Gold’s Tug-of-War: The Metal Everyone Wants to Own (and Bitcoin’s Sneaky Entrance)

it’s gold and Bitcoin, two sides of the same rebellion. Gold’s the grizzled veteran, trusted and steady. Bitcoin’s the loud, reckless newcomer, promising a future where money doesn’t need a middleman.

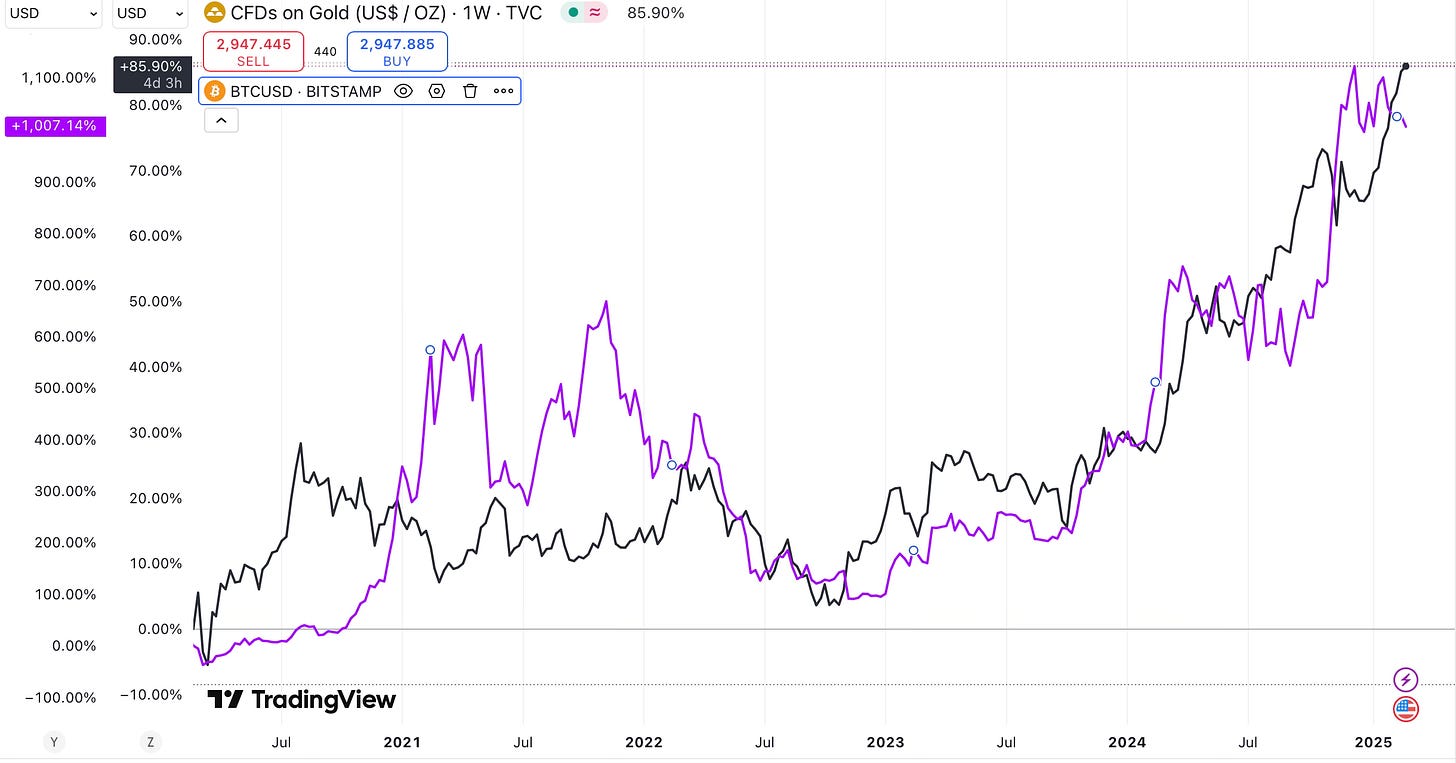

BTC (purple) Vs GOLD (Black).

Picture this: the stock market’s tanking, headlines are screaming, and gold’s just sitting there, gleaming like it knows something we don’t. It’s not just another crash—it’s a moment where the world’s rethinking money itself. There’s talk of a new system, whispers of a “Mar-a-Lago Accord,” and a global power shuffle that feels like Cold War 2.0. In the middle of it all? Gold. Everyone wants a piece of it—the U.S., the BRICS countries, you name it. But why? And what’s it mean when the old safe haven becomes the new battleground?

Now, toss Bitcoin into the mix—“digital gold,” they call it, crashing the party with its wild, untamed energy. It’s not just gold under the spotlight anymore; it’s gold and Bitcoin, two shiny rebels in a world pulling every which way. Let’s unpack it, step by step, like a story over coffee. It’s messy, it’s human, and it’s got both gold and Bitcoin right at the heart.

Gold: The Eternal Backup Plan

Gold’s been around forever. When Rome fell, when markets crashed in ‘29, when the dot-com bubble popped—gold was there, steady as a rock. People don’t buy it because it’s flashy; they buy it because it’s reliable. Right now, with stocks in freefall, that’s exactly what’s happening. Investors are piling in, prices are climbing, and gold’s doing its thing: being the one asset that doesn’t blink when everything else does.

But this time, it’s not just fear driving the rush. There’s a bigger fight brewing—a tug-of-war over who gets to call gold their ace in the hole. And it’s not just governments; it’s the whole world watching, wondering if the rules of money are about to change.

The BRICS Play: A New Alternative

The BRICS crew—Brazil, Russia, India, China, South Africa—aren’t just sitting pretty. They’re tired of the dollar running the show. For decades, the U.S. dollar’s been the world’s go-to currency, backed by trust and power. But trust is fraying, and the BRICS want an alternative. Enter gold. They’ve been stockpiling it—Russia and China especially—because it’s a hedge that doesn’t bow to Washington.

Imagine a new system where gold backs their trade, their currencies, their power. It’s not sci-fi; it’s strategy. If they pull it off, gold becomes the middleman in a BRICS-led monetary rebellion. It’s neutral, it’s tangible, and it’s a jab at the dollar’s dominance. But here’s the catch: the U.S. isn’t about to let that happen without a fight.

The U.S. Counter: Leverage Over the Old Metal

The U.S. has over 8,000 tons of gold stashed in Fort Knox—more than anyone. It’s not just sitting there collecting dust; it’s leverage. If the BRICS want gold to anchor their new system, the U.S. wants to keep it in their orbit too. Enter the “Mar-a-Lago Accord” idea floating around financial circles. Think of it as a modern Plaza Accord—back in ‘85, big economies weakened the dollar to fix trade gaps. Now? The chatter’s about weakening the dollar again, restructuring debt, and maybe using tariffs to flex muscle.

Why does this matter for gold? A weaker dollar makes gold pricier, sure—but it’s more than that. If the U.S. can steer this shake-up, they keep gold tethered to their influence. They’re not blind—they see the BRICS hoarding it. So, banks moving gold from London to the U.S.? Could be a quiet power play, positioning it where the U.S. can watch it close. The message: “You can have your gold, but we’ve got ours—and we’re not letting go.”

Cold War 2.0: The Economic Battlefield

Zoom out, and it’s bigger than just gold bars. This is Cold War 2.0—U.S. versus China, Russia, and whoever else picks a side. It’s not just missiles; it’s money, trade, sanctions. Gold’s the perfect pawn. The BRICS want it to dodge dollar-based sanctions; the U.S. wants it to shore up their own system if the dollar wobbles. Countries are picking teams, and gold’s the one asset nobody’s arguing about—it’s just there, neutral, waiting to be claimed.

And then there’s Fort Knox. No full audit since the ‘50s? That’s fuel for rumors. Is it full? Empty? Doesn’t matter—what matters is people wondering. Doubt in U.S. reserves could spike gold prices higher, playing into everyone’s hands but complicating the game.

Bitcoin: The Digital Wildcard

But hold up—there’s a new kid on the block. Bitcoin. It’s not gold; it’s “digital gold,” a decentralized, borderless, and wildly unpredictable challenger. Born in 2009, it’s barely old enough to drive, but it’s already turning heads. Unlike gold, you can’t hold it, but you can send it anywhere, anytime, no permission needed. That’s huge in a world where sanctions and borders are tightening.

In this new Cold War, Bitcoin’s the wildcard. Russia’s used it to skirt sanctions. China’s keeping an eye on it while stacking gold. It’s not as steady as gold—its price swings like a rollercoaster—but it’s a lifeline when trust in banks or governments cracks. And here’s the twist: Bitcoin doesn’t care about Fort Knox or audits. It lives on a blockchain, transparent to anyone with Wi-Fi. It’s not poised to knock gold off its throne—not yet—but it’s shaking things up, offering a way to opt out of the old system entirely.

The Tug-of-War Expands

So now, it’s not just gold caught in the middle—it’s gold and Bitcoin, two sides of the same rebellion. Gold’s the grizzled veteran, trusted and steady. Bitcoin’s the loud, reckless newcomer, promising a future where money doesn’t need a middleman. The BRICS see gold as their ticket to a new order; the U.S. sees it as a way to hold the line. Bitcoin? It’s the joker in the deck—borderless, uncontrollable, and a headache for anyone trying to keep the system neat.

In this tug-of-war, gold’s the rope, Bitcoin’s the wild swing, and everyone’s pulling every which way. The U.S. wants the dollar to stay king, the BRICS want a multipolar world, and Bitcoin’s just there, daring both sides to ignore it. It’s a fight for the future—one ounce, one coin at a time.

The Middle of the Mess

So here we are. The market’s crashing, gold’s rising, Bitcoin’s bouncing, and it’s not just about safety anymore—it’s about power. The BRICS see gold as the center of their new alternative, a way to slip the dollar’s grip. The U.S. sees it as leverage to stay on top. Bitcoin’s the chaos agent, hinting at a world where money doesn’t need governments at all. Cold War 2.0 makes it a battlefield; Fort Knox makes it a mystery. It’s not just about metals or code—it’s about who gets to write the rules when the old ones fray.

Next time you hear gold’s up or Bitcoin’s spiking, don’t just think “crash.” Think about the hands reaching for them—BRICS pulling one way, the U.S. the other, and Bitcoin slipping through the cracks. Gold’s not picking sides; it’s just sitting there, shiny and smug. Bitcoin’s not waiting for permission; it’s rewriting the playbook. And us? We’re just along for the ride, watching the world figure out what money means next.

This is gold and Bitcoin’s moment—not just as refuges, but as the stakes in a global power pull. Simple, messy, and oh-so-human. What do you think?

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

February 24th, 2025