The Hidden Cost of the Dollar’s Reign—and Bitcoin’s Quiet Revolution

In a world where geography can trap you, the internet is an escape. And Bitcoin is the key. It dips with volatility—sure—but it learns, adapts, and climbs. Its ecosystem—developers, miners, users...

In 2013, a routine announcement from the U.S. Federal Reserve turned the world upside down. The Fed hinted it would slow its bond-buying spree—a move later called the “Taper Tantrum”—and markets panicked. For Americans, it was a technical shift, a tweak in monetary policy. But halfway across the globe, in places like India, Brazil, and South Africa, it was a wrecking ball. Currencies crashed, borrowing costs spiked, and economies staggered. The “Fragile Five”—India, Brazil, Indonesia, South Africa, and Turkey—took the hardest hits, their vulnerabilities laid bare.

That moment wasn’t an isolated event. It was the opening chapter of a recurring story, one that’s played out again and again: 2018 with the China trade wars, 2020 with the pandemic, 2021 with another devaluation wave. Each time, emerging markets bear the brunt of decisions made in Washington. And each time, a quiet alternative has been gaining ground—Bitcoin.

This is a tale of power, fragility, and a potential escape. It’s about how the U.S. dollar’s dominance drains liquidity from emerging markets, how volatility exposes their weaknesses, and how 4.1 billion people are caught in the fallout. But it’s also about a lifeline—a decentralized asset that might just rewrite the rules.

The Dollar’s Privilege: A Modern-Day Seigniorage

Picture this: You’re a landlord who can print the money your tenants need to pay rent. They sweat to earn it; you just crank the press. That’s the U.S. dollar’s superpower—what economists call “seigniorage.” As the world’s reserve currency, the dollar gives the U.S. a free pass to expand its money supply whenever it wants. The Federal Reserve tweaks its balance sheet, and new dollars flood the system. For America, it’s a stimulus tool. For everyone else, it’s a game of catch-up.

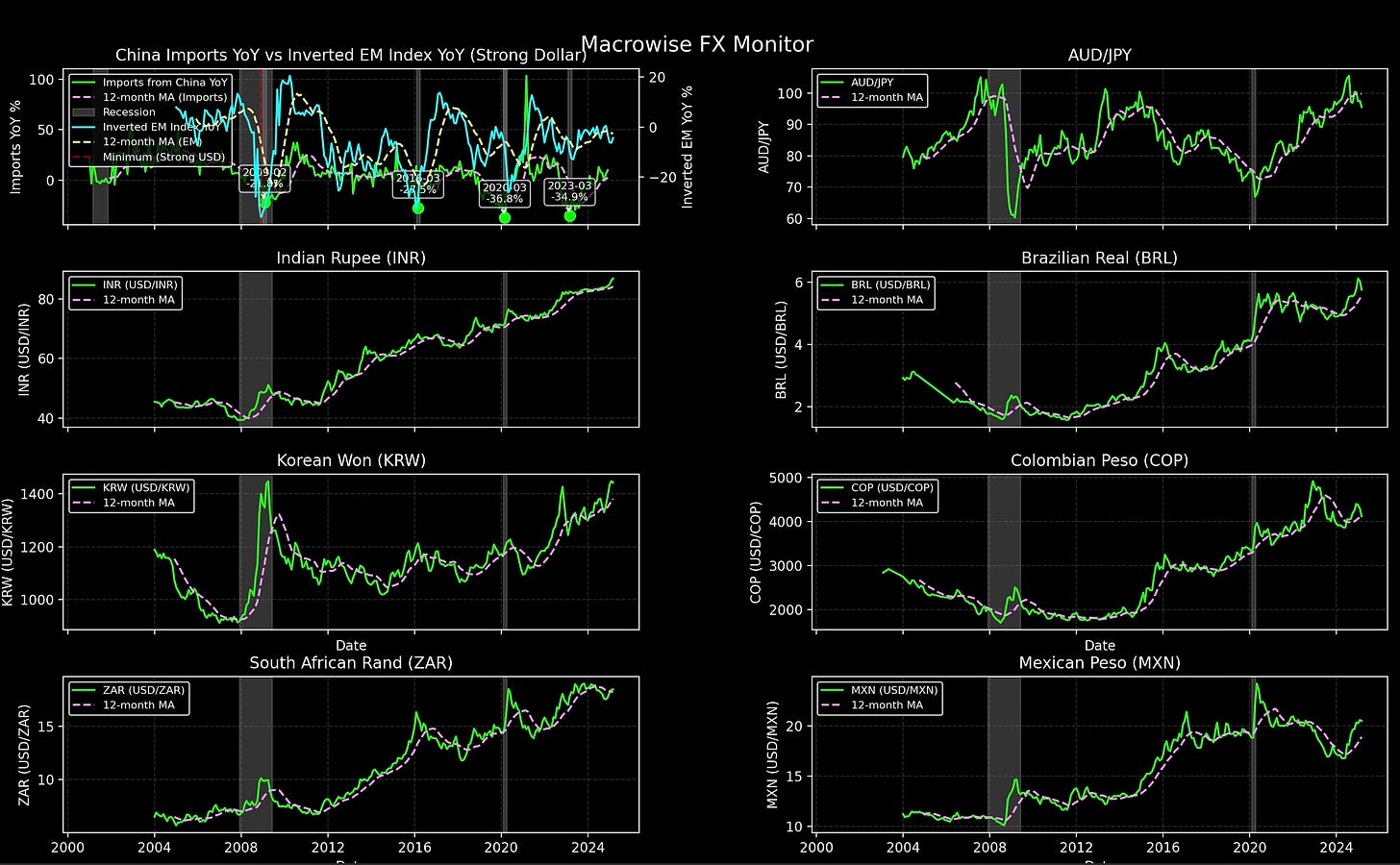

Emerging markets don’t have that luxury. To get dollars, China exports goods, Brazil mines iron ore, Korea ships chips. It’s hard work, and the payoff isn’t guaranteed. When the U.S. pumps out dollars—like during the post-2008 recovery or the pandemic—it’s a tide that lifts some boats and swamps others. Emerging markets see capital rush in, then rush out just as fast when the Fed tightens up. The data backs this up: when U.S. imports from China drop, signaling fewer dollars flowing offshore, emerging market currencies—like the Indian rupee, Korean won, and Brazilian real—tank. Check the graphs: sharp import declines in 2013, 2018, and 2022 match currency crises like clockwork.

This isn’t just economics—it’s a power imbalance. The U.S. reaps the rewards of printing money; emerging markets pay the price in devalued currencies and lost purchasing power.

The Fragility Trap: Volatility’s Lasting Sting

Here’s where it gets brutal. When volatility spikes—say, during the Taper Tantrum or the 2020 crash—emerging market currencies take a beating. The South African rand, the Mexican peso, the Colombian peso—they all plunge. The VIX, Wall Street’s fear gauge, shoots up, and capital flees to safety. Investors unwind carry trades, borrowing cheap yen to fund riskier bets, and the AUD/JPY pair—a proxy for this game—nosedives.

You’d expect a recovery when the dust settles, right? Not quite. The graphs tell a different story. After each crisis, these currencies crawl back a bit, but never to where they started. The rupee’s keeps climbing (that’s bad—it means more rupees per dollar). The rand and won follow suit. Volatility fades, but the damage sticks. These economies don’t adapt or reinvent—they just limp along, more fragile each time.

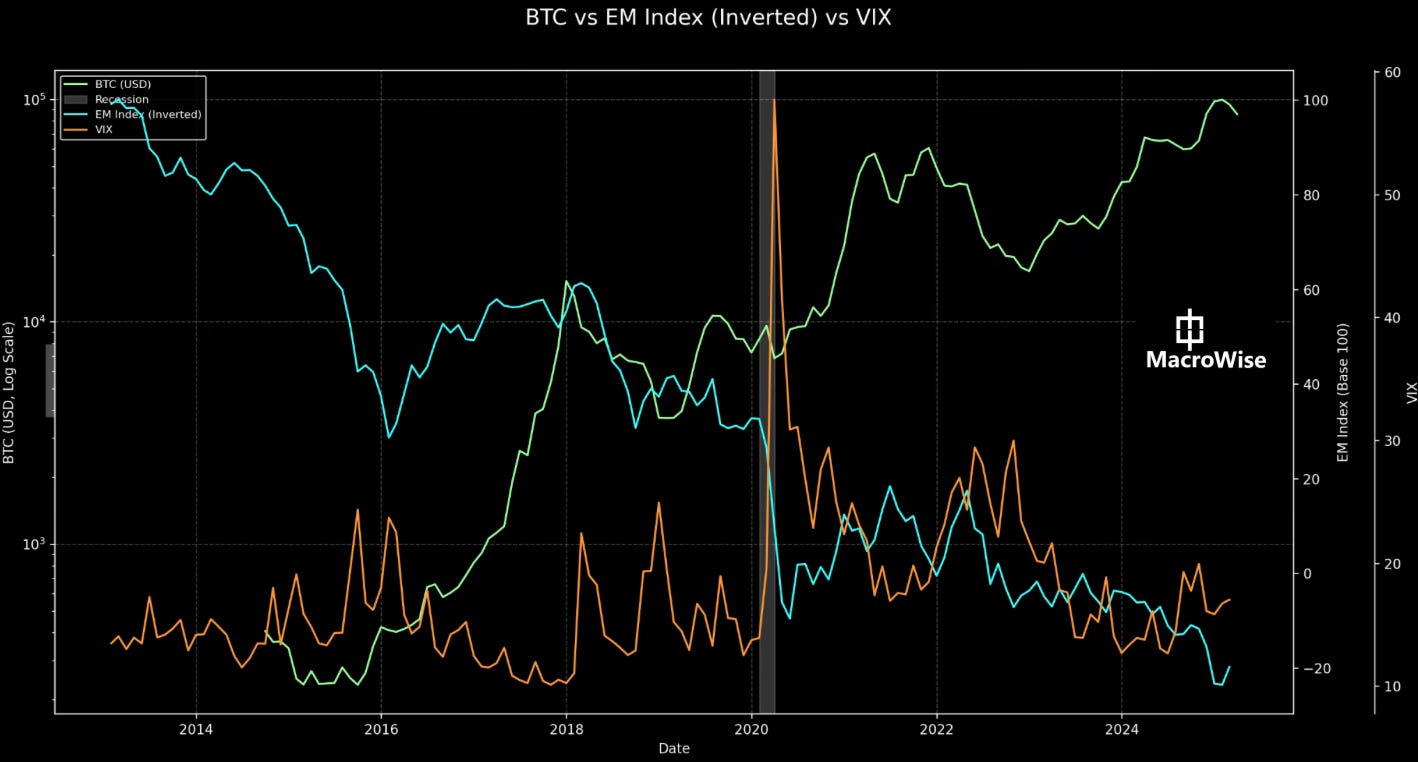

Contrast that with Bitcoin. When the VIX spiked in 2020, Bitcoin crashed too—down to $4,000. But then it soared, hitting nearly $69,000 by late 2021. It’s done this before: a dip in 2018, then a new peak; a tumble in 2022, then a rebound. Bitcoin doesn’t just survive volatility—it thrives on it, reaching new highs while emerging market currencies stagnate.

Bitcoin: A Game-Changer for 4.1 Billion

This brings us to the human side. There are 4.1 billion people in emerging markets—shopkeepers in Lagos, farmers in Punjab, teachers in Bogotá—whose savings erode with every currency drop. For them, the dollar’s reign isn’t an abstract concept; it’s a shrinking paycheck, a pricier loaf of bread, a dimmer future. Past crises—in ’95, ’98, the ’80s—left them with no way out. Governments devalued, banks faltered, and citizens suffered.

Bitcoin changes that. It’s not tied to any central bank or Fed policy. Its supply is capped at 21 million coins—no printing press can dilute it. And it’s accessible: all you need is a smartphone. For a Venezuelan facing hyperinflation or a Zimbabwean watching the Zim dollar collapse, Bitcoin’s wild swings are less scary than a currency that’s worthless by breakfast.

The graphs highlight this shift. While emerging market currencies hit new lows against the dollar, Bitcoin’s chart shows resilience. It dips with volatility—sure—but it learns, adapts, and climbs. Its ecosystem—developers, miners, users—keeps evolving, making it “antifragile” in a way traditional economies aren’t.

The Liquidity Drain and the Carry Trade Twist

There’s a deeper trigger here: liquidity. Emerging markets depend on dollar flows, often tied to U.S. imports from China. When those imports fall—like the -34.9% drop in 2023—dollars dry up offshore. The graphs show it: import slumps align with currency crashes. It’s a drainage system, siphoning liquidity from the vulnerable.

Then there’s the carry trade. When AUD/JPY falls, it signals investors are bailing on risk—bad news for emerging markets. But here’s the flip side: that same unwind can fuel a boom elsewhere. Capital fleeing traditional markets often lands in crypto or tech. The next crisis could tank the Real, the Peso , the Rand but ignite Bitcoin.

A Quiet Revolution

The dollar’s dominance won’t vanish overnight. Bitcoin isn’t flawless—its volatility and regulatory risks are real. But for 4.1 billion people, it’s a crack in the system. With whispers of a Trump-era strategic reserve amplifying dollar power, the need for an alternative grows. Emerging markets can’t keep bleeding liquidity to the Fed’s whims.

Bitcoin offers a way out—not a cure-all, but a choice. It’s a decentralized rebellion against seigniorage, a hedge against fragility, a chance at financial sovereignty. As the next Taper Tantrum looms, those 4.1 billion might find their best shield isn’t a central bank or a stock index—it’s a digital coin built to outlast the chaos.

The Internet and its Monetary Layer: Bitcoin’s Role

Imagine a world where money doesn’t care where you live, what passport you hold, or who governs your country. A world where your wealth isn’t tied to the decisions of a central bank or the borders on a map. It sounds like science fiction, but it’s happening right now, in the vast, borderless territory of the internet.

We’ve always seen currencies as tied to nations: the dollar to the U.S., the euro to Europe, the yuan to China. Each currency is backed by a country’s resources, laws, and trust. But for the first time, we have a system that transcends geography and relies on the digital economy. Bitcoin is the monetary layer of the internet—a foundational system for value transfer in the digital age.

The Old World: Currencies Trapped by Borders

For centuries, money has mirrored geography. The dollar versus the euro pits the U.S. against the eurozone; the dollar versus the yuan is the U.S. against China. These are economies defined by their borders, their social contracts, their histories. But those borders can be cages. When a nation stumbles, its currency falls with it. We’ve seen it time and again: the Argentine peso collapses, the Venezuelan bolívar evaporates, the Zimbabwean dollar becomes worthless overnight. Geography can limit and punish.

Now, look at the internet. It has no borders. It’s a global space where ideas, goods, and people connect without walls. Historically, the internet has relied on traditional currencies brought in from the outside. But that’s changing.

Bitcoin: The Monetary Layer of the Internet

Bitcoin isn’t just another way to pay online, like PayPal or a credit card. It’s something bigger: a currency created for the internet, belonging to no country and obeying no government. It’s as if the internet has its own money, a medium of exchange that lives in code and connections, not in land or laws.

Here’s the fascinating part: if the internet were a country, its economy would already be enormous. The seven largest tech companies—Apple, Microsoft, Google, Amazon, Nvidia, Meta, and Tesla—have a combined market value of about $15 trillion. That’s larger than the GDP of almost every country except the U.S. and China. And that’s just seven companies. The entire internet, with all it produces and connects, has far greater potential.

Now, imagine that “country” had its own currency, one that didn’t depend on the dollar or yuan, one that no central bank could inflate or government could confiscate. That’s what Bitcoin offers. If the internet has a GDP, that GDP could surpass China’s ($18 trillion) or the U.S.’s ($26 trillion). And that GDP would back this digital economy, a backing not tied to geography but to the value we create online.

The Internet’s GDP: Beyond Borders

Let’s make this concrete. When I compare the dollar to the yuan, I’m comparing the U.S. economy to China’s. But when I compare the dollar to Bitcoin, I’m looking at the potential of an entire economy built on the internet. Today, that economy isn’t fully formed. Much of the internet is centralized in those seven giants—companies that dominate platforms, data, and money. But that’s shifting.

Cryptographic protocols like Bitcoin, Solana are opening a new frontier. They’re faster, more open, and decentralizing the power once held by a few corporations. Think of this as the internet’s wild west: first, it was a free land, then giants took control, and now crypto protocols are returning that freedom. Decentralized finance (DeFi) platforms offer loans and savings without banks. NFTs are redefining digital ownership. And Bitcoin, as the original currency of this world, anchors it all.

The internet’s GDP isn’t easy to measure today. It’s not in textbooks. But add up everything created, exchanged, and innovated online, and it’s immense. Every Bitcoin transaction, smart contract, and decentralized app adds to that GDP. Unlike traditional economies that grow slowly, the internet economy can scale exponentially. A farmer in Kenya, a programmer in Ukraine, a designer in Brazil—anyone can plug into this digital economy, contribute, and earn without being tied to their local currencies.

The Dollar vs. Bitcoin: A New Perspective

Look at the data. National currencies like the Mexican peso, Brazilian real, or South African rand have lost value against the dollar over the past two decades. In the “Macrowise FX Monitor” chart, you see these currencies rise and fall with crises—2008, 2020—while the dollar stays strong. But even the dollar is tied to geography, to the Federal Reserve’s decisions, to one country’s economy.

Bitcoin, on the other hand, is different. The “BTC vs EM Index (Inverted) vs VIX” chart shows its price against the dollar from 2014 to 2024. Yes, it’s volatile—rising to nearly $100,000 in 2021, then falling. But notice the overall trend: it grows over time, even as emerging markets (EM Index) and volatility (VIX) wobble with each crisis. Bitcoin isn’t perfect, but its value doesn’t depend on a government or a border. It depends on trust in a decentralized network and the growth of the digital economy.

Today, Bitcoin’s market cap is around $1 trillion. That’s small compared to China or the U.S. But it’s not just about Bitcoin’s price. It’s about the economy it can support. That’s the massive potential just beginning to take shape.

The Future: A Digital Economy with Bitcoin as its Layer

We’re at the start of this story. The internet economy is like a teenager: full of potential but still finding its way. Crypto protocols are evolving, adoption is growing, and infrastructure is being built. But the vision is clear: a borderless digital economy with Bitcoin as its monetary layer. A place where your money isn’t limited by where you were born but by what you create and contribute online.

In a world where geography can trap you, the internet is an escape. And Bitcoin is the key.

One last thought: Next time you hear about Bitcoin’s volatility or a crypto scandal, don’t stop there. Think about what’s behind it: the construction of a new economy, one that could one day rival the giants of the old world. That’s the potential we’re just starting to uncover.

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise

March 2nd, 2025