📉 Key Lesson: The 60/40 diversification model is broken. 💡

The fatal mistake isn’t volatility—it’s failing to embrace change. The real danger is missing out on the outliers like Bitcoin, Tesla, Nvidia, Apple, and Taiwan Semiconductors.

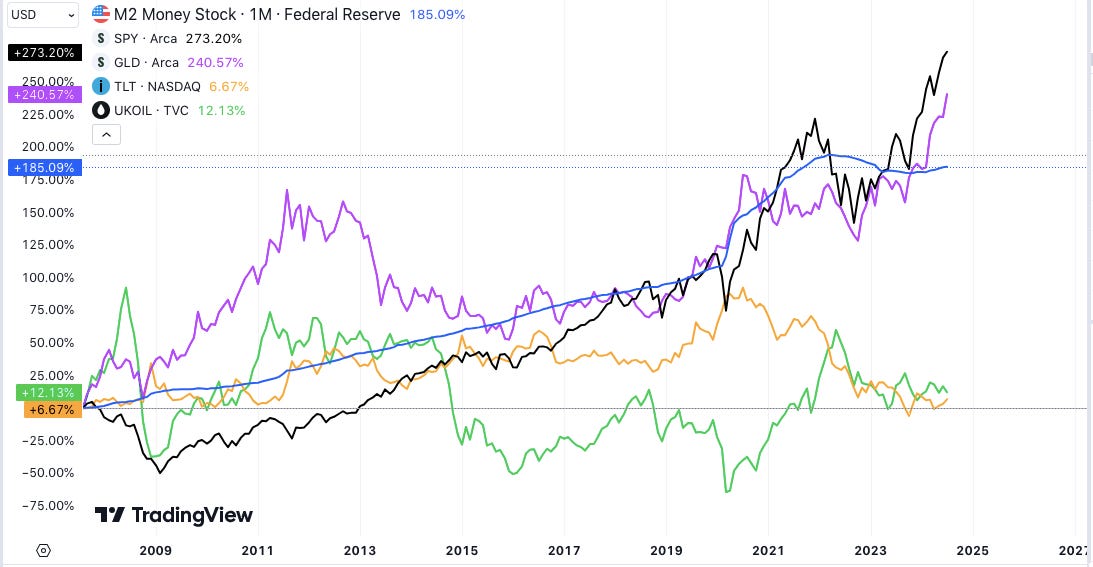

Since 2008, we've been living through an unprecedented economic experiment. The monetary base has grown by 185%, but the real story lies in the results: the Nasdaq is up 873%, the S&P 500 by 275%, gold by 240%, while Treasury bonds have returned a modest 6.67% and oil just 8%.

And then, there are the outliers—the assets that have shattered expectations:

Bitcoin: A staggering 268,000% growth, with an annual return of 63.78%, but it has endured 5 drawdowns of more than 50%.

Tesla: Up an impressive 24,000%, with a 40.89% annual growth rate, but has suffered 3 drawdowns of more than 50%.

Nvidia: A 12,700% gain, with a 35.43% annual return, accompanied by 4 drawdowns over 50%.

Apple: Up 4,300%, with a steady 26.68% annual return, showing a more stable growth trajectory with less volatility.

Taiwan Semiconductor: Up 1,800%, with a solid 20.20% annual return, but has also faced 2 drawdowns of more than 50%, reflecting the volatility of the semiconductor industry.

These outliers have generated remarkable returns but not without significant volatility. Investors had to endure sharp declines to reap the massive gains.

The Market's Big Anomalies:

The explosive growth of these assets challenges traditional diversification principles. Bitcoin, Tesla, Nvidia, Apple, and Taiwan Semiconductors have been the clear winners in a liquidity-driven environment, but the road has been far from smooth.

🔍 Why does this matter?

Nasdaq, the tech refuge: With a 15.28% annual growth rate, the Nasdaq has been the go-to for those betting on innovation and technology in a world of monetary expansion.

Bitcoin, Tesla, Nvidia, Apple, and Taiwan Semiconductors—the outliers: These assets have delivered extraordinary returns—63.78% (Bitcoin), 40.89% (Tesla), 35.43% (Nvidia), 26.68% (Apple), and 20.20% (Taiwan Semiconductor)—but at the cost of high volatility, with drawdowns over 50% in some cases.

S&P 500 and gold, barely keeping up: Both grew at annual rates of 8.62% and 7.39%, just enough to keep pace with monetary expansion, which averaged 6.94% annually.

Treasury bonds, the big losers: Growing by only 6.67% over 16 years, bonds have failed to live up to their promise as a safe haven.

Oil: With just an 8% return, oil has clearly lagged behind.

💡 Conclusion: We’re no longer in a world where avoiding volatility is the goal. In a time when the monetary base expands at 6.94% annually, bonds and conservative assets are an anchor that drags portfolios down. The fatal mistake isn’t volatility—it’s failing to embrace change. The real danger is missing out on the outliers like Bitcoin, Tesla, Nvidia, Apple, and Taiwan Semiconductor. In a world fueled by disruption and liquidity, the biggest risk isn't taking chances—it's ignoring the assets that are rewriting the rules.

Thanks for reading ,

Guillermo Valencia A

Cofounder of Macrowise

September 18th , 2024