Petro Politics Unleashed: The Geopolitical Chessboard of Oil

The formula for elevated oil prices begins with remarkably low oil prices.

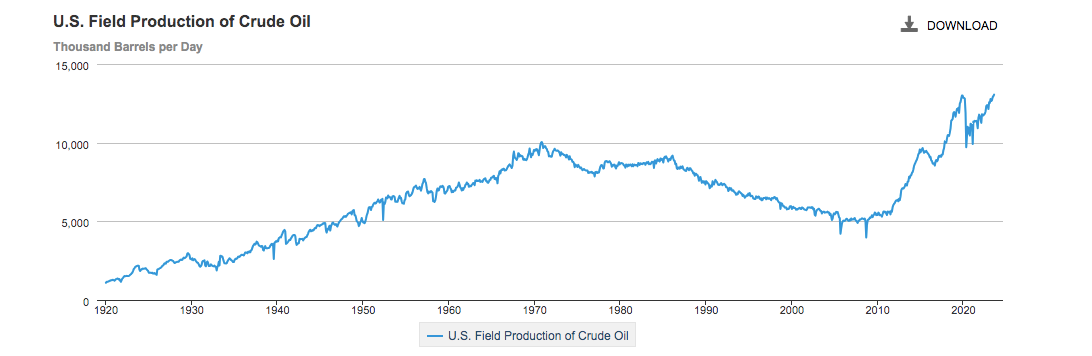

The United States stands as the primary global oil producer at 13 million barrels/day, surpassing the output of major players like Saudi Arabia, currently producing only 9 million barrels with a capacity of 12 million. Russia, with a production of 10.3 million barrels, and Iran, the geopolitical rival of Saudi Arabia, producing 3.5 million, approximately 1 million of which is exported to China. What truly shifts the game is the projection that, if the U.S. maintains its current production levels, it will be exporting around 2 million barrels by March 2025—exceeding Norway and rivaling the size of the Emirates.

Coordinating within OPEC+ proves challenging; higher oil prices grant more power to Iran and Russia, concurrently fueling shale oil production. This complexity undermines Saudi Arabia's hegemonic position in the oil market. Game theory suggests that the optimal strategy for Saudi Arabia is to flood the market. The pivotal question is the timing—when this action will be effective and potentially bankrupt smaller producers while allowing Saudi Arabia to maintain its dominant stance.

Currently, demand is slowing in China and emerging markets, while higher real interest rates in the U.S. bode ill for oil prices. This strategic approach was previously employed in 2020, during the pandemic-induced demand crash. China, being the leading global oil importer, secures favorable deals with non-Western countries. Essentially, China obtains cost-effective oil from Russia, Iran, and Iraq, aligning with its economic interests.

Real Interest Rates (Blue) & Oil prices. Source: St Louis Federal Reserve

While many analysts attribute high oil prices to geopolitics, I posit a different causality: low oil prices precede economic challenges in Iran and Russia, leading to geopolitical escalation aimed at disrupting oil supply and affecting prices.

The formula for elevated oil prices begins with remarkably low oil prices.

If you are a fund manager, a family office, or an ultra-wealthy individual, do not hesitate to contact us. We invite you to add different perspectives to your investment process, enriching it with insights that navigate the delicate balance between stability and adaptability in the ever-evolving market.

Guillermo Valencia A

Brazil, 27/11/2023