Tesla’s Robot Boomers and Apple’s Reinvention Imperative: A Cold War Where Productivity Picks the Victor

Cold War 1.0 rode baby boomers; Cold War 2.0 anoints robot boomers. AI crowns the last mover—MySpace sparked social, Facebook owned it.

The Cold War of the 20th century wasn’t just a clash of missiles and ideologies—it was the baby boomers, a demographic surge that fueled America’s factories, suburbs, and economic supremacy. Millions of new workers turned scarcity into abundance, making the U.S. an unstoppable force. Now, we’re in Cold War 2.0, a very real battle with China, not for land or dogma, but for the soul of productivity. Tesla’s “robolution”—Optimus humanoids and robotaxis—is America’s gambit, a ruthless innovation engine unleashing a synthetic demographic boom that dwarfs the baby boomers’ legacy. This is technology’s defining force, because it rewrites labor economics into a story of boundless output. Meanwhile, Apple, once the king of interfaces, is a titan under siege, its wearable empire buckling under Huawei’s onslaught and hyperscaler ambition, forced to reinvent or fade into obscurity. China looms largest, its state-driven scale a juggernaut that will dominate unless the West’s giants adapt. In this war, Tesla’s relentless execution leads, Apple must pivot to survive, and China will crush those who can’t reinvent.

Tesla’s Robot Boomers: Ruthless Innovation Redefining Productivity

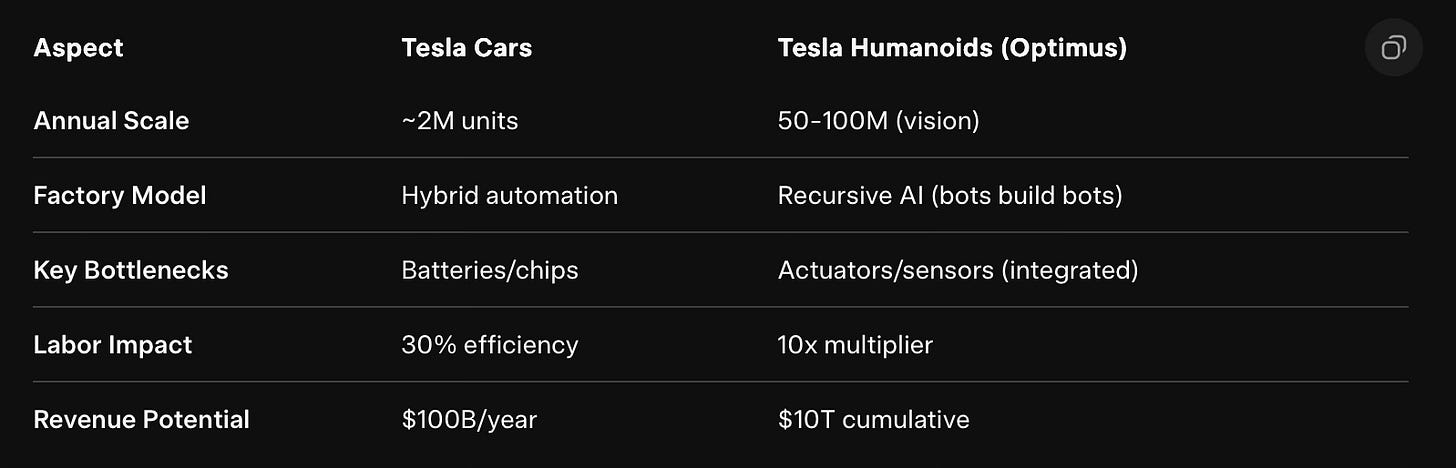

Tesla doesn’t innovate—it obliterates. Optimus, its humanoid robot, isn’t a product; it’s a synthetic population explosion. Elon Musk’s latest updates show V3 prototypes with surgical precision: cradling eggs without cracking, flowing through Kung Fu forms, balancing like gymnasts. Production ramps late 2025, targeting 5,000 units by year-end, with a vision of 50-100 million annually—a robot boomer generation rivaling a nation’s workforce every year. These aren’t gadgets; they’re labor unbound, slashing costs 50-80% in factories, care homes, and operating rooms, amplifying output tenfold. Musk calls it “sustainable abundance,” the end of labor scarcity.

Then there’s robotaxis, Tesla’s transportation-as-a-service (TaaS) blitz. FSD V14.1.3 logs 250,000 safe miles, four times Waymo’s safety record, with AI mastering drop-offs and maintenance. Cybercab, a two-seater built for scale, targets sub-bus fares, launching in Arizona by late 2025 and eyeing 8-10 cities, though full autonomy waits until 2026. Together, humanoids and TaaS are a $10 trillion opportunity by 2050, outstripping the baby boomers’ economic surge. This is why Tesla’s robolution is tech’s defining force: it doesn’t tweak productivity—it reinvents it.

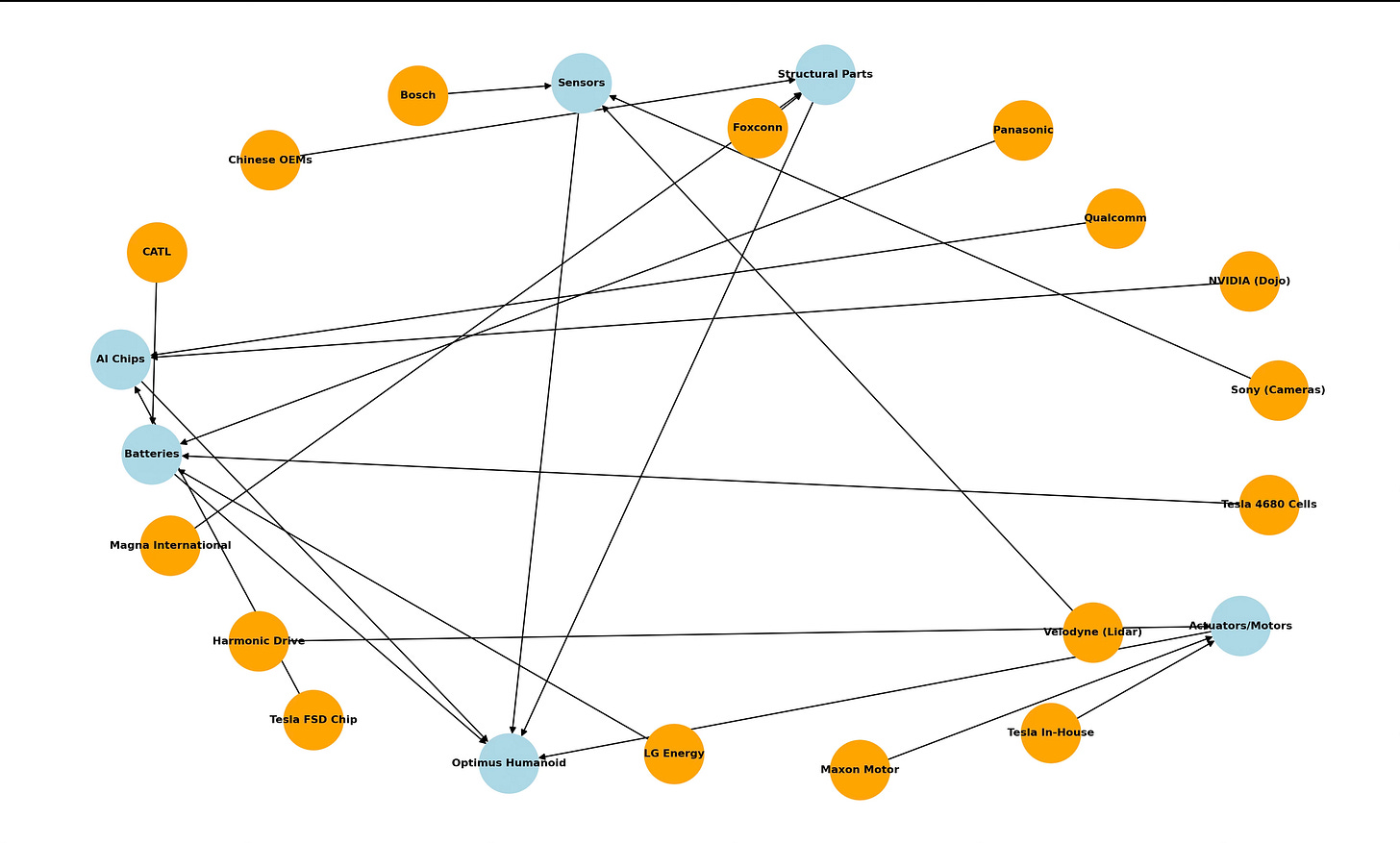

China’s counterstrike is relentless. Its “Made in China 2025” plan, fueled by $200 million+ in robotics, churns out humanoids at cutthroat prices—Unitree’s at $5,900, a tenth of Optimus’s cost, dominating the 2025 World Humanoid Robot Games. Agibot targets 5,000 units in 2025; UBTech’s Walker and Ant Group’s bots flood factories. China installs 295,000 industrial robots yearly, eight times the U.S., running “dark factories” with zero humans. Tesla’s edge—FSD data training bots for real-world smarts—faces China’s volume play, backed by $98 billion in AI capex (48% growth) and Huawei’s Ascend 910C chips dodging U.S. export bans. Tesla’s supply chain, a fortress of Harmonic Drive actuators, Panasonic/4680 batteries, and NVIDIA/Dojo chips, holds firm.

Tesla’s factories—2M cars yearly with hybrid lines—go recursive with bot-built bots, targeting 1M humanoids by 2030. China’s dark factories loom, but Tesla’s ruthless iteration—data over dogma—keeps it ahead.

Apple’s Reinvention Imperative: A Titan on the Brink

Apple’s story is a stark warning of empire under siege. Its wearables—Watch, AirPods—were meant to own the AI agent interface, where glasses and earbuds anticipate needs. But the numbers are brutal: global wearables hit 136.5 million units in Q2 2025 (+9.6%), yet Apple’s Watch has slumped for six quarters, down 19% in 2024. Huawei seizes 21% of smartwatches, dominating China, where Apple’s phone share lags at 13.9%. Xiaomi surges 53%; Meta’s Ray-Ban glasses, with Llama 4 AI and neural bands, redefine style and smarts. Google’s Gemini (10-15%) and Samsung’s Galaxy AI erode further. Hyperscalers—AWS, Azure, Google Cloud—fuel cloud agents at 37% CAGR, threatening Apple’s 25% services revenue.

China’s wearable strategy is Huawei’s dagger: HarmonyOS locks in users, while affordable AI glasses from DeepSeek rival Meta. Apple’s $30B R&D pushes on-device agents and 2027 glasses, but Siri delays and poaching to Meta scream fragility. A $1K home bot by 2027 is a distraction—Apple must reinvent or lose the interface war.

China’s Relentless March: Domination Through Scale

China’s Cold War 2.0 playbook is merciless: scale, subsidies, self-reliance. “Made in China 2025” pours $98B into AI and robotics, half state-funded, dwarfing U.S. efforts. Huawei’s Ascend chips bypass U.S. bans; Unitree, Agibot, and UBTech flood markets with cheap bots. Dark factories—295,000 robots yearly—outpace America’s 34,000. It’s Japan’s auto playbook, but faster: quantity buries quality unless innovation outpaces. Tesla’s data moat holds for now; Apple’s premium gamble falters. Nvidia’s Jensen Huang warns of a robotics “ChatGPT moment”; China’s ready, America’s debating.

The Last Mover’s Triumph: China’s Go Strategy Spells Reinvention or Ruin

Cold War 1.0 rode baby boomers; Cold War 2.0 anoints robot boomers. AI crowns the last mover—MySpace sparked social, Facebook owned it. Tesla’s ruthless innovation leads, its data-driven robolution a productivity juggernaut. Apple must adapt—fast—or lose the interface war to Huawei and hyperscalers. But China plays Go, not chess. While Tesla and Apple chase tactical wins, Beijing encircles the board, placing stones—cheap bots, state-backed chips, dark factories—with patient, suffocating precision. In Go, you don’t strike; you surround. China will dominate those who can’t reinvent, a lesson etched in history: productivity picks the victor, and hesitation is defeat. Tesla’s charging forward; Apple’s on notice; China’s board is vast.

Thanks for reading ,

Guillermo Valencia A

Cofounder MacroWise

Muchas gracias Guillermo. Este tipo de artículos me convencen más del potencial de Tesla. Gracias por ocmpartir.

Gracias viejo Guille , como siempre una joya tus substack " el conocimiento es un bien publico que crece y se multiplica cuando se comparte, demostrando así que somos seres inteligentes" Yo