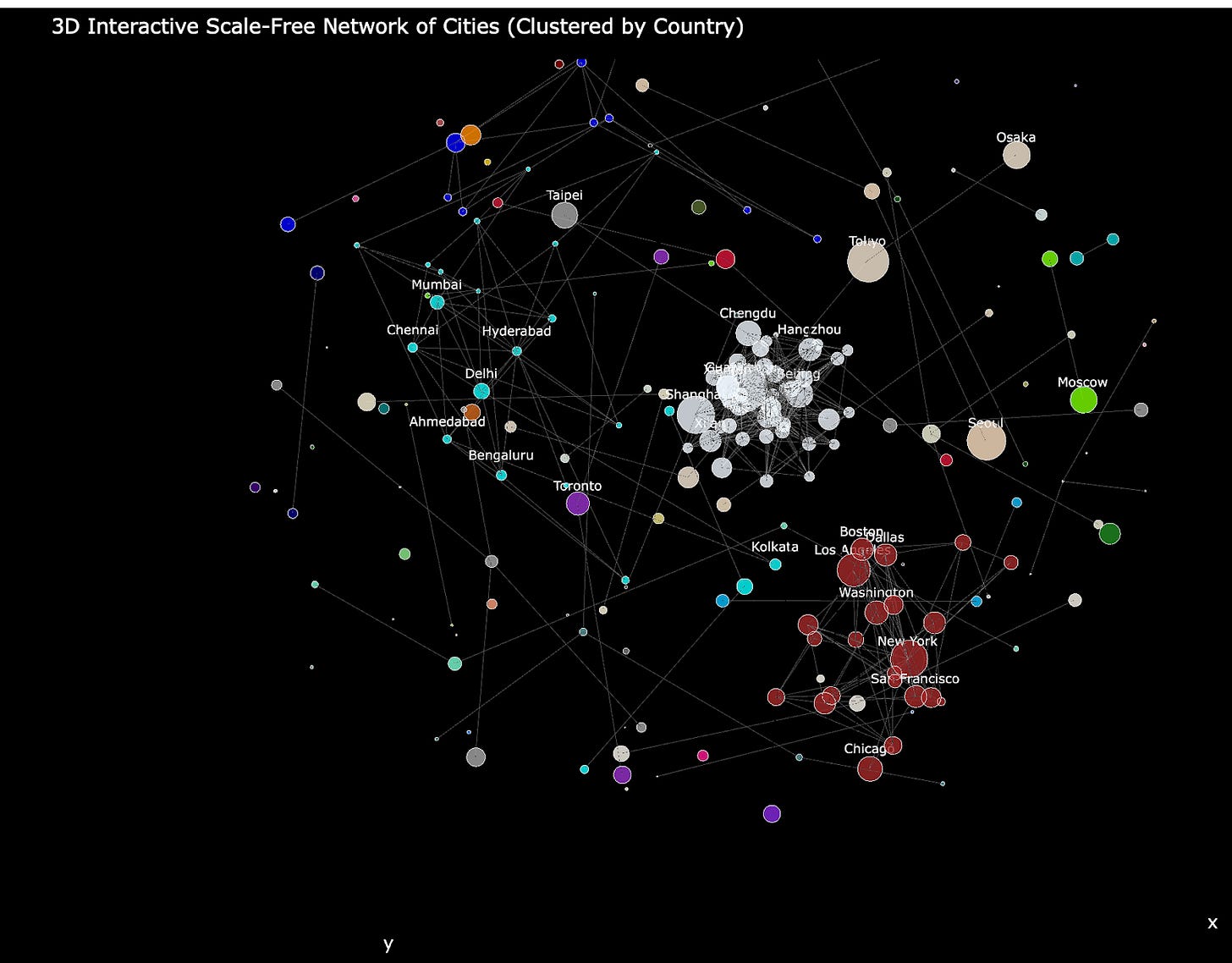

The world is no longer organized as a map of nation-states, but as a network of cities with scale-free topology.

In this new model:

Electricity replaces oil as the central energy source.

Chips and semiconductors are the critical infrastructure.

Labor is automated with AI and robotics.

Capital must be allocated to real value creation, not just minimizing volatility.

Education must train creative generalists, not niche specialists.

17. From the Average to the Network

The old world was understood in averages:

GDP as a nation's average.

Stock indices as the market's average.

Real growth occurs in specific nodes that solve critical problems and scale globally.

The future is not an average: it is a living, adaptive, and scale-free network.

Cities are the key

Markets are not an index but a Scale Free Network

What do you think? Is the shift to networks inevitable, or can globalization adapt? Share your thoughts in the comments below. If you enjoyed this, subscribe for more insights on emerging paradigms.

Freedom , Ultra learning, Abundance.

Thanks for reading,

Guillermo Valencia A

Cofounder of MacroWise