Second Order Effects of a Global Trade War.

China spending less USD for imports → Low Commodities Prices→ Low Oil Price→ Weak Russian Ruble. Weak Chinese Imports→ Low Semiconductors Prices→ Weak Korean Won.

This newsletter is a very light version of our research. It is not advice or an investment recommendation. We have skin in the game so it is highly probable our ideas have some confirmation biases.

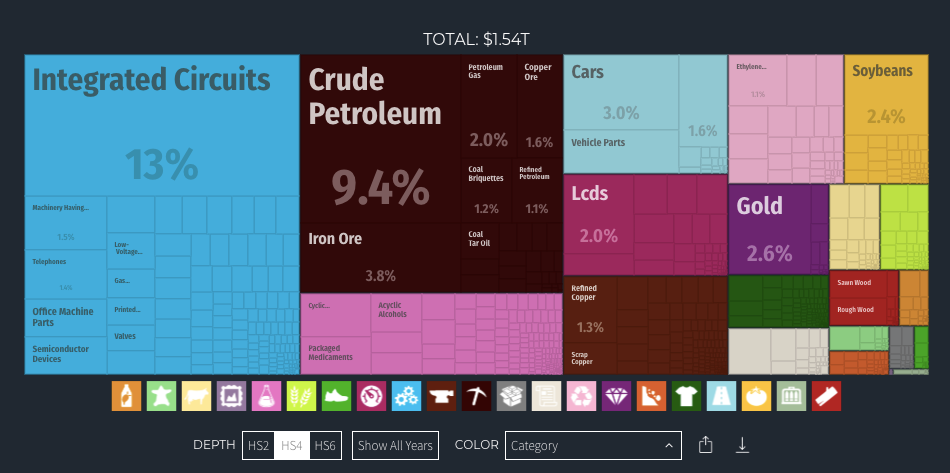

Everybody is focused on what China is exporting. I think that what matters more is what China is importing.

The Chinese strategy is not to have a direct confrontation with the US but to neutralize and compensate the deficit of USD via imports.

Source: MIT Complexity Map

OIL

The easiest way to reduce the USD deficit is by exercising influence over the oil markets. China is the number 1 importer of oil with 239.2 billion USD (20.2%), while the United States 163.1 billion USD (13.8%).

With the continued rise of US shale oil production, the OPEC cartel is losing the pricing power.

Source: US energy information (EIA)

The power is now on the demand side. That means that China has the pricing power and it is in their best interest to collapse the price of oil. Lower energy prices mean less need for USD.

Source: macrotrends.net

We can see an oil price of around 40 USD. That means a lot of pressure for the Russian Ruble (USDRUB), Colombian Peso (USDCOP) and the Brazilian Real(USDBRL). The Russian Ruble has not reacted as the Latin American peers.

USDCOP, USDBRL and USDRUB.

Source: Tradingview

Semiconductors and the Korean Won

The other sector that is highly exposed is semiconductors. We expressed this trade by shorting the SOX. However there is another way to express this trade, that is by being long the Singaporean Dollar(SGD) and Shorting the Korean Won (KRW).

Source: MIT Atlas of economic complexity.

Global Semiconductors

SGDKRW

SGDKRW.

Source: Tradingview.

Sao Paulo, June 7 2019Guillermo Valencia AHead of Global Macro Research