The Silent Siege: CyberArk’s Triumph in a Digital Cold War

This isn’t about stealing secrets anymore; it’s about breaking things that keep society running. Power grids, water treatment plants, semiconductor factories—if it’s connected, it’s a target.

In 2010, a tiny piece of code named Stuxnet crept into Iran’s Natanz nuclear facility, a place humming with the quiet ambition of uranium enrichment. It wasn’t loud or flashy—no explosions, no fanfare. But it spun centrifuges into a frenzy, breaking them apart with the precision of a surgeon. Some say it set Iran’s nuclear program back by years. Others whisper it was the brainchild of the U.S. and Israel, a digital dagger in a world still clinging to the idea that wars needed soldiers. Stuxnet wasn’t just a hack; it was a glimpse into the future—a future where battles are fought in the shadows of servers and code.

Fast forward to 2025, and that future is here. We’re in a new kind of Cold War, one where the frontlines aren’t marked by trenches but by fiber-optic cables. Nations like the U.S., China, and Russia aren’t just trying to control global supply chains—they’re aiming to break them. A single cyberattack can shut down a pipeline, cripple a hospital, or halt a factory on the other side of the world. In this silent siege, cybersecurity isn’t a luxury; it’s survival. And one company, Israel-based CyberArk Software (CYBR), has risen above the rest, its stock a soaring testament to the world’s desperate need for protection.

The Stakes of a Digital Cold War

Imagine a chessboard where every piece can move at the speed of light. That’s today’s geopolitical landscape. The 2021 Colonial Pipeline attack showed how a stolen password—likely snatched by a ransomware gang with ties to state actors—could empty gas stations across the U.S. East Coast, sparking panic and long lines. The 2017 NotPetya attack, pinned on Russia, started in Ukraine but spread like wildfire, costing companies like Maersk billions as their shipping operations ground to a halt. Then there’s the 2020 SolarWinds breach, where Russian hackers slipped into software updates to infiltrate U.S. government agencies and tech giants, a digital Trojan horse that exposed just how fragile our systems are.

This isn’t about stealing secrets anymore; it’s about breaking things that keep society running. Power grids, water treatment plants, semiconductor factories—if it’s connected, it’s a target. The cost of cybercrime is staggering, projected to hit $10.5 trillion annually by 2025, more than the GDP of most countries combined. In this new Cold War, the goal isn’t just dominance; it’s disruption. And the companies that can stop it are worth their weight in gold.

Israel: A Tiny Nation’s Outsized Role

In the middle of this digital battlefield stands Israel, a country smaller than New Jersey but with a cyber reputation that looms large. Israel accounts for 20% of global cybersecurity investment and is home to over 500 startups in the field, a remarkable feat for a nation of 9 million. This isn’t luck—it’s survival. Surrounded by threats since its founding, Israel has turned necessity into innovation. Its military intelligence unit, Unit 8200, trains cyber experts who often go on to start companies, creating a pipeline of talent that’s the envy of the world.

Macrowise Research

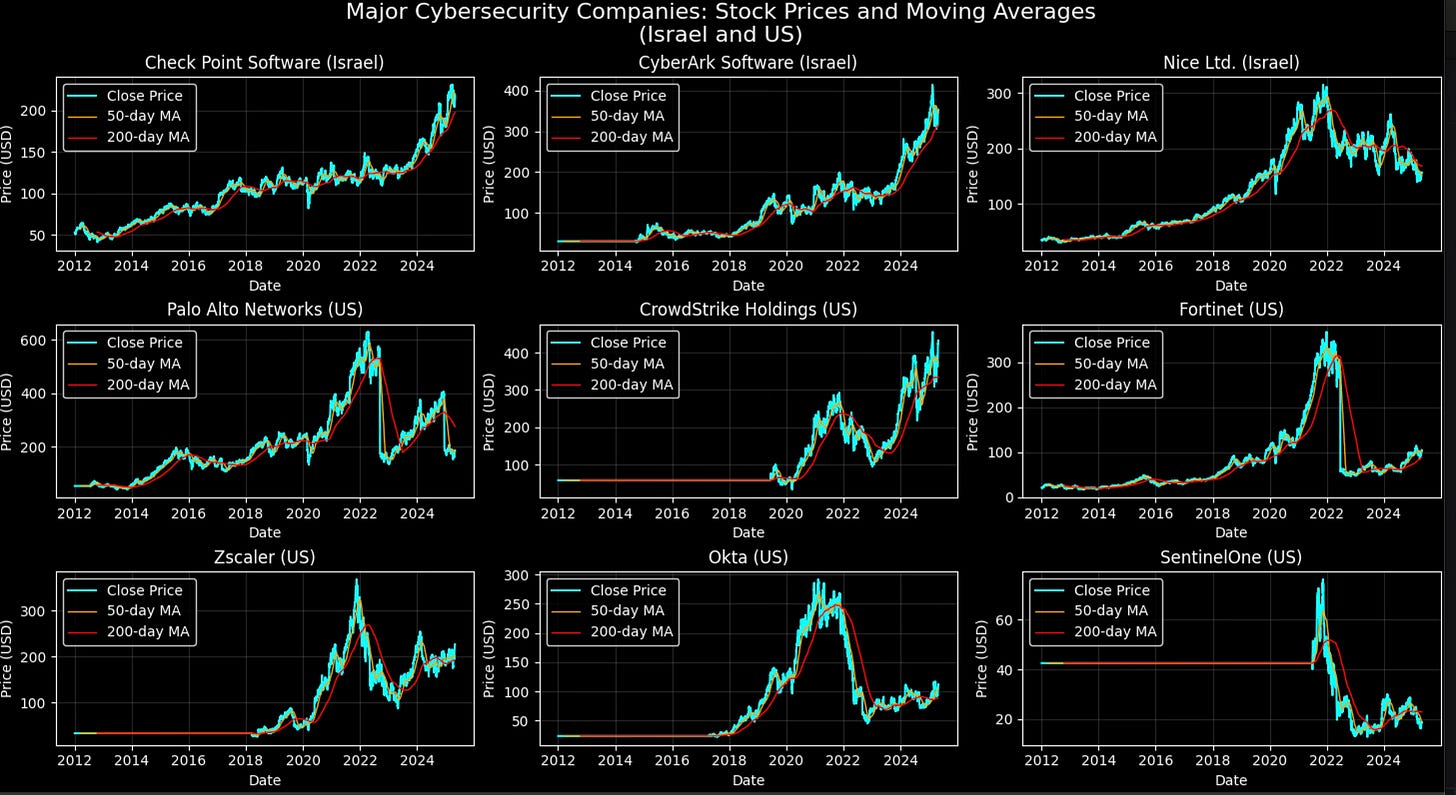

Look at the charts of Israeli cybersecurity firms, their stock prices tracing a jagged but upward climb in cyan, flanked by the steady teal and red lines of their 50-day and 200-day moving averages. These aren’t just financial metrics; they’re a story of resilience. Companies like Check Point Software and Nice Ltd. have held the line for years, their graphs showing steady growth from 2012 to 2024. But one name stands out above the rest: CyberArk Software, a guardian of the digital keys that unlock the world’s most sensitive systems.

CyberArk: The Stock That Soared

CyberArk’s story begins in 1999, founded by Udi Mokady, a veteran of Israel’s cyber defense forces. The company’s mission is simple but profound: protect privileged accounts, the master keys that hackers crave. These are the credentials that let you into a company’s core—servers, databases, even industrial controls. If a hacker gets one, they can do almost anything. The 2021 Colonial Pipeline attack started with a single stolen password. CyberArk’s technology rotates those passwords automatically, monitors for suspicious activity, and uses AI to spot threats before they strike.

The numbers tell a tale of triumph. When CyberArk went public in 2014, its stock debuted at $29. By 2024, it had soared to around $325, an 11-fold increase that outpaced many of its peers. The graph of its journey is a thing of beauty: a cyan line tracing its closing price, climbing steadily with the teal 50-day and red 200-day moving averages trailing like loyal companions. Analysts at Jefferies have named it their top cybersecurity pick for 2025, with a price target of $400, citing its leadership in identity security and a market that’s only growing hungrier for protection.

Compare that to others in the field. Palo Alto Networks, a giant in firewalls, has seen its stock rise to over $600 by 2024. CrowdStrike, a leader in endpoint security, hit $400. Zscaler, a cloud security titan, reached $300. These are impressive runs, their charts showing the same upward momentum in cyan, teal, and red. But CyberArk’s growth feels different—more focused, more urgent. It serves over 6,770 clients, including half the Fortune 500, and has expanded through smart acquisitions like Venafi in 2024 for $1.54 billion, bolstering its machine identity protection, and Zilla Security in 2025 for $175 million, adding identity governance. With $1 billion in trailing 12-month revenue by late 2024, CyberArk isn’t just surviving this war—it’s thriving.

The Ghosts of Cyber Past

To understand why CyberArk matters, look to the ghosts of cyber history. Stuxnet was the first shot across the bow, a proof that code could cause physical destruction. But others followed. In 2015, Russia turned off the lights in Ukraine, cutting power to 230,000 people by hacking the grid’s control systems—a chilling preview of what’s possible. In 2024, China was accused of infiltrating U.S. telecoms, not just to steal data but to prepare for disruptions that could sever communications in a crisis.

Supply chain attacks are the new weapon of choice. The SolarWinds breach showed how hackers could poison software updates, reaching deep into the systems of thousands of organizations. CyberArk’s solutions tackle this head-on, securing the non-human credentials that power software pipelines. In a world where a single breach can halt global shipping or crash a stock market, that’s not just valuable—it’s indispensable.

A Fortress in the Shadows

The charts of CyberArk and its peers—Check Point, Nice, Palo Alto, CrowdStrike, Fortinet, Zscaler, Okta, and SentinelOne—stretch across the years from 2012 to 2024, their cyan lines rising like battle standards, teal and red moving averages weaving a tapestry of stability and growth. They tell a story of a world under siege, and the companies that stand as its defenders.

CyberArk’s rise isn’t just about money; it’s about what it represents. In a Cold War where the weapons are invisible and the stakes are everything, cybersecurity firms are the fortresses we rely on. Israel, with its unmatched cyber legacy, has given us one of the strongest. As the digital battlefield grows darker, CyberArk’s light shines brighter—a beacon of protection in a world that desperately needs it.

Thanks for reading,

Guillermo Valencia A

Co-founder of MacroWise

May 5, 2025