In a Post-Index Investing Era: Mastering the Power of Selection Over Diversification

Nature tends to lean towards selection rather than diversification. It's through a multitude of samples that we're able to filter and pinpoint the elements that truly impact our lives.

Reducing the complexities of the world to mere indices is akin to oversimplification, a tendency that blinds us to the deeper currents shaping our reality. GDP figures and stock market indices serve as convenient markers, but they often obscure the fundamental forces at play.

In the arena of geopolitics, we witness a clash of titans—the United States and China—each vying for supremacy in an ever-shifting landscape. With the U.S. economy approaching a staggering 27 trillion USD and China's not far behind at 19.4 trillion USD, the stage is set for a geopolitical showdown of unprecedented proportions.

Yet, amidst this apparent duopoly, a subtler narrative unfolds—one of emerging powers and resurgent giants. The rise of Japan, Germany, and the burgeoning prowess of India, each boasting economies now surpassing the $4 trillion mark, signals a broader recalibration of global power dynamics.

To truly grasp the unfolding narrative of our times, we must eschew the comfort of conventional indices and delve deeper into the underlying currents of geopolitics, technology, and resource competition. Only then can we glean the insights necessary to navigate the complexities of our rapidly evolving world.

DEBT

When examining global debt, the United States, China, and Japan stand out as the nations carrying the heaviest burdens. Notably, China is unique among them, lacking the status of a full reserve currency. Conversely, both the US and Japan enjoy the exorbitant privilege of being able to leverage their reserve currency status to effectively print money in order to service their debts.

Economic Growth and Demographics

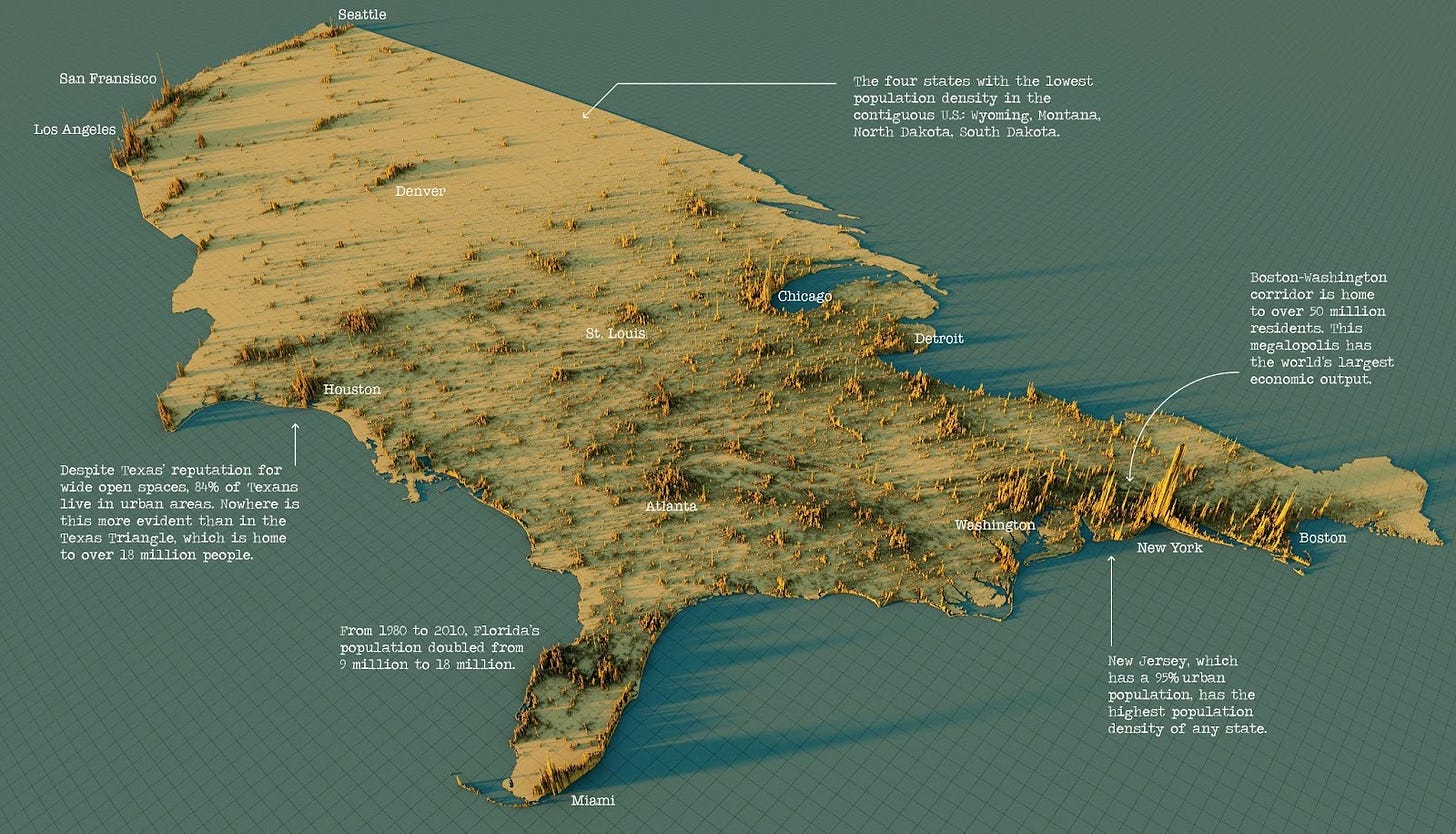

In the realm of economic growth, conventional wisdom often fixates on the nation-state as the locus of progress. However, a closer examination reveals that the true crucibles of innovation and prosperity are the cities. It is within these urban epicenters that population density, human creativity, and wealth accumulation reach their zenith. Yet, amidst the vibrancy of urban life, we confront the harsh realities of crime and pollution, underscoring the complex tapestry of urban dynamics.

UNITED STATES

CHINA

INDIA

JAPAN

GLOBAL EQUITY

Currently, the lion's share of global financial returns is concentrated within the United States.

Out of the 100 largest companies globally, 51 are based in the United States!

OIL

The United States stands as the leading oil-producing nation globally, contributing nearly 20% of the world's total oil production.

CHIPS MANUFACTURING

Japan holds the distinction of being the largest manufacturing country of chips.

ROBOTS

Korea leads the world in robot density within the manufacturing industry, boasting an impressive ratio of 1012 robots per 10,000 employees.

Thanks for reading,

Guillermo Valencia A

Co-founder of Macrowise

Miami, February 13th 2024