Power Shift: The Unwind of Oil, the Euro’s Fall, and the Rise of Electricity

The Euro: The Scapegoat in the Unwind of the Carry Trade

We’re now in the second step of the carry trade unwind. The first step was when the Bank of Japan raised interest rates, setting off a chain reaction. Now, weak U.S. employment data is signaling lower demand for oil, and falling oil prices are amplifying the impact. The AUD/JPY is signaling that this unwind could last more than 15 months, marking a prolonged shift in global markets.

But this isn’t just about currency movements—there’s a much larger structural change happening beneath the surface.

Oil and the Dollar: A Strengthening Greenback, Weakening Demand

The U.S., now the world’s largest oil and gas producer, is reshaping the global energy landscape. The power of OPEC+ is fading, and as demand for oil continues to weaken, the balance of power will shift to those who control the sources of electricity. This transition will define the future of global markets.

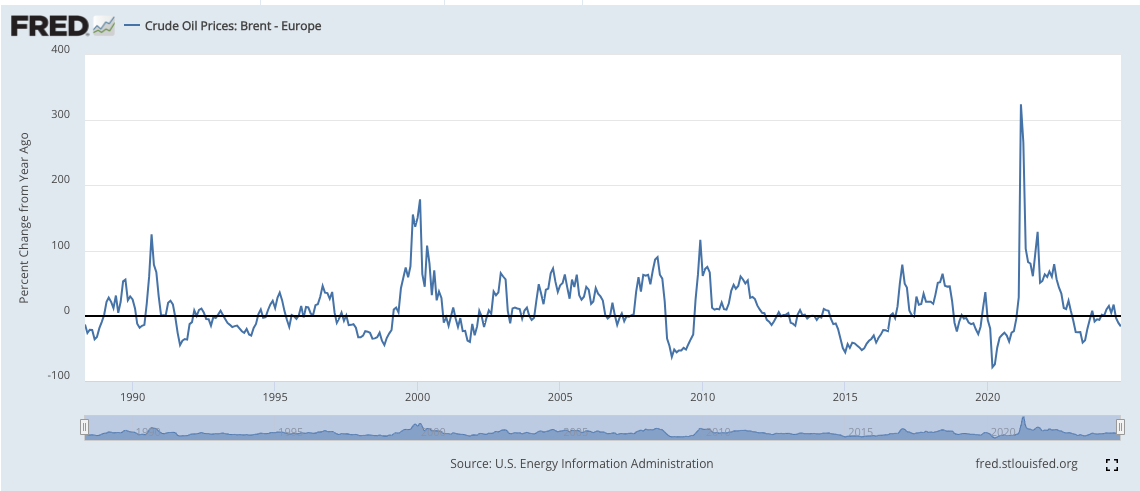

As oil prices fall, pressure mounts on oil-exporting countries, strengthening the U.S. dollar. A weaker oil market forces oil exporters to consider flooding the market, potentially causing Saudi Arabia and Russia to abandon their OPEC+ supply cuts. If they do, oil prices could crash further, just like they did in 2014 and 2020.

This isn’t a short-term fluctuation—low oil prices could drive smaller producers out of business. Over time, this will consolidate power among the big players. But more importantly, the demand for oil is falling, and the world is starting to transition away from oil to electricity.

The Changing Energy Market: Oil is Losing Its Crown

The world is shifting from oil to electricity. In the 21st century, electricity is the new oil. Technologies like AI, electric vehicles, Bitcoin mining, and cloud computing all consume massive amounts of energy. This surge in demand is driving the global energy market away from oil and towards natural gas, nuclear, hydropower, and renewables.

Emerging Markets: The Multiplicative Impact of DXY, Oil, and Populism

Emerging market currencies are reacting in nonlinear—and increasingly volatile—ways to three interconnected forces: DXY, oil prices, and populism. But these aren’t just individual factors—they have a multiplicative effect. When the U.S. dollar strengthens, oil prices weaken, and political noise intensifies, emerging market currencies can experience extreme volatility.

This isn’t a linear equation. These forces amplify one another, creating a feedback loop that can lead to sudden and dramatic movements in less liquid currencies. As oil-exporting nations face economic pressure, political instability increases, further destabilizing their currencies.

Behind the immediate market reactions lies a deeper, structural transformation driven by the global energy shift.

Europe: Vulnerable in the New Energy Era

The Eurozone is in a precarious position in this evolving energy landscape. Europe is heavily dependent on oil and gas, and while it aims to pivot towards renewables, the costs remain high. Worse yet, many European nations have dismantled their nuclear energy infrastructure, leaving them with few viable alternatives in this new electricity-driven world.

From a technological standpoint, Europe isn’t leading the charge. Among the AI Magnificent 7, Europe has no major players. In the semiconductor race, ASML stands alone as the continent’s only bright spot. But that won’t be enough to secure Europe’s foothold in a future shaped by AI, chips, and energy.

Compounding these issues is the ongoing war in Ukraine and the political shifts underway in Germany, which is seeing a surge in right-wing support. France may not be far behind. The grand vision of integrating Western Europe with Islamic cultures now feels like a distant memory, a fading dream from the era of the Austro-Hungarian Empire.

The Eurozone’s Automotive Industry in Decline

Europe’s car industry, once a pillar of economic strength, is under siege. Volkswagen, the icon of German engineering, is being overtaken by BYD, NEO, and Tesla. Even Japanese automakers, benefiting from a weak yen, are gaining ground in Europe. The struggles of Europe’s automotive giants signal the broader decline of its industrial competitiveness.

The Euro: The Scapegoat in the Unwind of the Carry Trade

The Eurozone is fast becoming the scapegoat of global markets. As the carry trade unwinds, a weakening euro could further amplify the effects, triggering extreme volatility in emerging market currencies. The multiplicative effect of a strong U.S. dollar, weak oil prices, and political instability in these markets could drive even more instability.

The offshore dollar liquidity premium is already rising, and as liquidity in these markets dries up, the volatility in emerging market currencies will become more pronounced. This isn’t just a short-term blip—it’s part of a larger shift in the global financial landscape.

The Big Picture: A World in Transition

The unwind of the carry trade has entered its second phase. Japan’s interest rate hikes marked the first step, but the second step is unfolding now as oil prices fall, the U.S. dollar strengthens, and emerging markets face increasing volatility. The energy market is shifting away from oil, and electricity is becoming the new driving force of the global economy.

In this new landscape, the countries that control the sources of electricity—natural gas, nuclear, hydropower, and renewables—will shape the future. The power of OPEC+ is waning, and the U.S. is stepping into a dominant role as the world's largest oil and gas producer, reshaping energy geopolitics.

Europe, with its dependence on oil and gas, is struggling to adapt. The euro is under pressure, and as the carry trade unwinds, emerging market currencies will experience heightened volatility, driven by the multiplicative effect of a strong dollar, weak oil prices, and political instability.

The transition from oil to electricity is just beginning, but its impact will reverberate for decades. We’re only at the start of this shift, and those who understand the changes will be positioned to navigate the risks and seize the opportunities that lie ahead.

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

September 9th , 2024