OIL: is not the OPEC+ but China.

I observe that the market, akin to an intricate enigma, always presents three elements: a distraction, a signal, and an unsuspected opportunity.

I observe that the market, akin to an intricate enigma, always presents three elements: a distraction, a signal, and an unsuspected opportunity.

The distraction in question is inflation, heavily influenced by the rhetoric of Larry Summers and the Federation. These entities, in their financial chess game, persist in keeping the rates high.

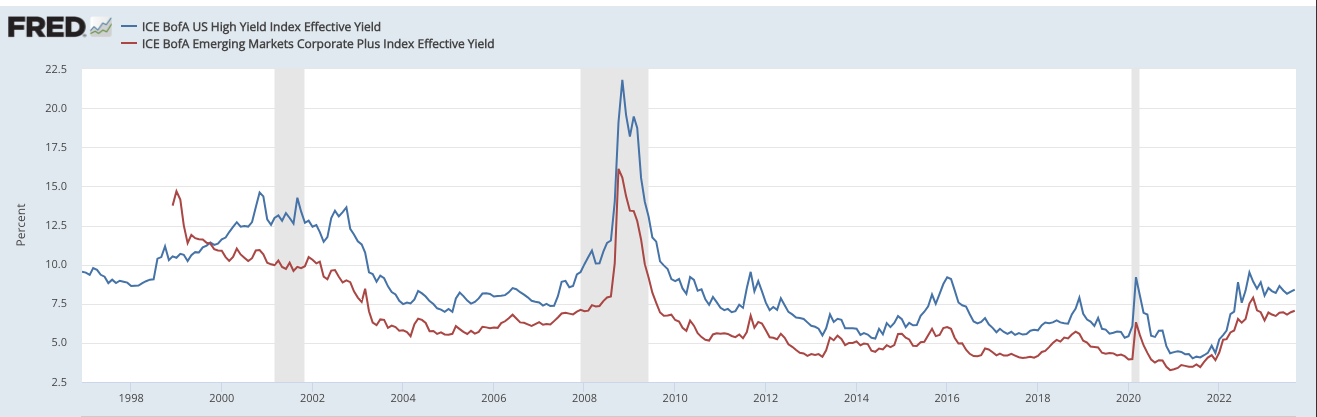

The signals, if one looks beyond the surface, indicate that the producer price index is on the decline, as is the cost of freight. However, the most telling clue lies in the challenge faced by the high yield market: high rates and the rising cost of oil. It's merely a matter of time.

High Yield Rates in EM and US. Source: St Louis Federal Reserve.

Should there be an imbalance in demand, oil will face unimaginable pressure. Despite popular perceptions, the facts speak for themselves: The United States, in its surge of power, has reached pre-pandemic production levels. And the truth, veiled in shadows, is that OPEC+ has lost its former dominion.

US Oil production. Source: EIA.

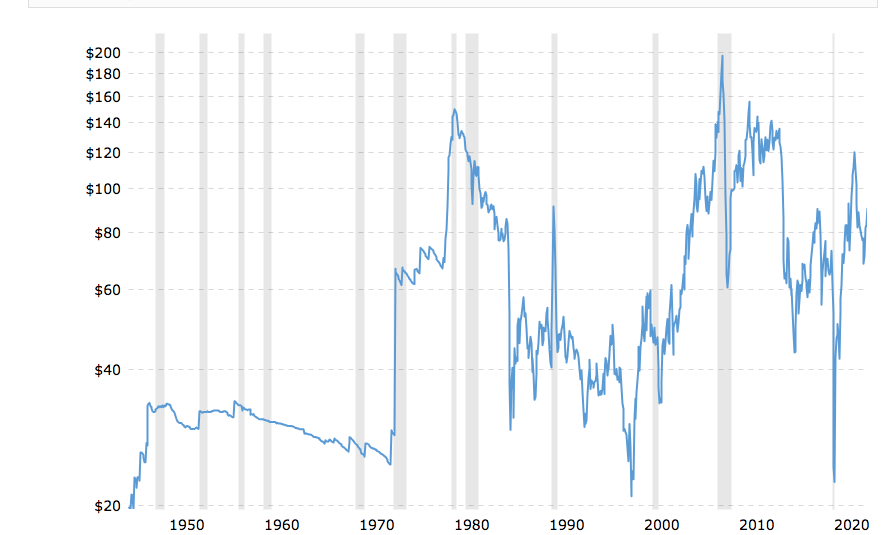

It's akin to the 80s and 90s when Mexico and Venezuela challenged the Cartel. Now, the contender is America's shale oil. And although events like the Kuwait war in the 90s temporarily spiked oil prices, the eventual geopolitical stabilization brought about a drastic correction. The recent conflict in Ukraine echoes such events.

Crude Oil Price adjusted by inflation. Source: Macrotrends.

However, the driving force behind oil prices is not OPEC, but the Asian giant: China. Their sole ambition is to have very cheap oil.

Thus, an oil barrel at an average of 40 USD, akin to the 80s and 90s levels, is more likely than many suspect.

With the highest regard,

Guillermo Valencia

September 18th, 2023

Brazil