Oil, BBVA and USDCOP could suffer from the tectonic shifts of globalization.

We are at the beginning of a new Cold War.

When Elephants Fight, Grass Suffers

Oil

From the beginning of the year, there has been a disconnect between oil and other leading indicators, such as copper. Doctor Copper is suggesting WTI should be trading below $50.

Source: stockcharts.

Shifts in globalization affect not only currencies, but also the price of crude oil. We must ask ourselves, how effective are these sanctions against Iran, if China has every incentive to short-circuit the US blockades.

As we have described in previous posts, the logic behind oil prices will change and will no longer be dominated by producers, but by net importers of fuel. In this scenario, China will determine prices in the near future.

BBVA and the Eurozone Risk

A devaluation of the Euro is the last leg of a very strong USD.

Elections will be a good barometer of how antiglobalization forces are playing out in the Eurozone.

We see BBVA as a fragile point on account of heavy exposure to Turkish and Mexican debt, on top of European liabilities.

Source: Tradingview

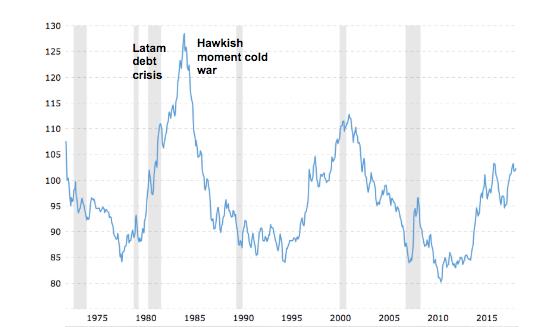

The beginning of a new Cold War → A strong USD

Reagan’s presidency was among the most hawkish stages of the Cold War, causing the US dollar to sky-rocket.

Source: megatrends.net

Colombian Peso (USDCOP)

The first signals of a tectonic movements in globalization have been in the Argentine peso, the Turkish Lira and the Colombian peso. The first two have clear idiosyncratic problems while the Colombian peso’s fundamentals have not been as bad. However, twin deficits and a dependence on crude oil make the Colombian peso a high beta currency.

The microstructure of the market is dominated by foreigners and pension funds. With only a few players, liquidity drives large price fluctuations.

Source: Tradingview

Risk of cyberattack

This new cold war will be different from proxy wars between the US and the USSR: it will take place in cyberspace. However, based on the Blackrock geopolitical index, this risk has not been priced in the market.

Source: BlackRock

Bogotá, May 23 2019

Guillermo Valencia A

Head of Global Macro Research

guillermo@macrowise.co