Philosophies at Odds: Exploring Selection vs. Diversification with Warren Buffet and John Bogle

Ultimately, the significance lies not solely in what to pick, but rather in what to avoid.

In the realm of investment philosophies, two contrasting yet successful approaches have risen to prominence. Enter the legendary Warren Buffett, renowned for his astute stock picking, and the visionary John Bogle, a champion of index investing.

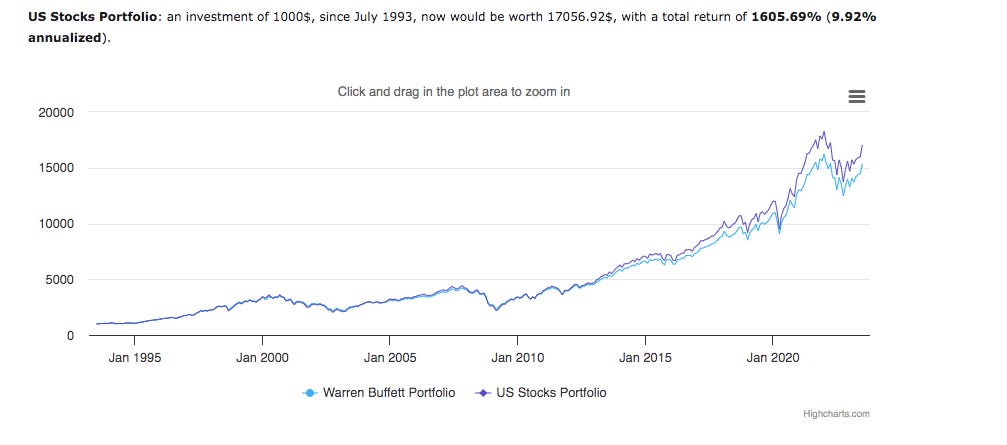

Buffett sees diversification as a shield against ignorance, considering it illogical to hold a plethora of stocks when a select few can yield favorable returns. However, when comparing Buffett's performance over the past three decades to that of index investing in stocks, the returns are remarkably similar. While Buffett's portfolio boasts an average annual return of 9.53%, the S&P 500 index has achieved 9.98% in the same period.

Since 1990, Bogle's philosophy of "buying the haystack instead of searching for the needle" has proven just as successful as Buffett's stock picking. Moreover, index funds offer the advantage of lower costs. So, why is Warren Buffett among the world's wealthiest individuals?

A mere 30-year timeframe is insufficient for truly comparing these investment philosophies. ETF investments have thrived in the era of globalization, driven by a mindset focused on cost-effectiveness. Giants like Vanguard and BlackRock have flourished. Warren Buffett experienced his greatest performance prior to the fall of the Berlin Wall and the dawn of globalization. As a beneficiary of the Cold War, he operated under a different set of rules, amidst rising inflation and geopolitical instability.

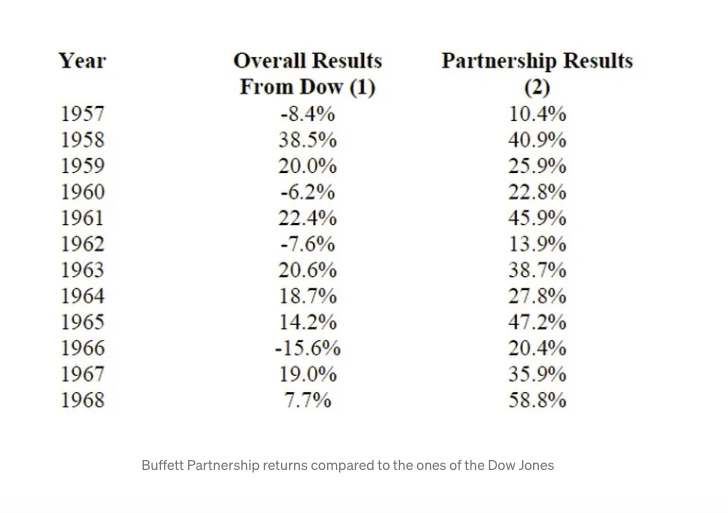

During the initial 20 years of Buffett's investment journey, his yearly returns soared above 30%. Having commenced his investing endeavors at the tender age of 10, he has remained dedicated for almost six decades. Buffett's long-term mindset, characterized by holding companies indefinitely, reveals his inclination towards playing the infinite game in investments. He places great emphasis on investing in high-quality companies with robust fundamentals, even if their prices don't appear to be bargains. In his eyes, intrinsic value prevails over short-term market fluctuations.

Buffett and Bogle are not as dissimilar as they may initially seem. They share numerous commonalities. Both engage in the infinite game, with Buffett focusing on a concentrated portfolio and Bogle on a diversified index portfolio. They both advocate for long-term investment plans, with an emphasis on compounding returns over time.

Amidst the market's fixation on returns, the survival rate of companies is often overlooked. A company's or currency's failure jeopardizes our investments, hindering our ability to compound returns. Implicitly, both Buffett and Bogle invest in the stability and resilience of institutions within the United States of America.

Consider the challenges of implementing their strategies in countries like Mexico, Brazil, or Argentina. During the 1980s, the Latin American debt crisis decimated the compounding potential of local assets. Brazil underwent three currency changes between 1989 and 1993! Emerging markets lack the luxury of playing the hold-forever strategy, as defaults or currency crises promptly reset the compounding capacity of any financial asset.

Ultimately, the significance lies not solely in what to pick, but rather in what to avoid.

Guillermo Valencia A

Co-founder Scale & Macrowise

Florianópolis, Brazil

July 10th , 2023