The True Drivers of Wealth Creation : Allocating Money in a Brave New World.

When a civilization or a company fails to create something new, its destiny is war or conflict.

Innovation is the true force behind progress. When humanity dares to rethink the fundamental principles of existence, we unlock the potential for exponential wealth creation. However, this requires a visionary founder. As Joseph Campbell suggests, the archetype of the Modern Hero is embodied by figures like Jim Simons with Renaissance Technologies, Steve Jobs with Apple, Bill Gates with Microsoft, Peter Thiel with Palantir, Elon Musk with Tesla and SpaceX, Pavel Durov with Telegram, and David Vélez with NuBank.

A legendary hero is often the founder of something new—a new era, a new religion, a new city, a new way of life. To discover something new, one must abandon the old model and seek out a seed idea, a germinal idea with the potential to birth great innovation. As Campbell describes in The Hero with a Thousand Faces.

Creation is the most powerful process of energy transmutation humans possess and, consequently, the greatest source of wealth. The challenge is that these epiphanies, if not connected and integrated, remain fleeting. Thus, the world not only needs innovators but also people who can combine these innovations with existing elements or apply them in unexpected ways.

Yet, the power of innovation does not end there. When combinations are exhausted, the focus shifts to optimization, imitation, and efficiency. The winner is the one with the most efficient supply chain and cost structure.

However, imitation carries a significant cost. At some point, the largest players develop monopolies and engage in such fierce competition that the only path to growth is through conflict.

When a civilization or a company fails to create something new, its destiny is war or conflict.

Interest rates serve as a crucial barometer, indicating the level of societal tension. Historical declines in Treasury bond prices signal that we are entering a new regime similar to the period between World War II and the climax of the Cold War in the 1970s.

The graph shows the S&P 500 drawdowns in red and the 3-month T-Bills in black. My thesis is that we are repeating the Cold War period. While there are tactical opportunities in Treasuries, the long-term trend is a multi-decade bear market. Conversely, the stock market represents a true opportunity. Drawdowns are frequent, but each drop paves the way for new highs.

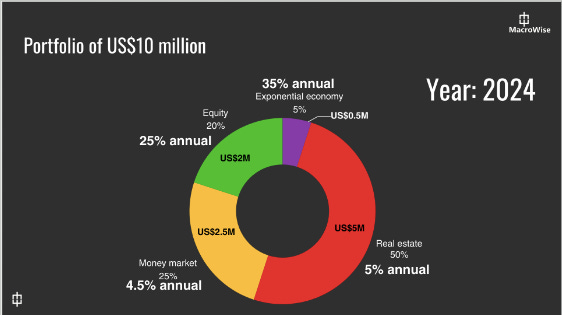

How should one allocate money in such a tense world? Imagine a family with $10 million, with 50% in real estate due to the nature of their business. After decades of diversified portfolios with limited results, they decide to invest 25% in a money market, 20% in strategic tech and commodities stocks, and 5% in the most innovative sectors we consider the exponential economy.

.

In a scenario where the market falls 50%, this portfolio would experience a modest 20% drop, assuming severe declines in the equity component. Over 10 years, the capital could potentially quadruple, outperforming a traditional 60/40 bonds-to-equity retirement portfolio or a diversified stock portfolio like the S&P 500.

This is not investment advice but a scenario demonstrating that the rules of asset allocation change in the face of geopolitical risk and the potential for a significant reinvention of our production model.

Thanks for reading,

Guillermo Valencia A

Cofounder of Macrowise.

Medellín, Colombia

May 19th , 2024