The Turkish Lira, Facebook and the Coming Zeitgeist

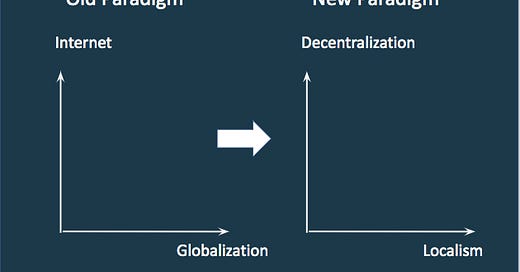

The devaluation of the Turkish Lira and a coming Facebook share crash will mark the transition towards two paradigms: decentralization and localism.

Paradigm shift of the drivers of economic growth.

Thomas Friedman stated, The World Is Flat, meaning that globalization and the Internet would level the playing field between industrial and emerging market countries. Our current reality is actually very different. The Internet is not evening the competitive landscape, but rather promoting a very complex fractal where a select few control the majority of information gathered and disseminated. The Rebalancing of our digital property will be one of the most important developments of the 21st century.

The Internet Fractal. Source: shromery.org

From Connectivity to Fragility

Globalization is based on the mobility of factors of production, including capital, labor, land and information. That in principle is very good. However, over multiple decades, globalization has been concentrated into a few major players. Big Banks and big capital, Tech Information Giants, cheap Chinese labor and the migration from emerging to developed markets.

The problem with this is that it creates colossal hierarchical structures, too big to fail.

It already happened in 2008 with big banks in the US, and we think that it is happening now with the tech-controlled monopoly of our information. Specifically with Facebook, who as the parent of Whatsapp and Instagram, reaches so many lives. The same is also happening in China, but the situation there is quite different. The government has a very well-established stake established in the monopoly, which contrary to the US, will boost the information mining control.

Big regulations and big sanctions against Facebook will signal the beginning of this new development. “How Facebook Has Hijacked Democracy” will be a headline everywhere.

Fear and Immigration

In the logic of globalization, immigration is an important mechanism to compensate for the imbalances created by the asynchrony of business cycles around the globe. It’s crucial for there to be trust as this free flow of people spreads across nations. Lately, this trust has been eroding. Global states are vulnerable to decentralized cells. While globalization creates free avenues for labor mobility, it opens the gates for drugs and terrorism as well.

The immediate solution has been the rise of populist governments. On the heels of Brexit, Trump, Marine Le Pen and Germany’s AfD party, even more far right movements have sprouted in Poland, Italy and Hungary.

Turkey, the Forgotten Door to Europe.

The Turkish Lira is on the verge of a currency crisis that will reverberate throughout Europe.

Turkey has been a key character for many changes in mankind throughout history.

Stefan Zweig wrote in Sternstunden der Menschheit (Decisive Moments of History) about how the Ottomans conquered Byzantium. Byzantium was the frontier of western civilization. It also marked the separation between the Catholic and Orthodox churches. The defense of Byzantium was a priority in the defense of Christinaty. For centuries the walls of Constantinople were able to withstand the attacks from the East…..until an event beyond anyone’s expectation occurred in 1453.

Something wholly improbable has happened. A few Turks have made their way through one of the many breaches in the outer walls, not far from the real point of attack. They do not venture to attack the inner wall, but as they wander aimlessly and full of curiosity between the first and second city walls they discover that one of the smaller gates in the inner-city wall, known as the Kerkoporta, has by some incomprehensible oversight been left open……

…...Mankind will never know the whole of the havoc that broke in through the open Kerkoporta in that fateful hour, or how much the intellectual world lost in the looting of Rome, Alexandria and Byzantium.

Today, the Kerkoporta is not made of stones, but instead the interconnectivity of the European financial system and the dam is holding back immigrants from Syria and many others who seek refuge from the conflict in the Middle East.

Uncontrolled immigration and the contagion of Turkey’s currency crisis is a threat to European stability, not only for the financial risk but also for empowering the populist movements advocating for distance from continuity. Turkey has decreased their foreign exchange reserve ratio from 37.5% in 2015, to 29.7% as of the end of January 2019. Turkey is on edge for a multitude of reasons: political instability, international diplomatic errors, balance of trade deficits, heavy economic reliance on one sector (construction), low foreign currencies and over dependence on foreign currency loans in the private sector.

The construction industry was able to source financing while the Turkish Lira was stable, or rising. Now however, the falling Lira has put a great amount of pressure on the industry. Large construction projects take years to complete and the changing financial landscape while a skyscraper is under construction can ruin the developer and it’s backers. The series of events that could cause a collapse is outlined by the following:

The falling Lira makes the income collected from sales by property developers worth less in terms of foreign currencies → Builders are unable to repay their foreign currency loans → Large apartment buildings remain unfinished → Property buyers who paid deposits lose their investments → Local banks that lent to local property traders can’t recover their loans → Local banks can’t cover their debts or reimburse depositors → Depositors learn of the bank’s problems and try to withdraw their money → The government bank guarantee scheme is forced to compensate depositors.

Source: BIS

This leaves Europe susceptible to a knockout effect. The European Banking System is comprised of deadmen walking, fed by the negative interest rates. The recipe for monetary expansion will only continue to work if the ECB remains a supranational entity and is able to surpass sovereign state authority. If individual nation-states decide to free themselves from the jurisdiction of the ECB, the tools of monetary stimulus will not be effective.

If populist movements continue to rise in Europe, long term rates of sovereign bonds will increase, affecting the balance sheet of many European Banks, and less credit will be available in the economy. With an ineffective monetary policy and the lack of political power for structural reforms, big fiscal will be the new normal in many developed countries in their effort to stimulate the economy in the short term.

Bogotá, April 17 2019

Guillermo Valencia A

Head of Global Macro Research