The Carry Trade Unwind, High-Yield Bonds, and a New Nasdaq Giant: Why Latin America Should Brace for Impact—and Turn to Bitcoin

That’s the carry trade, and it’s unraveling right now—shaking global markets, hitting Latin America hard, and creating opportunities in the Nasdaq and Bitcoin.

Imagine you borrow money from a friend at a low rate to buy a rental property that pays you more. It’s a sweet deal until your friend raises the rate, the property’s value drops, and you have to sell at a loss to pay him back. That’s the carry trade, and it’s unraveling right now—shaking global markets, hitting Latin America hard, and creating opportunities in the Nasdaq and Bitcoin. For the 664 million of us in Latin America, this is a wake-up call—but also a chance to get ahead. Let’s break it down, and I’ll tell you why you should join my new blog to navigate what’s coming.

The Carry Trade is Unwinding, and AUDJPY is Sounding the Alarm

The carry trade is simple: borrow in a low-interest currency (like the Japanese yen) and invest in a higher-yielding one (like the Australian dollar). For years, AUDJPY has been a favorite for this strategy. But now, it’s falling apart. Interest rates are climbing—especially in the U.S., where the Secured Overnight Financing Rate (SOFR) has replaced the manipulable LIBOR, showing the real cost of borrowing. The yen is getting stronger, and investors are unwinding these trades, selling off riskier assets to cover their bets.

This isn’t happening alone. Oil prices are falling, just like in 2014–2016 when U.S. shale oil flooded the market, crashing prices and hurting emerging market currencies. History doesn’t repeat, but it rhymes, and today’s setup feels very familiar.

High-Yield Bonds Are Starting to Crack

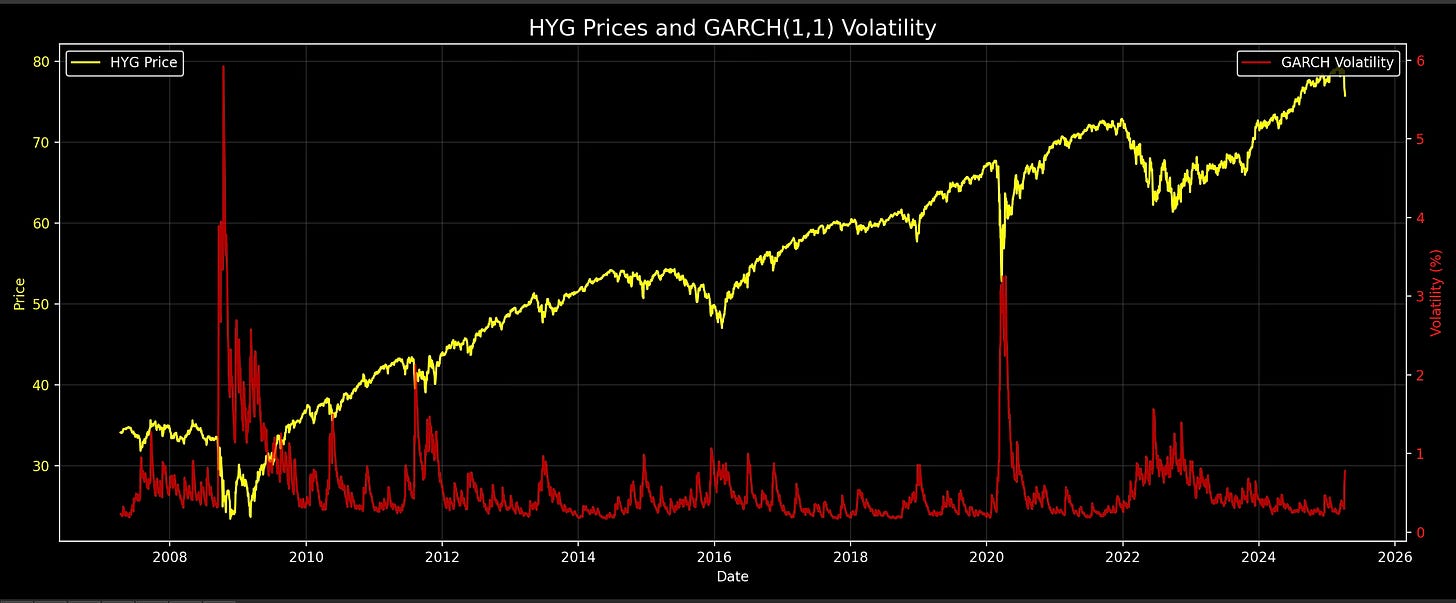

Take a look at this chart of high-yield bond prices (HYG) and their volatility (GARCH):

HYG Prices and GARCH Volatility Chart

The yellow line is high-yield bond prices, and the red line is volatility. Notice the red spikes—big ones in 2008, 2011, 2020, and now in 2024–2025. Each spike comes with a price drop. High-yield bonds, or junk bonds, pay more because they’re riskier. When the carry trade unwinds, investors dump these bonds for safer assets, pushing prices down and volatility up. We’re seeing that now, just like in 2014–2016.

Shadow Banking Feels the Pressure—KKR and Apollo Are in the Hot Seat

Private Equity Firms Drawdowns, AUDJPY (carry trade proxy) and OIL.

The shadow banking system—private equity firms, hedge funds, and other non-banks—depends on cheap money to operate. Firms like KKR and Apollo borrow dollars from offshore markets (eurodollars) to invest in high-yield bonds and leveraged buyouts. These eurodollars, free from traditional rules, have been a cheap funding source for years.

But the carry trade unwind is drying up that liquidity. Borrowing costs are rising with SOFR, and a stronger dollar makes repaying those loans harder. KKR, which focuses on higher-quality high-yield bonds, might handle this better, with lower default risks. Apollo, a distressed debt expert, could profit by buying cheap bonds during the dip. But Apollo’s strategy of issuing more debt to manage struggling investments—like with Claire’s—could backfire if volatility sticks around.

Emerging Markets Are the Biggest Losers—Especially in Latin America

Here’s the tough part: emerging markets are going to take the biggest hit, and we in Latin America are right in the crosshairs. In 2014–2016, falling oil prices crushed currencies like the Brazilian real, Mexican peso, and Colombian peso as investors fled to safety. Today’s oil price drop, combined with the carry trade unwind, is setting up the same storm. A stronger dollar and tighter liquidity could lead to deep devaluations, making imports more expensive, driving up inflation, and hitting households hard across our 664 million-strong region.

I’ve been writing about this bigger picture in La Nueva Guerra Fría: Un Tablero en Movimiento. The global value chain shifts—where trade and manufacturing are moving due to U.S.-China tensions—are making things worse for commodity-dependent Latin America.

The Fiat System is Failing—and Bitcoin is Becoming a Necessity

Here’s the bigger problem: the fiat system is failing. Governments print money to solve problems, but it often leads to inflation and currency devaluation—especially in places like Latin America, where we’ve seen this play out before. When fiat currencies lose value, people look for alternatives. That’s where the monetary layer of the internet comes in—Bitcoin.

Bitcoin isn’t just a speculative asset; it’s a digital ark for times like these. As fiat currencies devalue, Bitcoin gets stronger because it’s not tied to any government or central bank. It’s a fixed supply—only 21 million coins will ever exist—making it a hedge against inflation and devaluation. For Latin Americans, Bitcoin isn’t an option; it’s a necessity in the face of a “diluvio” of currency devaluations. Countries like Argentina and Brazil are already seeing huge demand for Bitcoin and stablecoins as people try to protect their savings, as I’ve explored in my new blog.

The Nasdaq Will Soak Up Global Liquidity—and Palantir Could Be the Next Big Thing

There’s another opportunity on the horizon: the Nasdaq. When liquidity gets tight, investors flock to the safest, most liquid markets—U.S. tech stocks. The Nasdaq, home to giants like Apple and Microsoft, thrives in this environment. The same global value chain shifts hurting Latin America are boosting U.S. tech, as companies bring production home and double down on automation and AI.

There’s a new player to watch: Palantir. This company is carving out a unique spot at the intersection of AI, governments, and corporations, and it could become a Nasdaq giant. Palantir started by helping U.S. intelligence track threats, but now it works with governments worldwide—like managing COVID-19 vaccine systems—and big corporations like Morgan Stanley and Airbus. Its Foundry platform handles massive data sets, and its Apollo platform streamlines software across industries.

What sets Palantir apart is how it uses AI in ways that go beyond typical language models (LLMs). To understand this, let’s talk about something called an ontology. Think of an ontology as a giant library catalog for the world’s knowledge. In a library, books are organized by categories—fiction, history, science—and you can see how they’re connected, like how a history book might link to a science book about inventions. An ontology does the same for data: it maps out concepts, relationships, and rules in a structured way, so a computer can understand the world more like a human does.

Why does this matter for LLMs? Most language models are great at generating text, but they can make things up—like guessing a book’s plot without reading it. An ontology gives them a map to follow, ensuring they stick to real connections and facts. For Palantir, this is key. Its AI doesn’t just chat—it solves complex problems, like spotting fraud for governments or optimizing supply chains for businesses, by relying on these structured knowledge maps. This makes Palantir’s tech more reliable and powerful, positioning it as a leader in a world increasingly dependent on data-driven decisions.

Why This Matters for Latin America—and Why You Should Join My New Blog

If you’re in Latin America, get ready for currency devaluations—they’ll make life tougher for a while. But don’t just sit back. Bitcoin is your digital ark to weather the storm of devaluations, and the Nasdaq, especially Palantir, is a long-term opportunity. As liquidity flows to the U.S., tech stocks will surge, and Palantir’s role in AI, governments, and corporations makes it a potential game-changer. The carry trade unwind is painful, but it’s also a chance to protect your wealth and invest in the next winners.

This is why I started my new blog—to help you navigate these changes. From Mexico to Argentina, we’re all facing the same challenges: devaluations, inflation, and uncertainty. But we can also find opportunities, like Bitcoin’s rise and the Nasdaq’s potential. My blog breaks down these complex trends in a simple way, so you can protect your finances and come out stronger. I’ll share insights on markets, geopolitics, and investments, all tailored for our Latin American reality.

¡Únete a mi nuevo blog hoy! Suscríbete gratis y recibe cada artículo directamente en tu correo. Juntos, podemos entender este mundo que cambia rápido y encontrar las mejores oportunidades para nuestro futuro. Haz clic aquí para suscribirte:

https://nuevaguerrafria.substack.com/p/la-nueva-guerra-fria-un-tablero-en

What’s your plan—are you preparing for the currency hit with Bitcoin, or are you eyeing the Nasdaq and Palantir? Let’s talk in the comments.

Un Abrazo ,

Guillermo Valencia A

Cofounder of MacroWise

April 20, 2025

Think assumption that liquidity from carry trade unwinds will flow to US tech stocks in the current climate is pretty contentious…

Bitcoin definitely is the best option, not only for Latam, but also for the world. It empowers the citizens and give them

Real

Value (sound money) and sovereignty on their assets.