It’s Not the 70s, It’s the Golden 50s

A strong dollar and a rally in oil markets is an oxymoron in a globalization regime. But it is the rule in a cold war. Long technological revival & long de-globalization

Long Nasdaq, Long Copper, Long Uranium, Long BTC and Long USD

Short EM Fixed Income

Short Euro

Our framework

The consensus is discounting a macro scenario like 1970. High inflation and stagnation. We think we are in a different macro scenario like 1950 -1970 the beginning of a new inflationary trend and the Cold War between the US and Soviet Union.

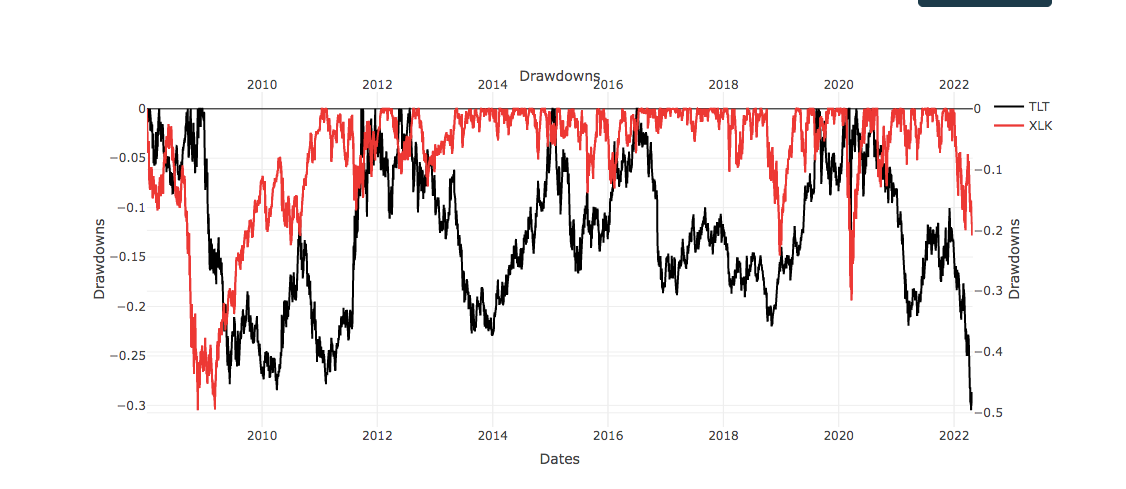

The big drawdown in TLT (US Treasuries ETF) and XLK (Nasdaq ETF) along with the massive rally in Energy Stocks and Commodities is consistent with this scenario.

However, there is a big if in the FX market. The strong USD (USDJPY, USDEUR, USDKRW) is telling us something different. The strong dollar is not what happens in the world experimenting with stagflation.

Strong USD, weak treasuries is a signal indicator of economic growth. I think the most contrarian investment idea is to bet on an increase in productivity in the US. The pandemic triggered a rewire in the global supply chains and production capacity is back to the US. The war in Ukraine is accelerating the pace of the de-globalization trend.

Reminiscence of the 50s.

AAA Bond Rates vs. S&P 500 Since 1910

Beginning in 1942, the world began to transition from a multipolar war into a Cold War setting.

It presented a tremendous opportunity for equity markets and commodities, in particular copper and energy related ones. This is a very interesting template for the decades to come.

Oil (Orange) vs S&P 500

The short term losers of the current geopolitical situation which are developed countries with energy dependency- Europe, Japan, South Korea. Another loser is Russia. Strong rates are not good for emerging market countries, even commodity exporters.

The shale oil & gas industry is one of the biggest advantages of the US economy.

Golden age of a technological revolution

We are in the golden age of the semiconductor technological revolution that began in the 70s and picked its Frenzy Stage in 2000. Since 2020, we embarked on the golden age of information technology. It is also the beginning of the genetic engineering era.

Many failed bubble crash predictions in the Nasdaq.

Beautiful buying opportunities.

Crypto is in a tipping point

Bitcoin is only at the beginning of the adoption curve. We think the current global environment is a tipping point for crypto. We think we are close to experiencing a frenzy period in crypto assets.

Crypto is now trading more like Nasdaq stock than as a reserve of value.

Thanks for reading,

Guillermo Valencia

Co-founder Macrowise & Scale

Brazil, April 29th 2022