The Rising Current: From Oil's Grip to Electric Abundance in a Rewired Financial World.

Energy powers progress, money measures it.

Imagine the world as a vast engine, humming on oil for over a century—black gold powering factories, cars, and economies, but leaving a trail of exhaust that's harder to ignore. In the mid-20th century, this fuel underpinned the post-war boom, where welfare states promised equality through redistributed wealth, education, and safety nets. Soldiers turned workers, and oil greased the wheels of growth. But by July 2025, that engine is sputtering. Birth rates dip below sustainability in many nations, money printing since 2008 has bloated debts without proportional output, and shadows loom in the financial underbelly. China exports dominance, the U.S. innovates through tech, yet the old system's cracks widen: Zombie banks linger on subsidies, shadow banking swells to $250 trillion—nearly half the world's financial assets—hiding risks in opaque loans and leverage. We've seen the warnings: Lehman's 2008 implosion, the 2013 Taper Tantrum rattling emerging markets and oil exporters, Evergrande's 2021 property default in China, Silicon Valley Bank's 2023 collapse amid rate hikes. Each event exposes the same flaw—debt migrating to less-regulated corners, like private credit and hedge funds, where illiquidity meets overconfidence.

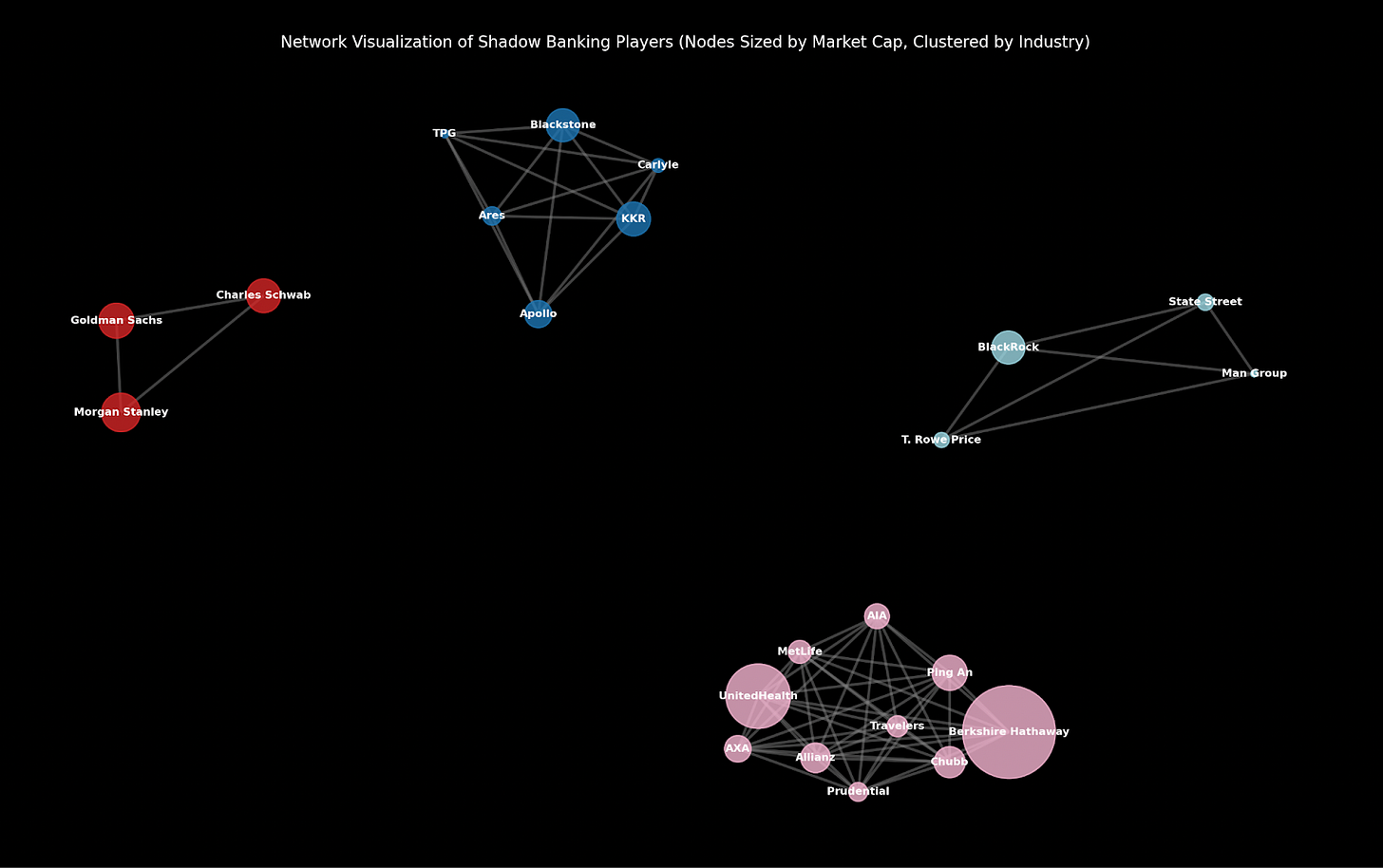

Network Visualization of Shadow Banking Players.

The psychology is familiar: We chase stability like a mirage, borrowing cheap to fund the present while ignoring the bill. Shadow banking thrives on this, offering credit outside bank rules, but it's a house of cards. Funds lend to middle-market firms or real estate, often with lenient terms that mask weaknesses. When rates rise—as Treasury yields hover around 4.4% now—refinancings falter, defaults ripple. Private equity ties in, using high-yield bonds for buyouts, but exits slow in downturns, amplifying pain. It's human nature: Prefer the known drain over unknown failure, much like keeping an outdated car running on fumes because memories outweigh the math. Nations do it too, propping up unproductive debt amid demographic shifts—fewer young workers supporting more retirees. Without change, collapse beckons, especially if triggers like a 2026 yen carry trade unwind hit, where rising Japanese rates force asset sales, spiking global yields and squeezing shadows further.

Yet, here's the quiet revolution: A new current is rising, shifting the economy from oil's finite grip to electricity's boundless flow. Oil once symbolized power—extracted, refined, burned—but electricity, abundant and clean, promises reinvention. Global energy demand grew 2.2% in 2024, faster than the decade average, with clean sources surpassing 40% of electricity generation, led by solar's explosive growth. Investments hit $3.3 trillion in 2025, twice as much in renewables and grids as in fossils. This isn't just green talk; it's necessity. AI data centers devour power like small cities, automated labor demands constant compute, and productivity surges hinge on reliable energy. We've shied from nuclear due to past fears—visible accidents overshadow silent pollution—but small modular reactors change that. Compact, factory-built, with auto-shutdown safety, they're like power's Lego blocks: Deploy near remote AI farms, snap together for gigawatts, fueling algorithms that streamline factories or invent drugs. This pivot enables abundance—automated systems boosting output 10-20 times, freeing humans for creativity. But it needs fuel beyond watts: A financial system that allocates to builders, not borrowers, and minds rewired to question, discover, and risk in an AI age.

Network Visualization of the Crypto Ecosystem

Enter the digital challengers: Crypto and stablecoins, emerging as shadow banking's sleek successor. Stablecoins—pegged to dollars, backed by Treasuries—have ballooned to a $252 billion market by July 2025, processing trillions in volumes annually, far outpacing traditional rails. They're not just tokens; they're programmable money, offering yields, instant transfers, and lending without middlemen. Platforms like Ethereum automate smart deals, tokenizing assets for efficient flows—think AI agents directing loans to nuclear projects or solar grids. Solana zips at high speeds, hosting institutional payments that bridge old debt to new growth. This system mimics shadows—credit creation, liquidity provision—but transparently, on-chain, with full reserves reducing mismatches. It could partially replace the old guard: Where shadows hide risks in private loans, stablecoins enable permissionless access, especially in the Global South amid currency woes. Hybrid models emerge—banks tokenizing deposits, issuers becoming "stablecoin banks"—disrupting fractional reserves while stabilizing yields through Treasury demand.

Market Capitalization of Shadow Banking and Crypto Actors

The transition isn't seamless; it's a behavioral battle. We cling to outdated maps—fiat as eternal, oil as king—ignoring erosion. Break to basics: Energy powers progress, money measures it. Ripple effects loom: Stablecoins ease pressures now, but scale could fragment liquidity or spark runs. Odds of full shadow replacement? Slim, perhaps 20%—regulations lag, trust builds slowly. A hybrid? Closer to 70%, as adoption climbs. Flip the script: Focus on success—channeling credit to electric abundance, educating for curiosity over certainty. Efficiency trumps complexity; the simplest path wins.

In this 2025-2050 reinvention, from welfare to tech empires, the story arcs toward hope. Oil yields to electricity's current, shadows to crypto's light—unlocking automated worlds where machines labor, humans innovate. We've adapted before; we'll do it again, persistently. What role will you play in the rising tide?

Thanks for reading ,

Guillermo Valencia A

Cofounder MacroWise

Guillermo : Excelente información. Gracias por compartir tu conocimiento