The S&P500 on Track to Conquer New Highs

When immersed in headlines about Inflation, the dollar crisis, and military conflicts, it's easy to lose sight of what truly drives progress: the pursuit of solutions.

In a world where pessimistic perspectives may momentarily capture attention, I firmly believe that true greatness and sustainability emerge from optimism. When immersed in headlines about inflation, the dollar crisis, and military conflicts, it's easy to lose sight of what truly drives progress: the pursuit of solutions.

We find ourselves amidst a new dynamic, a sort of Cold War between the United States and China. Yet, in this challenge, I envision a unique opportunity to reinvent the global production model. This scenario urges us to invest in innovation, supporting those who seek solutions to enhance productivity. Of course, it's not all smooth sailing; the geopolitical struggle for dominance between these titans could lead to armed conflicts and disruptions in value chains, creating shortages in crucial raw materials.

Our investment strategy revolves around supporting elements that enhance productivity, be it through technology stocks or investments in commodities, a realm where scarcity prevails. Cryptocurrencies, often dubbed digital gold, embody an intriguing fusion of scarcity and productivity. However, it is imperative to acknowledge that, as this space undergoes evolution, a cautious approach is essential. We must navigate potential pitfalls by implementing a stringent vetting process to tackle the presence of fraudulent actors head-on.

Lastly, I want to emphasize the importance of avoiding immersion in the most abundant: debt. Ironically, fixed-income products, traditionally considered low-risk, might not be the optimal choice in these uncertain times. By focusing on investing in solutions, in innovation that propels productivity, and in what is genuinely scarce, we can pave a path toward a more prosperous and sustainable future.

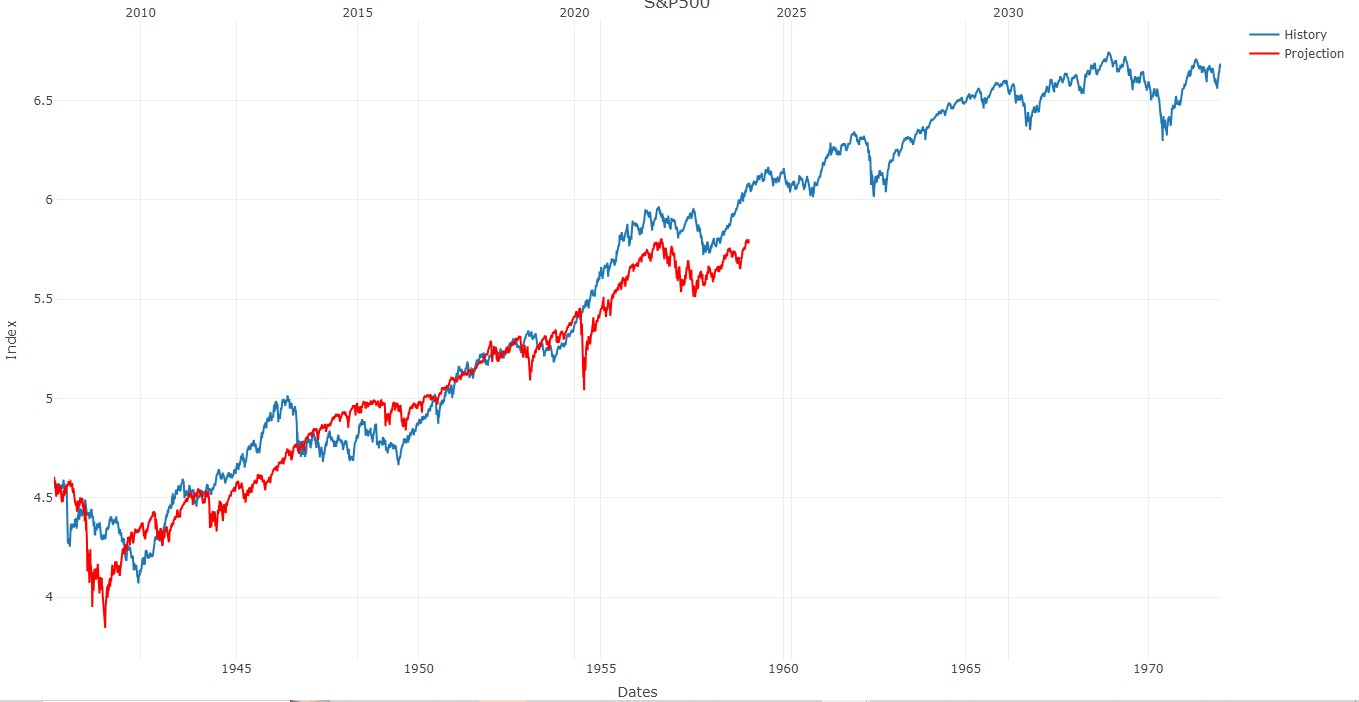

Presently, we find ourselves in a bullish market for stocks in the United States, a situation comparable to the boom experienced during the Cold War between the United States and the Soviet Union. The blue graph I share below highlights history as a potential predictor of what could unfold with the S&P500 in the ongoing confrontation between the United States and China.

Thanks for reading,

Guillermo Valencia A

Medellín, January 21st, 2024

Co-founder of Macrowise , a Research Company.