Latin America vs. Tech Stocks

If you had invested 100,000 USD in the Latin America ETF (ILF) in 2014, you would have 64,000 USD today. In contrast, if you had invested in the Technology ETF (XLK), you would have 520,235 USD.

In 2014, a prevailing narrative suggested that Latin American stocks were undervalued, a potential value opportunity. However, this optimism failed to materialize into sustained growth; instead, these stocks remained mired in a prolonged bear market. Concurrently, discussions around technology stocks hinted at a looming bubble, with every market correction - August 2015, February 2016, December 2018, March 2020, and November 2022 - fueling speculations about the bubble's burst. Surprisingly, though, each time, these stocks rebounded to reach new highs within a year.

Source: YahooFinance.

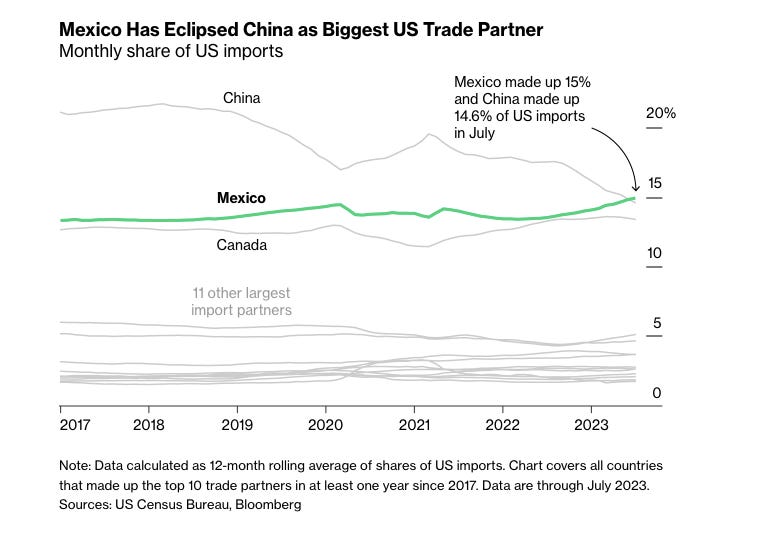

In stark contrast, Latin America struggled to surpass its 2008 highs following each downturn. The investment narrative in the region, driven by the commodities cycle, seems persistent, with Mexico emerging as a potential exception. Mexico adeptly leveraged the reconfiguration of value chains, turning what was once a risk associated with China into an opportunity. The country's stock index is poised to reach the heights of 2013.

Source: Bloomberg.

EWW ETF Mexico. Source: YahooFinance.

On the other end of the spectrum, the Nasdaq stands as the domain of technology behemoths, solidifying their oligopolistic grip on internet services, cloud services, and, more recently, artificial intelligence. A noteworthy Nasdaq trend is the shift from software to hardware, with semiconductors playing a pivotal role in this transformation.

From our vantage point, the 1990s heralded the era of software dominance, while the 2020s pivot towards hardware. At the core of this transition lies the semiconductor industry, exemplifying how the world of bits is reshaping the world of atoms.

If you are a fund manager, a family office, or an ultra-wealthy individual, do not hesitate to contact us. We invite you to add different perspectives to your investment process, enriching it with insights that navigate the delicate balance between stability and adaptability in the ever-evolving market.

Thanks for reading,

Guillermo Valencia A

Co-founder Macrowise

Brazil, November 28th 2023