The Bell Curve of Truth: How Ideas Like Crypto Go From Laughable to Inevitable

All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident. — Arthur Schopenhauer

Ideas don't just appear and conquer the world overnight. They sneak in, get laughed at, fight for survival, and eventually settle in like they've always been there. That's the story of progress, and it's a story that repeats itself in ways big and small, from music to money.

Take the Gaussian adoption curve—it's a fancy name for something pretty simple. Imagine a bell-shaped graph that shows how new things spread through society over time. At the start, only a handful of bold souls—the innovators—jump in. They're the ones tinkering in garages, ignoring the eye-rolls.

Then come the early adopters, who see potential and spread the word. The curve peaks as the early majority piles on, followed by the late majority who wait until it's safe, and finally the laggards who hold out as long as they can. Add it all up cumulatively, and you get an S-shaped line: slow at first, then explosive growth, then leveling off as everyone gets on board.

It's not just math; it's human nature. We resist change until we can't, and then we pretend we saw it coming all along.

Rick Rubin understood this better than most. Back in the 1980s, rock and hip-hop were like oil and water—separate worlds, with fans on either side sneering at the other. Aerosmith, the hard-rock legends, were fading fast, bogged down by drugs and stale sales. Run-D.M.C., the hip-hop pioneers, were rising but stuck in a niche. Rubin, the producer with a knack for spotting buried potential, dragged them together for a remake of "Walk This Way." At first, it was ridiculed: Rockers called it a gimmick, hip-hop purists saw it as selling out. Then came the opposition—arguments in the studio, doubts from labels. But when that wall came down in the music video (literally), the song exploded, hitting the charts and reviving Aerosmith while catapulting hip-hop into the mainstream. What started as a weird experiment became the blueprint for genre-blending hits. Rubin didn't invent fusion; he just timed it right, riding that adoption curve from ridicule to revolution.

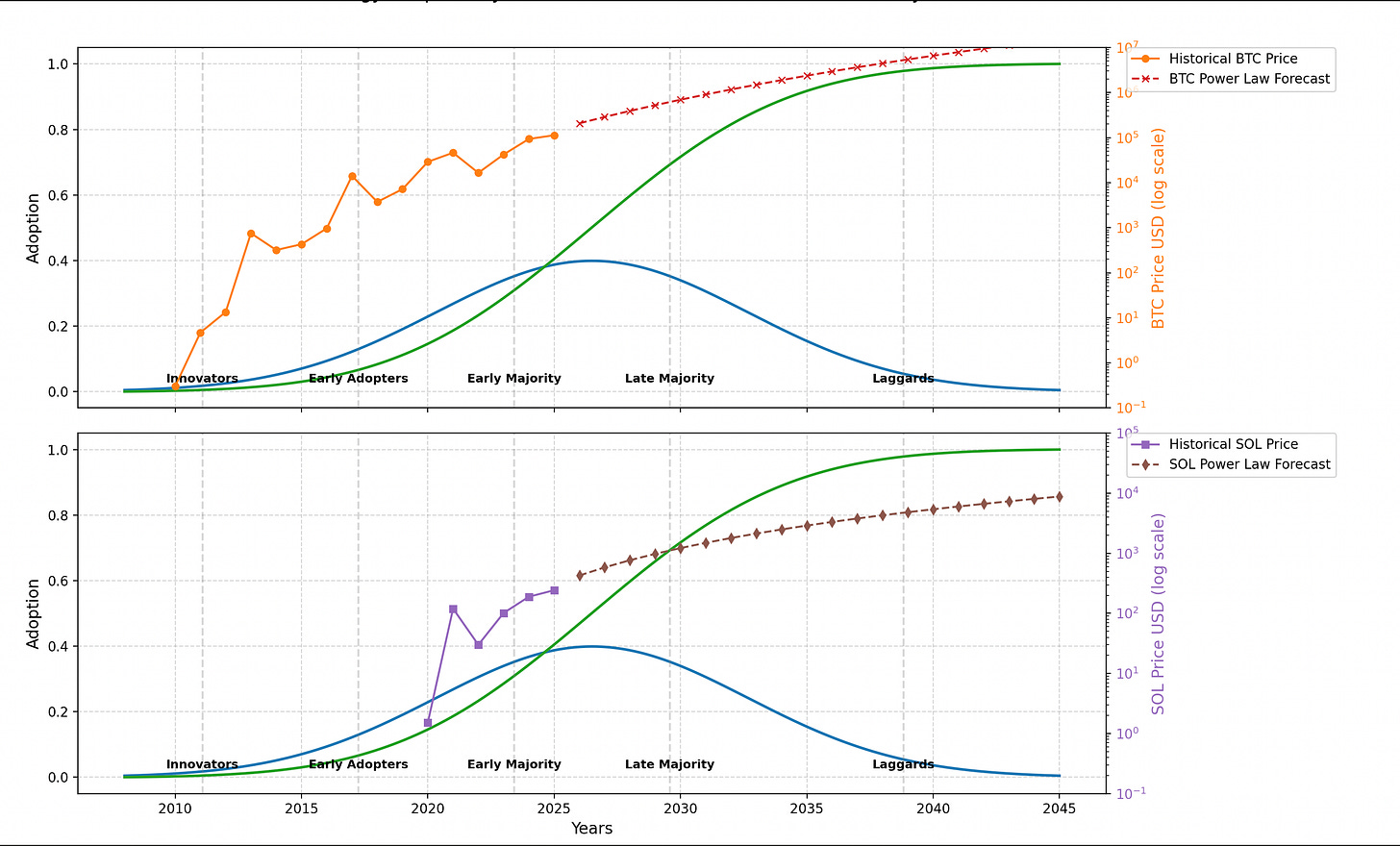

Crypto feels a lot like that today. Bitcoin launched in 2009 as a quirky experiment—"magic internet money," they called it, with more than a few laughs. Then the backlash hit: regulators cracked down, critics labeled it a bubble or worse. But look where we are in 2025: Institutions are buying in, ETFs are flowing, and it's starting to feel inevitable. It's not just about coins; it's the tokenization of everything. Imagine turning real-world assets—houses, art, stocks—into digital tokens on blockchains like Solana. No more endless paperwork or middlemen; you could own a fraction of a Picasso or a Manhattan apartment with a click. This renews the old fiat system, that clunky world of dollars and euros, making finance faster, fairer, and borderless. It's emerging now, in the early majority phase, where the real growth kicks in.The charts tell the tale. In the top graph, Bitcoin's price hugs that S-curve of adoption—starting slow with innovators in the 2010s, accelerating through early adopters in the volatile 2020s. By 2025, it's at $113,130, but the power law forecast (that red dashed line) points to a steady climb: around $208,000 by 2026, $288,000 in 2027, pushing past $1 million by 2031, and hitting an eye-watering $15.7 million by 2045. It's not a straight line; markets never are. But as adoption spreads to the late majority—think everyday banks and pensions—it could make those numbers look conservative.

Solana's story is younger, launching in 2020 amid Bitcoin's shadow. Its chart shows a bumpier ride: from $1.51 at the start, peaking around $120 in 2021 (smoothed here to reflect the wild swings), dipping to $30 in 2022's crypto winter, then rebounding to $242 by 2025. The forecast recalibrates for Solana's faster pace, with a fitted power law suggesting $427 in 2026, $583 in 2027, crossing $1,000 by 2028, and reaching about $8,823 by 2045. Solana's edge? Speed and low costs, perfect for that tokenization wave—turning fiat's slow grind into instant, global access.The lesson? Timing matters more than genius. Schopenhauer's stages aren't just philosophy; they're a roadmap.

Crypto's ridicule phase is fading, the opposition is cracking, and acceptance is coming. But like Aerosmith's comeback or hip-hop's breakthrough, the real magic happens when you stick around for the curve to bend. Patience isn't just a virtue—it's the ultimate edge in a world full of overnight skeptics.

Thanks for reading,

Guillermo Valencia A

Cofounder MacroWise

Excelente información Guillermo. Gracias por aportar valor real y excelso, filtrado por herramientas potentes y una mente brillante y generalista, y toda esta luz nos la entregas en medio de un mundo intimidante. Gracias totales.

Excelente como siempre, aún tratan a Bitcoin, Solana y demás, como pirámide, burbuja, estafa etc. Pero ahora, solo ahora es que empiezo yo a reir. Mil gracias Guillermo. Muchos éxitos...!