(NFLX), a stock we recently identified as an Icarus, or a potential bubble burster and big time short candidate, has plunged -22% since July 2019.We see more tough times ahead for NFLX.

Netflix Vs S&P500. Source: Tradingview.

We wrote in April 25th, 2019 Is Disney+ the Streaming Waterloo of Netflix?

It’s Not Only Netflix Vs Disney

Netflix has completely changed the entertainment business, with more than 100 million users binge-watching series like Stranger Things, Narcos and many others… and it is true that Netflix’s distribution model has proven to be very disruptive and the quality of production is excellent, but the cost has been excessive.

This war is not as much about Technology as it is about content and customer loyalty. The streaming business is easy to replicate. Services like Amazon Prime, Apple TV, Hulu and Google were some of the first to replicate the streaming business.

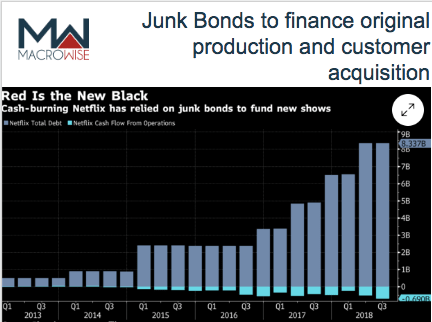

This is why the future of Netflix is a global macro bet. Central banks made capitalism a very different system. It is no longer solely about profits, but about customer acquisition, at any price. In the case of Netflix, this cost has been assumed by its huge debt position. And while interest rates have remained low, this strategy has been successful.

Source: Bloomberg.

Debt Works, but Until When?

The streaming war focuses on the ability to produce good content without going bankrupt in the process. It resembles a war of attrition, where the only winner is the last competitor to enter the war, or those that join alliances in order to siege a new scapegoat. These alliances are already evident between Apple, Disney and HBO.

Netflix’s strategy has focused on producing the best content no matter the price, and lots of it. They continue to flood the market with new movies and shows, but what really matters is new user acquisition. More users lead to more loans in the high-yield market. Disney’s strategy has been different. They have gone about acquiring brands with solid reputations to produce content and learned the business before undermining Netflix’s capacity to distribute quality, third-party content. The acquisition of 21st Century Fox also aimed to have control of Hotstar, the streaming service provider in the country with the most booming demographic: India.

Source: Disney.