Spinoza's Unity: Friendship, The Resurgence of Industrial America, and the Opportunity with Alibaba.

The market isn't encapsulated by the S&P500 or any singular index; rather, it comprises an array of thousands of companies, each with an inherent drive to persist.

A dear friend shared an article from The New Yorker about the philosopher Spinoza, sparking some profound reflections on life, friendship, and markets this weekend. As I delved into Spinoza's philosophy, I couldn't help but ponder the interconnectedness of existence and its parallels to the ever-evolving landscape of industrial America and the intriguing opportunities presented by Alibaba.

Spinoza's Philosophy in a Nutshell

In Spinoza's view, there's this one big thing in the universe, like this massive puzzle called "God" or "Nature." Everything—trees, thoughts, feelings—is just a piece of it. He didn't see God as some dude in the sky, more like everything combined. Spinoza imagined life as a long chain of falling dominoes—we can't change how they fall.Each entity, whether a tree or a fleeting notion, has an inherent drive to persist, a force known as "conatus," akin to how plants crave sunlight and water. But here's the kicker: understanding this chain can set us free and make us happy. We're not separate from nature; we're all part of it. Spinoza believed that if we grasp how things work, we can live better and happier lives. It's about being kind, thinking clearly, and finding joy in life, realizing we're all part of something bigger.

The Importance of Friendship

In Spinoza’s world, it’s all about living your best life. He believed that our interactions either build us up or bring us down. So, surround yourself with people who lift you higher. For Spinoza, friendship is like a divine blessing—it fills us with strength and joy.

He saw social life as a grand experiment. Friends help us grow—fueling creativity, lifting our spirits, and spreading happiness. True friends bring out the best in us, making life richer and more fulfilling.

Spinoza's philosophy teaches us to embrace social connections with an open heart and mind. Notice how people make you feel—positive vibes mean you're on the right track. Trust your instincts and live authentically.

In short, Spinoza's philosophy promises a life filled with deep, meaningful relationships—a true gift to cherish.

The Market Beyond the S&P500

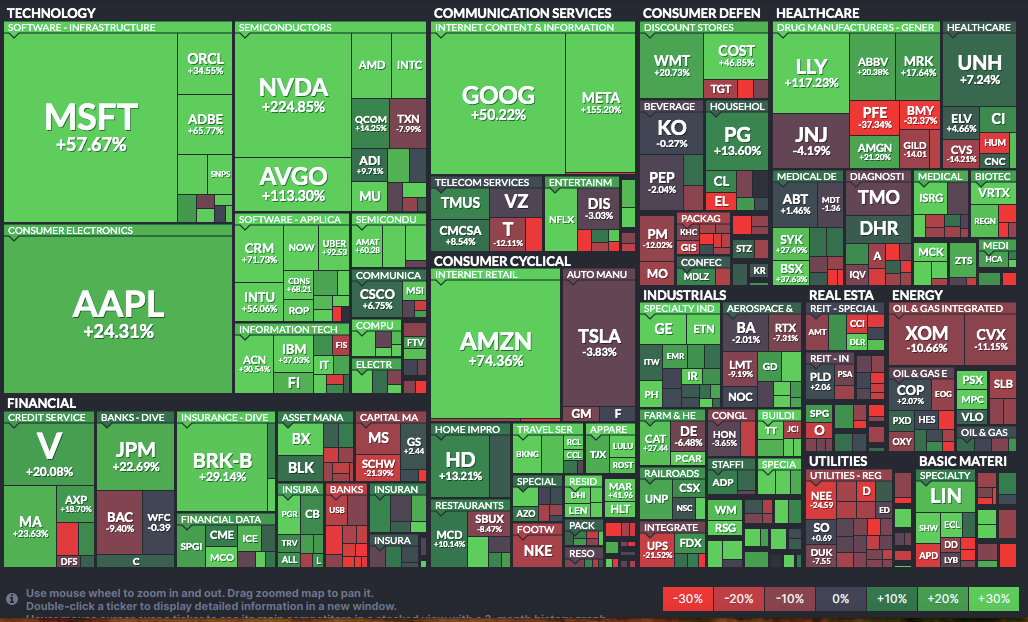

Instead of fixating on the S&P500, Spinoza invites us to consider the broader array of possibilities in the market, represented by the whole spectrum of ETFs and geographies. This broader perspective reveals intriguing trends, such as equity outperforming bonds and notable winners and losers across different regions and sectors.

-Equities have outperformed bonds.

-US equities have been the biggest winners.

-China has experienced the most significant downturn.

-Large caps are performing significantly better than mid caps and small caps.

-Returns are concentrated in the technology and consumer cyclicals sectors.

-India, Mexico, Taiwan, and Japan are also performing very well.

-Volatility is cheap, with the VIX down 68%.

-Bears are having a bad time.

-Taiwan is analogous to Arrakis, the desert planet in the movie "Dune." The most prominent company there is TSM.

-In Europe, ASML is akin to TSM in Taiwan.

-Companies consolidating in Ireland, such as Accenture (ACN) and Eaton (ETN), are robust performers.

-In Canada, the standout performer is Shopify.

-The black sheep of the global market is Alibaba.

Emerging Narratives: From AI to Industrial America.

While AI dominates the narrative, Industrial America is emerging as a significant theme alongside the traditional tech giants. Several companies are reinventing themselves, including General Electric (GE), Eaton (ETN), Emerson Electric (EM), Ingersoll Rand (IR), Parker Hannifin (PH), Caterpillar (CAT), and Paccar (PCAR). Industrial America's resurgence is poised to become one of the most crucial investment narratives in the coming years.

Alibaba Opportunity

Amazon Blue, Shopify Black and Alibaba Orange.

Let's unpack this. Shopify is quite remarkable, boasting 700 million users, a market cap of 116.5 billion, and yearly revenue of 4.3 billion. That's no small feat. Now, let's pivot to Alibaba, and the scale is just mind-blowing. With 1.3 billion consumers, revenue of 129 billion!, and a market cap of 183.2 billion, the sheer size is staggering! Yet, it's precisely this contrast that makes Alibaba an intriguing opportunity. Its potential value is immense, considering its vast market reach and market cap. Despite the current market climate in China, narratives can swiftly change. So, while the numbers may seem puzzling at first glance, Alibaba emerges as an enticing investment opportunity.

Wishing you a fantastic Sunday!

Guillermo Valencia A

Co-founder of Macrowise

Miami , February 11th 2024

Disclaimer:

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results.