The financial industry is constantly evolving as new technologies and trends present themselves. Exchange Traded Funds have become a simple, popular method for investors to diversify or provide a benchmark return at minimal cost. The development of blockchain technology and subsequent cryptocurrency craze is attempting to move the world of finance away from the traditional economy of centralized banks and fiat currencies, and towards a digital, decentralized economy.

In our ever-connected, international world, consumers must not only think about their home currencies, but also about how their money translates into the rest of the world. The aspiration to venture outside of one’s home nation or simply conduct business abroad has quite possibly never been more prevalent than it is today. Human beings are traveling, expanding their borders and trading with foreign partners in the never-ending pursuit to make a better life for themselves. Social contracts between nations and their citizens can complicate these desires when policies such as trade wars and changing political ideologies impact the economy and directly influence the wallets of their citizens. This situation is especially common in emerging markets.

There is an omnipresent need for a product to better protect the purchasing power of people around the globe. The demand for a stable, global currency is growing. The global financial crisis of 2008 made way for the creation of Bitcoin and the push for a new alternative decentralized banking system. Now, 11 years later, the volatility of bitcoin and various currencies amidst escalating political turmoil will launch the formation of a new global monetary alternative - the stablecoins and the development of decentralized finance.

The Rise of P2P Money

Money is not just a mechanism of exchange, unit of account, instrument of storage of value or a social convention. Money is portable power.

Defining money is a complex matter that intersects economic thinking, philosophy, mathematics and sociology. A major part of the studies conducted on money are centered around the functionality, i.e as a unit of account, an instrument of exchange, or the storage of value. Other studies focus on the format of money: fiat, commodity, digital, crypto. Our focus is on the hierarchical evolution of money and the opportunities that emerge with that.

Money is a common, hierarchical pool resource necessary to coordinate economic transactions for any kind of society. Indeed, money is a representation of the social contract between the individual and the state, but also between the individual and other communities. The first protocol, bitcoin, was the first step in the development of a complete new layer of the international monetary system. The hierarchical nature of money is illustrated below as a series of levels or rings. The innermost ring consists of commodities (our diagram uses gold), and as the layers expand outward, they move further away from the original monetary metal of exchange, representing different forms of money. The last layer, P2P money, consists of cryptocurrencies.

Figure 1. The hierarchical nature of money. Source: Macrowise.

Our point is that cryptocurrencies will not replace the role of the U.S. Dollar or the Chinese Renminbi just as the Dollar never replaced the role of gold in the financial system. Bitcoin is not a challenger of the Dollar’s status, but rather a complement and was the beginning of a newest layer within the international monetary system that will empower people with better odds to succeed.

To explain our argument, let us first explain our oversimplified framework of the hierarchy of money.

Hierarchical Level 1: Tribal Money

To begin, think of a simple tribal society in a disconnected world. Individual civilizations separated by seemingly immense terrains of land, with war being their only successful mechanism for achieving economic growth. Only by conquering new territories, rich in strategic resources or location were tribes able to assert their dominance and advance culturally and economically.

The lack of trust between competing tribes made it nearly impossible for economic coordination of the whole tribal society to take shape. Commodity money, such as gold or silver, were the only universal instruments for trade across societies.

Hierarchical Level 2: Reserve Money

Empires made possible the coordination of standardized economic transactions. Leaders minted their own version of money to be used throughout their kingdoms. However, without coordination between empires with differing currencies, the use of gold remained necessary in order to make ‘international’ transactions. Civilizations have undergone many attempts with fiat money backed by the state and many of them have ended in epic episodes of hyperinflation.

As empires and civilizations evolved into independent states and leading governance systems became democracies, independent central banks accomplished the feat of stabilizing inflation in countries with reserve currencies and emerging markets with responsible fiscal policies.

Coordination between states was a difficult matter. There were many attempts to better coordinate international transactions in the 20th century. The Gold Standard, the Bretton Woods System, and the Exchange Rate Mechanism were all experimented with an effort to simplify international trade.

However, the settlement was not reached by a mutual agreement among nations but rather by the geopolitical hegemonic role of the United States. As a result, the U.S. Dollar emerged as the preeminent reserve currency.

Hierarchical Level 3: Offshore Dollars

With globalization, there was a need for the US Dollar by central banks in other countries, Tier 1 Banks all around the world, as well as multinational corporations. Interest rate derivatives and currency swaps formed a new format of money in yet another layer of the international monetary system.

Hierarchical Level 4: Emerging Markets Local Currency & Banking Money

This layer is comprised of the local money of countries without the global reserve status and credit money. The emerging markets have implicit sovereign credit risk built into their currencies inherently.

Hierarchical Level 5: Securities - Household Money

This household layer of money comes in the form of securities: bonds, equities, and other investment vehicles.

Hierarchical Level 6: Peer to Peer (P2P)

This new layer constitutes of electronic peer to peer transactions supported by cryptography and blockchain technology. As stated previously, we see stablecoins as an essential tool to protect the purchasing power of people around the world, and it fits in this level. The users of cryptocurrencies have different cryptos as their assets while P2P credit makes up their liabilities.

Existing Currency Formats

Developed Market Fiat Money

The first logical alternative is to convert one’s home currency into another, more stable option. The U.S. Dollar and Euro are the most popular for numerous reasons, but this strategy too has its drawbacks. As stated previously, the exchange rate can be subject to extreme fluctuations, both in favor of the home currency and against it. Most banks or financial institutions only hold the currency of one’s home country in the banking account. It obviously wouldn’t be the safest option to hold large amounts of physical cash.

Emerging Market Fiat Money

The vast majority of people earn or have their savings in the currency of their home country. The problem with emerging market currencies is that the exchange rate is very susceptible to fluctuations, which can be swift and enormous. There is a strong bias for devaluations in these currencies as the economy and the political structure in these countries is prone to less stability.

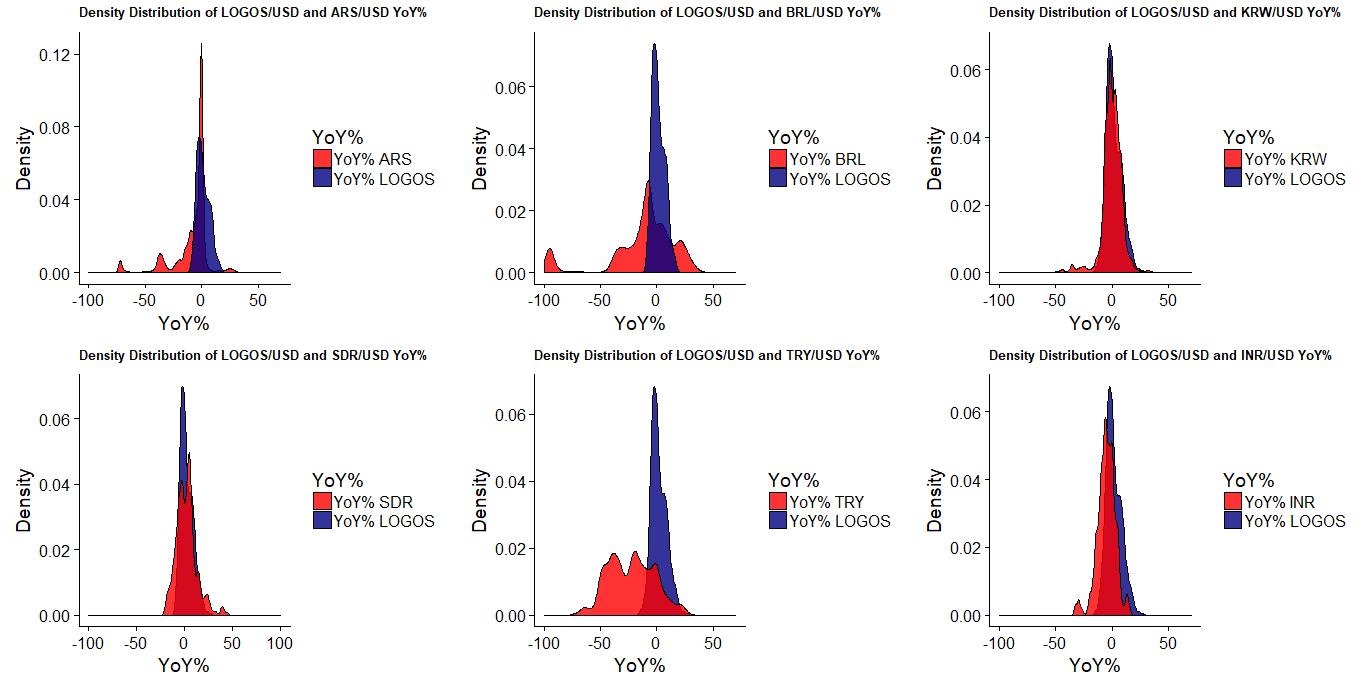

The graphics below show the histograms of the YoY variations of the Chinese Yuan and the Indian Rupee against the USD. Many emerging markets in Latin America, the Asian Pacific and Africa suffer from the same problem. A citizen living in an emerging country and earning in the local currency is vulnerable to a potentially volatile exchange rate and could suffer dramatic losses to their purchasing power.

Figure 2. Probability distribution YoY variation of emerging market currency versus a basket of reserve currencies we call LOGOS. Source: Macrowise.

Figure 3. Probability distribution YoY variation of emerging market currency versus a basket of reserve currencies we call LOGOS. Source: Macrowise.

Figure 4. Probability distribution YoY variation of emerging market currency versus a basket of reserve currencies we call LOGOS. Source: Macrowise.

Gold

Gold can be a great way to store value during times of uncertainty. When global economies are struggling or currencies are undergoing competitive devaluations, gold is usually a safe haven as it is during periods of trade wars and real wars. However, gold in general performs poorly during times of globalization and global economic growth.

Figure 5. Gold since 1900.

Figure 6. Gold (XAU) & Silver (XAG) YoY returns since 1980 versus LOGOS. Source: Macrowise.

Cryptocurrency

Cryptocurrencies essentially operate as a “peer-to-peer electronic cash system.” These digital or virtual assets work as a medium of exchange and function independently of a central bank. The decentralized control of these electronic currencies works through blockchain, which functions as a sort of public database or ledger, where all transactions are recorded and are made available for everyone to see. Each transaction is a file that consists of the sender’s and receiver’s public account information (their wallet address among other pertinent information) and the amount to be transferred. The safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties called miners. After the sender confirms the validity of the transaction, the miners mark them as legitimate, timestamp them and spread the transaction across the network where they become unforgeable and irreversible, thus completing the transaction. Miners have a financial incentive to maintain the security of a cryptocurrency ledger, as they receive payment for every transaction that they validate and attach to the ledger. These mathematical cryptographic validations used to confirm the proof of the transaction, or the “Proof-of-Work” as it’s referred to, adds another block to the ledger that cannot be changed, thus finalizing the record keeping system.

Bitcoin is an interesting solution of decentralized trust, however, it’s price behavior is extremely volatile with similar characteristics to a commodity.

Macrowise Digital Assets Team

Florianópolis, Brazil

24th September 2019