The Party of Indefinite Optimism: Liquidity Flows, Zombie Stumbles, and China's AI Sputnik

Liquidity is the lifeblood of this indefinite optimism, the belief that progress happens by accident, not design. Builders, not dreamers, will tip the scales.

Imagine a cocktail party where the champagne flows endlessly, the music swells, and everyone dances as if the night will never end. That’s the market in September 2025—buoyed by a flood of liquidity, fueled by a peculiar alchemy of money and optimism. Yet, beneath the glittering surface, two structural fault lines threaten to shatter the revelry: the staggering rise of zombie corporations teetering on bankruptcy, and a technological bombshell from China that redefines the AI arms race. This isn’t just a market story; it’s a human one, a tale of how small shifts—spreadsheets, chips, and secrets—could cascade into a global reckoning. But amid the chaos, the true innovator in the U.S. emerges: Tesla (TSLA), whose robotaxis and humanoids promise a completely new economy. Let’s break it down, with data as our guide and a nod to the definite builders who might save the day.

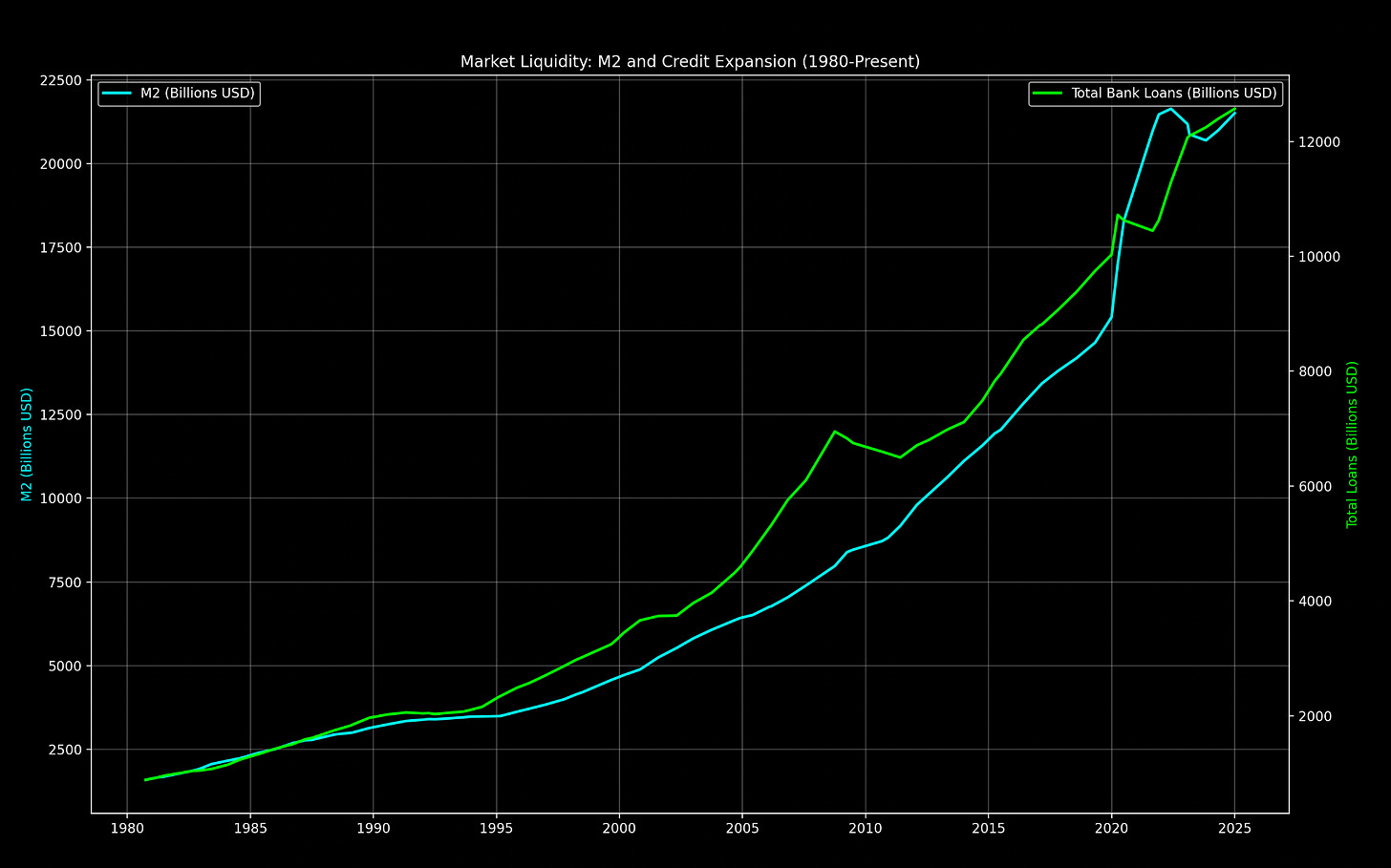

First, the party. Liquidity is the lifeblood of this indefinite optimism, the belief that progress happens by accident, not design. Look at M2, the broad money supply: it’s surged to $21.2 trillion as of this morning, September 21, 2025, up from a mere $4.5 trillion in 1980. That’s a fivefold increase, a tidal wave of cash that’s kept stocks soaring—S&P up 25% year-to-date, Nasdaq teasing 20,000. Banks are in on it too, with total loans and leases hitting $12.5 trillion, a 50% jump since 2020. This isn’t a trickle; it’s a deluge, the kind of abundance that makes investors bet on tomorrow without counting the cost. The connectors—traders, VCs, Fed policymakers—keep the music playing, each move amplifying the last.

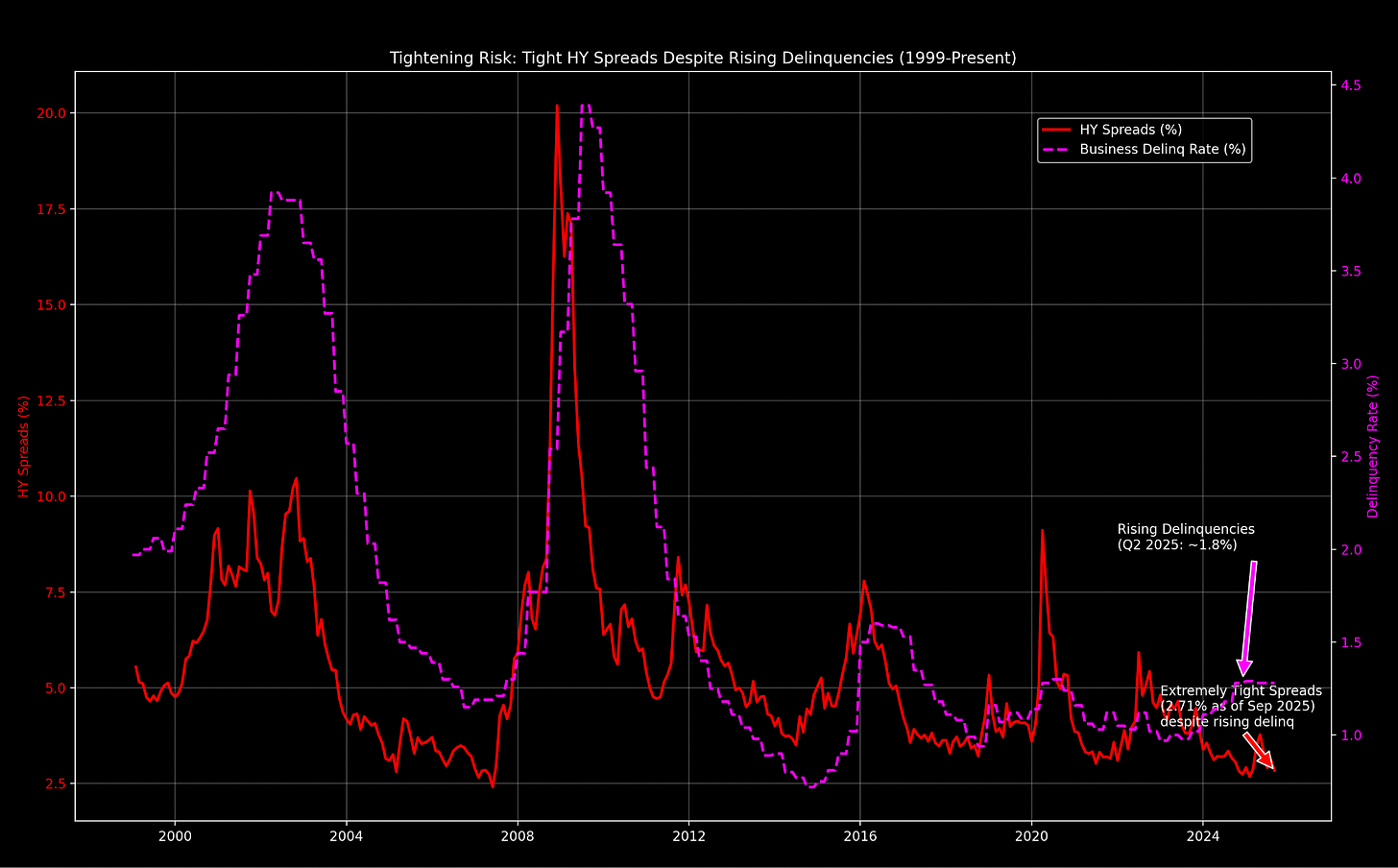

But every party has its crashers. The first structural fracture is the zombie economy—corporations so laden with debt they’re the walking dead, sustained only by cheap money. Nonfinancial corporate debt now sits at 45% of GDP, a level that echoes the dot-com bust and the Great Recession. Since rate hikes began in 2022, the burden has grown heavier; interest payments gnaw at cash flows, and the cracks are showing. High-yield spreads, at a mere 2.71% this week, are tighter than pre-2008 euphoria—a sign of blind faith. Yet business loan delinquencies have climbed to 1.8%, up 20% from last year’s lows. This disconnect—tight spreads amid rising defaults—is the prelude to a reckoning. When the music stops, bankruptcies will spike, clearing the undead but shaking the foundation. It’s not if, but when.

Then comes the second shift, the real Sputnik moment: China’s brewing breakthrough in a new potential architecture for AI chips that doesn’t demand ASML’s lithography machines or TSMC’s 2nm wizardry. Maybe it’s not exactly one chip we’ve seen yet—something big is coming, as innovation springs from two sources: necessity and curiosity. And China has the most significant need, forged in the fires of U.S. sanctions that choke off advanced tech. Take DeepSeek as a precursor anecdote: In January 2025, this Shenzhen startup unveiled its R1 model, trained for a mere $294,000—pocket change compared to the billions U.S. rivals burn. It matched top benchmarks with ruthless efficiency, a Mixture-of-Experts design that activated just a fraction of parameters, slashing compute needs by 90%. This wasn’t luck; it was necessity’s child, a harbinger of architectures that sidestep sanctions. By April, China severed ties with ASML and TSMC, betting on domestic paths like AI-driven lithography and quantum transistors at SMIC, producing 3nm chips without EUV tools. DeepSeek’s efficiency hints at what’s next: Cheap, sanction-proof designs leveraging older fabs for photonics or analogue computing, making AI infrastructure accessible and unstoppable. China’s breakthrough in a new potential architecture for AI chips. In 2025, researchers at Tsinghua University unveiled the All-Analogue Chip Combining Electronics and Light (ACCEL)—not just another digital processor, but a paradigm shift using photons for computing and transmission. This light-based, analogue design bypasses the need for advanced lithography like ASML's EUV tools or TSMC's 2nm processes, relying instead on a 20-year-old transistor fabrication from SMIC. In tests, ACCEL hits 4.6 PFLOPS—3,000 times faster than Nvidia's A100 for AI vision tasks—and sips 4 million times less energy. It's tailored for image recognition, low-light processing, and traffic ID, computing directly during sensing without the power-hungry data shuttling of traditional chips.

This isn’t incremental; it’s the leap that tips the tech Cold War.

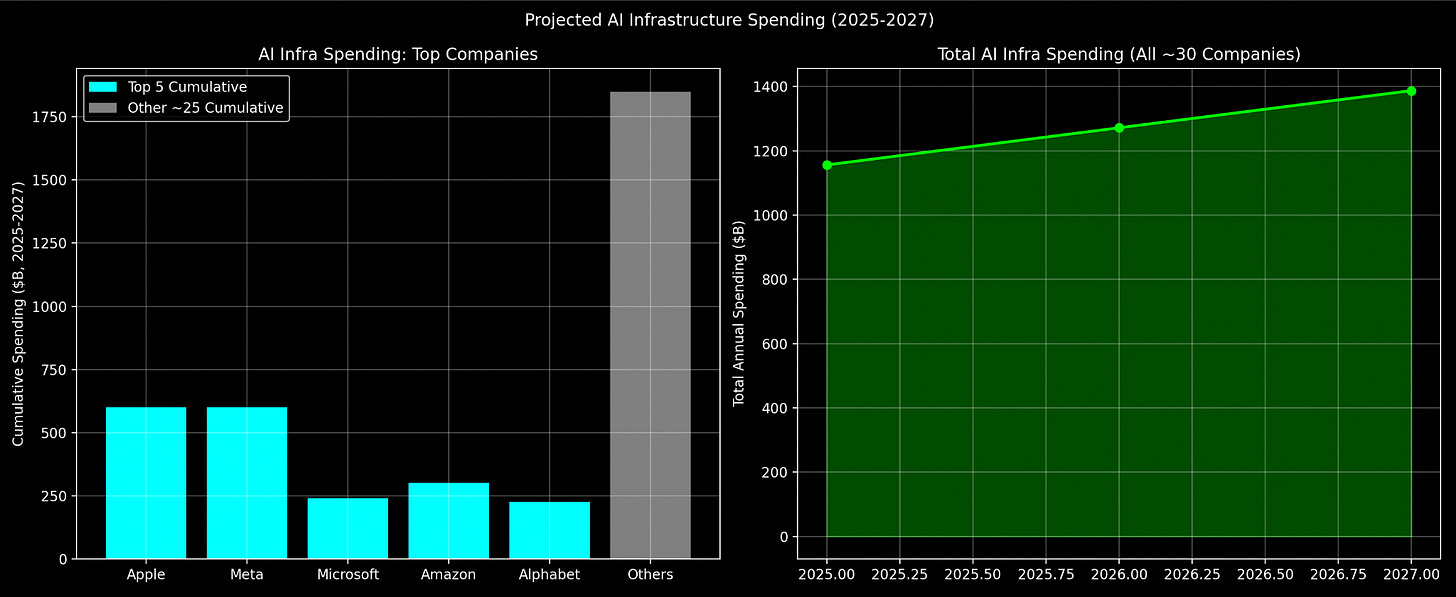

AI infrastructure, the trillion-dollar bottleneck, just got democratized. U.S. hyperscalers like Apple and Meta are committing $600 billion each over the next three years to data centers, part of a $3.5 trillion blitz by the top 30 AI players through 2027. Microsoft alone will drop $240 billion on servers and silicon; Amazon, $300 billion. Power grids strain, costs soar—McKinsey pegs global data center capex at $7 trillion by 2030.

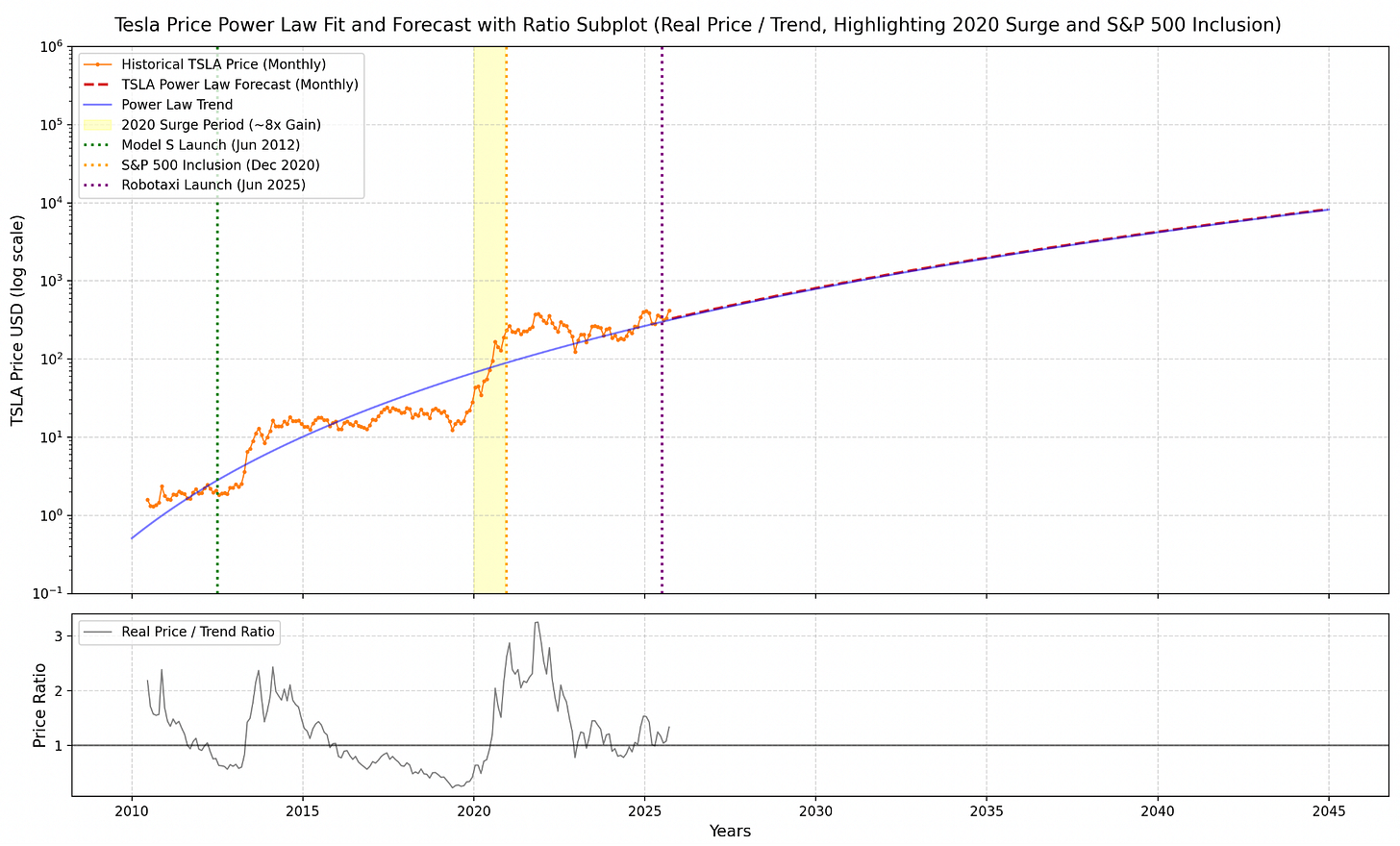

Yet, amid this East-West duel, the real innovator in the U.S. isn’t the hyperscalers—it’s Tesla. TSLA’s robotaxis, rolling out in Q4 2025 with full autonomy, and its Optimus humanoids, now in pilot production, are poised to create a completely new economy. Robotaxis promise to disrupt $5 trillion in annual transportation spend, slashing costs and emissions while generating a fleet-based revenue model that could dwarf traditional automakers. Humanoids, with their ability to automate labor in warehouses and factories, target a $100 trillion labor market. By 2030, TSLA could command a $ 10 trillion market cap from these alone—monopolies built on vertical integration and Elon Musk’s definite vision, not indefinite diffusion. This is the American moonshot, a counter to China’s efficiency with its own zero-to-one breakthrough.

So, what’s the takeaway? Liquidity keeps the party alive—$21.2 trillion M2, $12.5 trillion loans, $3.5 trillion AI spend—but zombies and China’s AI leap are the fault lines that could end it. Indefinite optimism—betting on more of the same—won’t cut it. We need definite optimism, and TSLA’s robotaxis and humanoids offer that path. The data screams abundance today, but the reckoning looms. Builders, not dreamers, will tip the scales. The beep of Sputnik echoes again; will we answer with Tesla’s moonshot, or stumble in the dark?

Thanks for reading,

Guillermo Valencia A

Cofounder of MacroWise

Genial Guillermo! Siempre dándonos la perspectiva que no todo el mundo alcanza a ver!

Muy importante tu visión Guillermo sobre cuanto tiempo durarán las condiciones actuales, y cuando será cauto tomar algunas posiciones por fuera de la mesa para recargar el cañon y volverle a entrar ante un retroceso. Cuanto puede durar este ciclo alcista?, meses?, hasta comienzos del otro año?, 6 meses?. Para tomar algo de liquidez y esperar una corrección... gracias por tu generosidad..