For years many have warned of the imminent collapse of the tech bubble. In 2012, then 2016 and again in 2018 the rhetoric was the same — the market, especially the tech giants, was due for a collapse as the volatility continued to mount. The market experienced rapid selloffs, but every time it rebounded. Once again the same doom and gloom has come to the forefront. Will this time be different?

If you search for the real zombies in the US market, they aren’t the FAANGs, but rather the old manufacturing and commodities economy — ALCOA (AA), United States Steel Corporation (X), DuPont de Nemours (DD), Exxon Mobil Corporation (XOM), Energy Select Sector SPDR Fund (XLE), Ford (F), Schlumberger (SLB), United Parcel Service (UPS), Philip Morris International (PM), The Boeing Company (BA), Chevron Corporation (CVX), Simon Property Group (SPG).

Old Economy vs. New Economy (NDX). Source: Tradingview.

Currencies are saying the same:

Commodity exporters and developing countries are experiencing record depreciations — BRLUSD, NOKUSD, COPUSD, MXNUSD, RUBUSD, ZARUSD, TRYUSD, KRWUSD.

Commodity exporters currencies vs. oil. Source: Tradingview.

Metal prices are saying the same as well:

Copper/Gold ratio. Source: Tradingview.

Copper vs. Gold ratio is at 2016 levels.

What was the outcome then?

The S&P 500 surpassed new highs and bond yields rebounded massively. A very similar setting occurred in 2013 and 2017.

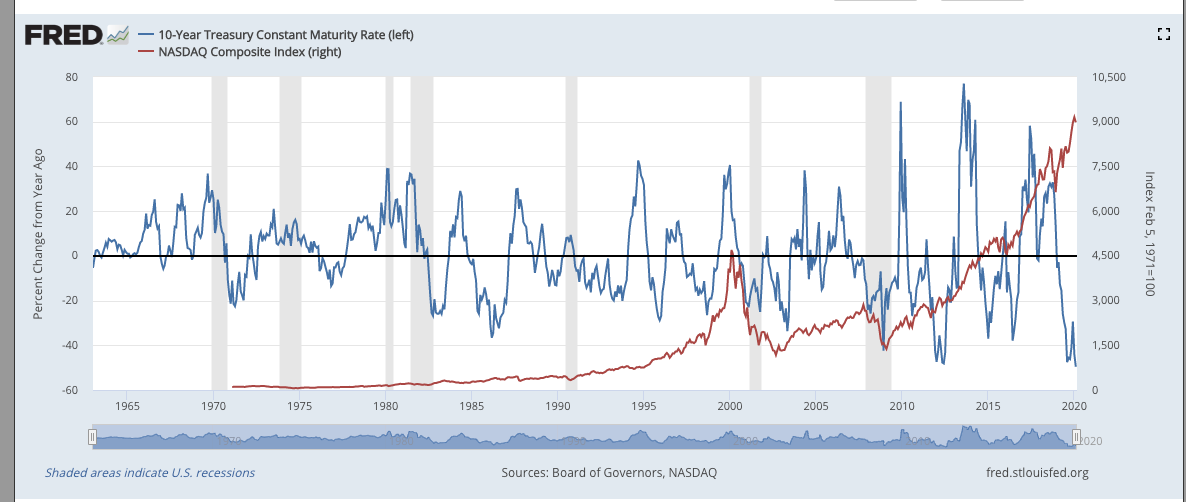

Source: St Louis Federal Reserve.

The bull market in the Nasdaq is not over yet. The coronavirus has shaken the market, but it is not enough to topple it. Short the old economy / Stay long the new one.

The old economy is the scapegoat that the tech stocks need to become a bubble.

Guillermo Valencia A

Head of Global Macro Research

February 27, 2020.

Brazil.