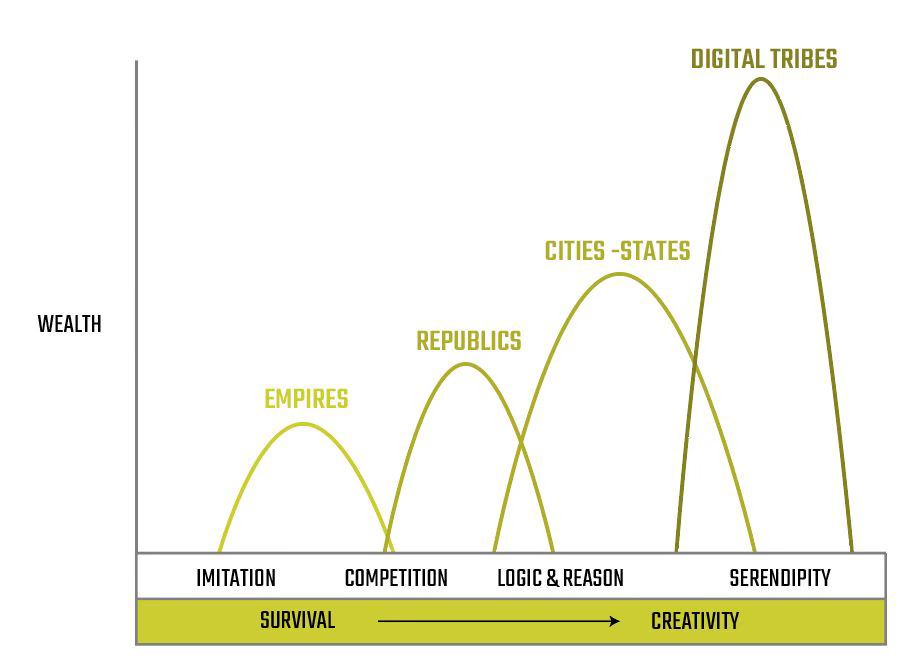

The Evolution of Wealth: From Imitation to Serendipity

As we slide from imitation to serendipity, from empires to digital tribes, we’re not just tweaking how we handle cash. We’re redefining what it means to belong.

Imitation: The Survival Algorithm

Imagine a school of sardines darting through the ocean. A shark circles nearby, its shadow slicing through the water. Suddenly, thousands of fish pivot as one—no leader, no plan, just pure instinct. Each sardine mirrors the one beside it, and in that seamless imitation, they survive. Thousands of years ago, humans weren’t so different. We watched, we copied: how to hunt, how to build shelters, how to dodge the jaws of death. From this primal urge to mimic, money was born. A chunk of gold stamped with an emperor’s face became valuable because we all agreed it was. If the king said, “This matters,” we nodded and traded it. Money was the glue that bound empires, religions, and hierarchies together. Imitation gave us order. It gave us survival. But it didn’t give us wealth and freedom.

Competition: The Game of Kings

Then came competition, a force as old as life itself. Empires didn’t just want to endure—they wanted to dominate. Gold morphed from a shiny trinket into a weapon of power. With it, you could buy armies, choke trade routes, or plant your flag on someone else’s soil. But here’s the catch: it was a zero-sum game. My chest of coins grew only if yours shrank. Kings and conquerors hoarded their treasures, stacking them high behind palace walls, yet the wealth that truly transforms the world—the kind that rewrites history—wasn’t glittering in their vaults. It was waiting somewhere else.

Logic and Reason: The Rise of Cities

That somewhere was the city. Not the sprawling empires, but the messy, vibrant chaos of urban streets. Real wealth didn’t sit still—it grew, sparked by the collision of ideas in places like Valencia. Stand there today, and you can feel it: a city that’s been Roman, Moorish, medieval, and now modern, constantly reinventing itself from the days of El Cid to the soaring, futuristic arches of Santiago Calatrava. But Valencia’s not alone. Florence fused art and commerce to light the fuse of the Renaissance. Manchester’s clattering looms coughed out the Industrial Revolution. New York sucked in millions and spat out a global marketplace. Tokyo and Shenzhen proved a city could leap from obscurity to powerhouse in a handful of decades.

These cities don’t just hold wealth—they generate it. They’re magnets for the restless, the brilliant, the oddballs. National GDP might tally the score for countries, but the real action unfolds where a baker and a philosopher bump shoulders on a corner and accidentally change the world. In the ordered chaos of urban life, logic and reason took root, and wealth bloomed.

Serendipity: The Digital Frontier

Now, in 2025, we’re stepping into something new. Money is shifting again because our networks are. We’re not just linking people anymore—we’re wiring together everything: phones, fridges, fleeting thoughts. And from this web emerges a revolution: the tokenization of real-world assets (RWA). Picture this: a painting, a skyscraper, a patch of farmland, chopped into digital slivers you can buy or sell from your pocket. Fancy owning a piece of Calatrava’s masterpiece in Valencia for $10? You can, whether you’re in Tokyo or Timbuktu.

Driving this is Solana, a blockchain that’s less a tool and more a rocket. It churns through 65,000 transactions a second—Ethereum limps along at 15 to 30—and each one costs less than a penny, while other networks might slug you $10 or more. Its secret sauce, something called Proof of History, sorts transactions with a precision that feels almost sorcerous, keeping the chaos at bay. Projects like Parcl let you snap up property fragments starting at a buck, while Ondo Finance turns stodgy government bonds into tokens anyone can grab. The numbers tell the story: DefiLlama pegs the value of RWA on Solana at $5 billion, up 300% in a single year.

But this isn’t just tech wizardry—it’s a rewiring of trust. Once, we leaned on emperors, banks, or the whims of the harvest. Now, we’re betting on code and digital tribes—communities that sprawl across borders. AI can turbocharge logic, but creativity? That’s serendipity’s domain. It’s the unexpected spark when two unconnected things collide. And these global, digital tribes are the petri dish where that spark catches fire.

Do you speak spanish?

Money as Our Social DNA

Money has always mirrored our social networks. First, we imitated to stay alive. Then, we competed to rule. Next, we reasoned to build. Now, we’re creating to dream. Cities showed us that chaos can breed wealth. Digital tribes, fueled by Solana and tokenization, are proving that value can flow as freely as a tweet—and that we can all dip our hands into the stream.

I’m standing in Valencia as I write this, gazing at Calatrava’s wild, impossible structures—tributes to a city that’s taken its past (Romans, Moors, conquerors) and hurled it into the future. We’re doing the same with money. Every tap on your phone, every token flickering on your screen, is a reminder: money isn’t just a thing we spend. It’s a thing we are. And with every network we spin, we’re drafting the next page of our story.

As we slide from imitation to serendipity, from empires to digital tribes, we’re not just tweaking how we handle cash. We’re redefining what it means to belong. In this new world, wealth isn’t about piling up coins—it’s about connection, creativity, and the guts to dream big.

Thanks for reading,

Guillermo Valencia A

Cofounder of MacroWise

Great approach.

Money is a language, a shared imaginary for human kind. Networks is our new society platforms, BTC/SOL is our new Language!

Guillermo,just wanted to say a big thanks for the awesome article on the evolution of wealth. It was super insightful and easy to follow—loved how you broke it all down. Keep up the great work!