In the Eye of the Storm: The Crude Oil War

It’s not about what everyone sees, but what no one notices.

The screen flickered with graphs and numbers, shifting at a dizzying pace. In a digitized world where information travels faster than ever, understanding markets feels like navigating the code of a vast system—much like the matrix that governs everything in The Matrix. But just like in that dystopian fiction, the headlines rarely reveal the most important signals. Investors are currently locked in endless debates about rate cuts, soft landings, or hard crashes. Yet, what’s truly defining long-term volatility often lurks beneath the surface, unseen.

“Let me show you how the system really works, Watson,” I murmured, watching the flow of data cascade across the screen. “It’s not about what everyone sees, but what no one notices.”

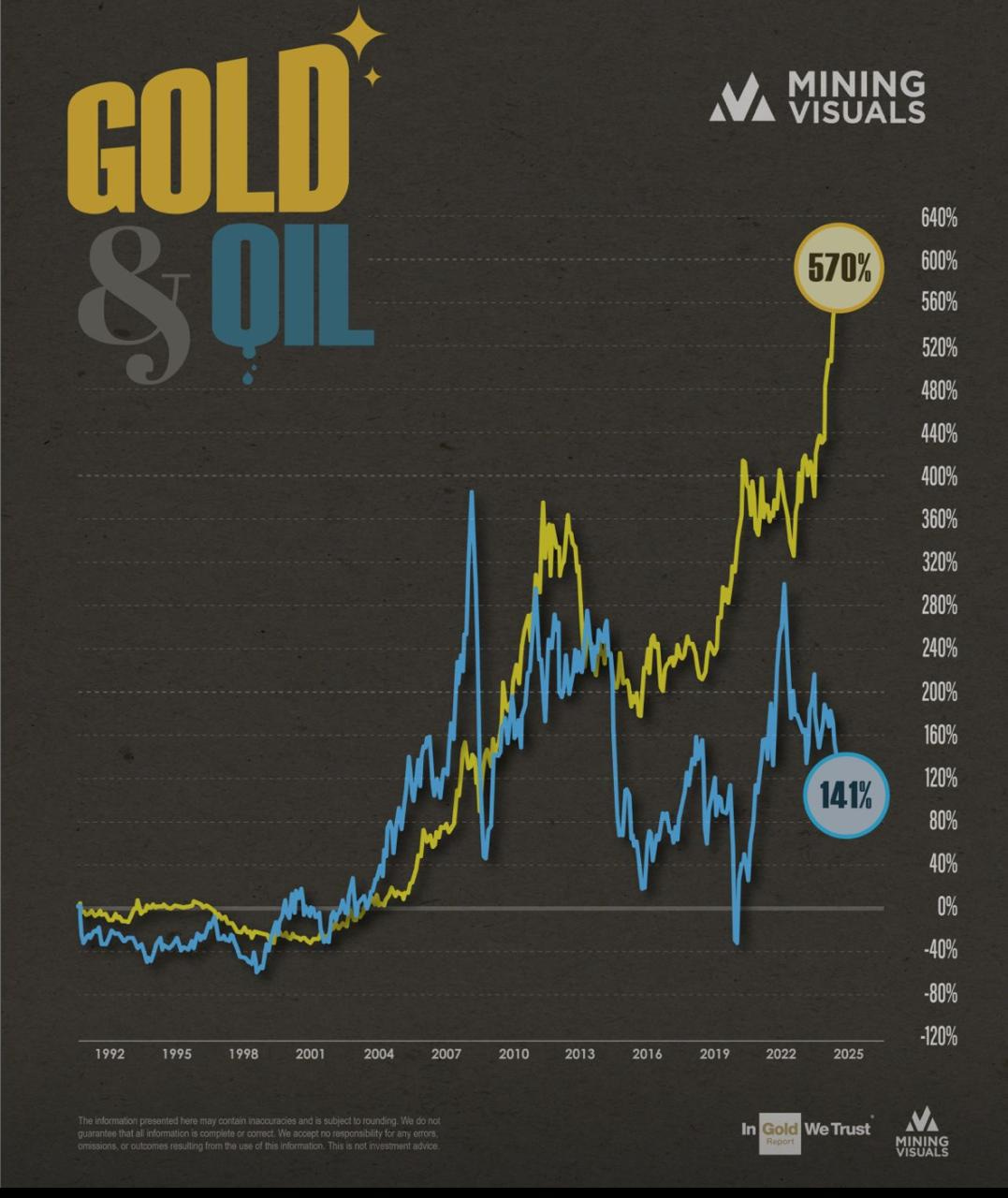

Watson, ever curious, posed the question while eyeing the live market feeds: “Holmes, I don’t get it. Gold is hitting historic highs, but oil is showing weakness. If gold is rising due to fears of conflict in the Middle East, shouldn’t both be climbing at the same time?”

“Ah, Watson, welcome to the game within the game,” I replied, as the data shifted and reorganized. “Since the great financial collapse of 2008, I’ve held that the system has changed. It used to be a perfectly synchronized global machine. Now, it’s become multipolar, with strands of code operating in opposite directions. The shale oil revolution in 2014 was a virus that rewrote the entire energy market, sending crude prices plummeting. Yet the dominant narrative—the one everyone follows blindly—claimed that a full transition to renewable energy was inevitable. But when Russia invaded Ukraine, it became clear that this transition wouldn’t happen as fast as people thought.”

I paused, watching as energy market indicators flickered on the screen. “What’s really happening, Watson, is a shift toward electricity. In this new code, gas, uranium, hydropower, and renewables are the true players of the future.”

Watson stared, trying to decipher the emerging patterns. “So, are you saying that Saudi Arabia and Russia could flood the market with oil to drive prices down? But how? Their economies depend on crude. Isn’t that too risky?”

“That, Watson, is pure game theory,” I replied as the system projected the future of oil prices on the screen. “Look at the numbers: Saudi Arabia has a breakeven point between $10 and $20 per barrel, while Russia’s is between $20 and $40. Meanwhile, U.S. shale oil production requires prices between $40 and $50 to stay profitable, and in places like Brazil, Guyana, and Canada, it’s even higher—between $50 and $70. If the price of crude falls to $40, they could cripple shale production and these competitors. In the long run, they preserve their market share, like a hacker defending their control of the system.”

Watson nodded, though still with traces of doubt. “But Holmes, oil prices don’t only depend on supply. What about demand?”

“Exactly, Watson,” I said, pulling up global demand trends. “Saudi Arabia and Russia can only pull off this attack if they know a recession is coming. Recent U.S. employment data has been weak, and if we look at iron ore prices, we can see the Chinese economy is softening. This is the perfect environment for them to execute their strategy.”

Watson, processing the scale of what lay ahead, spoke slowly: “If oil prices fall, volatility in emerging market currencies will explode. That means severe devaluations for the Brazilian real, the Mexican peso, and the Colombian peso.”

“Correct, Watson,” I nodded as currency charts flickered on the screen. “A low oil price, combined with poor fiscal policies in countries governed by populists, will destabilize their economies. The code will crack, and their currencies will crumble.”

But Watson wasn’t finished. “Holmes, if tensions escalate in the Middle East—if the Houthis attack a Saudi Aramco facility, or if Iran intensifies hostilities—wouldn’t that send oil prices skyrocketing in the short term?”

“Ah, Watson,” I replied, as the system projected a possible strike scenario. “In the short term, of course. A Houthi attack or Iranian aggression could push prices up temporarily. But here’s the irony of the system: if Saudi Arabia wants to weaken Iran in the long run, it needs low oil prices to limit the financial power that strengthens its rival. It’s a game of patience, of strategy. It’s not about the immediate reaction—it’s about how you manipulate the board for the long haul.”

Watson looked at me, finally grasping the gravity of the situation. “It’s a complex game, Holmes. It’s not what we see on the surface, but what’s behind the headlines that really moves the market.”

“Exactly, Watson,” I replied as the system projected multiple possible futures in a hyper-connected world. “In this vast game of shadows and code, don’t be fooled by the surface-level shine. What truly drives the market is the invisible game between the great powers, manipulating energy and geopolitics to maintain their dominance. Like The Matrix, it’s what you don’t see that’s really at stake.”

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

September 15th , 2024