The Unwind of the Carry Trade: A Looming Currency Crisis for Emerging Markets

Fear in one asset class is the fuel of euphoria in another. As emerging currency markets destabilize, tech stocks often benefit from a flight to perceived growth potential.

Long Tech Stocks , Short Emerging Market Currencies

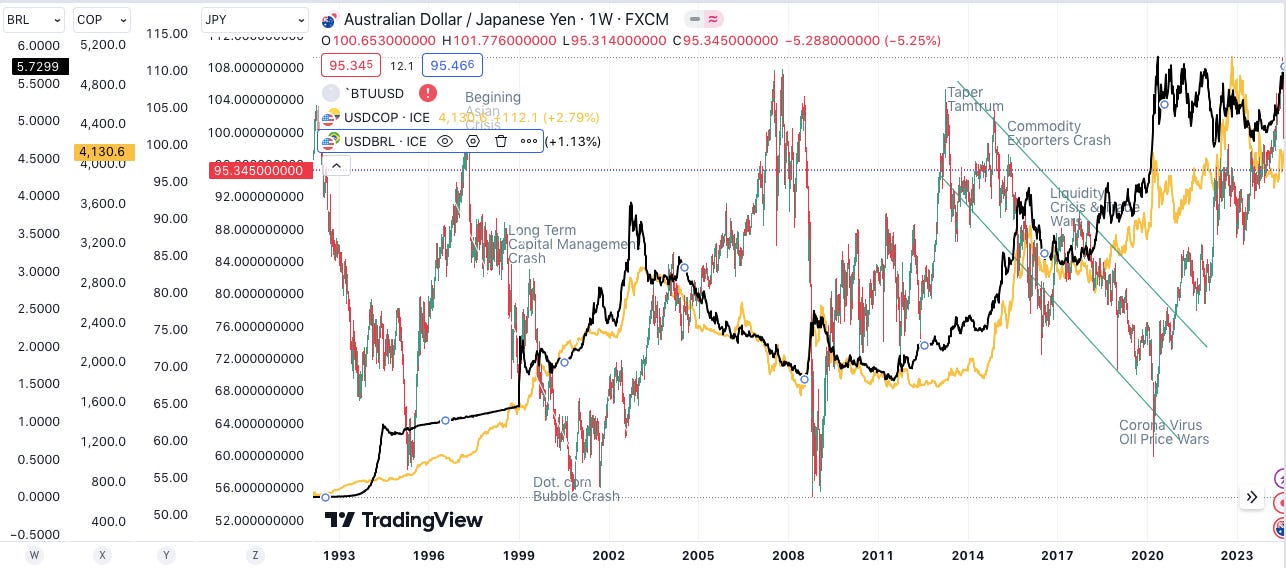

Financial markets are teetering on the brink of a significant risk: the potential unwinding of the carry trade, with the AUD/JPY as our proxy. This event threatens to unleash substantial instability, particularly in emerging markets, which have historically been highly vulnerable to such financial phenomena.

AUDJPY Vs USDBRL (Yellow) Vs USDCOP (Black)

Understanding the Carry Trade

In a carry trade, investors borrow in a low-interest currency (like the Japanese yen) and invest in a higher-yielding currency (such as the Australian dollar). This strategy thrives in stable conditions but can unravel swiftly when market dynamics shift, leading to what is known as the "unwind" of the carry trade.

Historical Context and Current Scenario

Historically, the unwinding of carry trades has led to significant market disruptions:

1997 Asian Financial Crisis: Massive capital outflows from Asia caused currencies like the Thai baht and Indonesian rupiah to plummet.

2008 Global Financial Crisis: The sharp appreciation of the Japanese yen during the crisis exacerbated global financial instability.

2014 Taper Tantrum and Oil Crash: Anticipation of tighter U.S. monetary policy led to significant depreciation in emerging market currencies.

Currently, the potential increase in Japanese yields could trigger a massive unwind of the carry trade. As Japanese interest rates rise, borrowing costs increase, making the carry trade less attractive. Investors would then start repaying their yen-denominated loans, causing the yen to appreciate and exerting downward pressure on high-yielding currencies like the Australian dollar (AUD/JPY).

Impact on Emerging Markets

The unwinding of the carry trade has far-reaching implications. Emerging market currencies such as the Colombian peso (COP), Brazilian real (BRL), Philippine peso (PHP), and Indonesian rupiah (IDR) are particularly vulnerable. These currencies often attract carry trade investments due to their higher yields compared to developed market currencies.

When the carry trade unwinds:

Capital Outflows: Investors pull out their investments from emerging markets to repay their yen loans, leading to capital outflows.

Currency Depreciation: The sudden withdrawal of capital causes these currencies to depreciate rapidly.

Economic Instability: Depreciating currencies lead to higher import costs, inflation, and economic instability within these emerging markets.

Vulnerability of Specific Emerging Markets

The most vulnerable emerging markets are those with high debt-to-GDP ratios and significant current account deficits. Among these, Brazil, Colombia, the Philippines, and Indonesia stand out:

Brazil: With a debt-to-GDP ratio of 93% and a current account deficit of -1.8%, Brazil's economic stability is highly susceptible to external shocks.

Colombia: Colombia's debt-to-GDP ratio is 50%, and it faces a current account deficit of -3.5%, making it vulnerable to capital outflows.

Philippines: The Philippines has a debt-to-GDP ratio of 45% and a current account deficit of -2.0%, which could lead to significant currency depreciation if the carry trade unwinds.

Indonesia: Indonesia's debt-to-GDP ratio stands at 35%, with a current account deficit of -2.5%, exposing it to risks from sudden capital flight.

The Game Theory of Oil Price Wars

Economic Indicators: Weak economic data and rising recession fears have created concerns about the stability of the bull market, especially in tech stocks. However, the more significant risk lies in the potential instability of emerging market currencies due to the carry trade unwind.

Oil Prices: With a potential recession on the horizon, monitoring oil prices becomes crucial. The increased oil production by the United States, Canada, Guyana, and Brazil (totaling an additional 2.5 million barrels per day) partially offsets the 1.3 million barrels per day reduction by OPEC+. This balance impacts global oil prices, which in turn affects economies dependent on oil exports.

The oil market, like many others, is subject to the strategic decisions of its major players. Saudi Arabia, with its 2.5 million barrels per day of spare capacity, could potentially flood the market. This move would aim to break weaker oil producers, complicating the economic landscape for emerging markets reliant on oil revenues.

Norwegian Krone(NOKUSD) , Brazilian Real (BRLUSD) , Austrialian Dollar (AUDUSD)

Potential Outcomes

Currency Crisis: The unwinding of the carry trade can lead to a full-blown currency crisis in emerging markets, characterized by rapid currency depreciation, inflation, and economic turmoil.

Impact on Tech Stocks: Interestingly, past unwinds of the carry trade have been positive for the NASDAQ and tech stocks. Investors seek refuge in more stable and growth-oriented assets during times of currency instability. Fear in one asset class is the fuel of euphoria in another. As emerging currency markets destabilize, tech stocks often benefit from a flight to perceived growth potential.

AUDJPY vs Nasdaq

Conclusion

The potential unwinding of the carry trade, driven by rising Japanese yields, poses a significant threat to emerging market currencies. Historical precedents suggest that such events lead to capital outflows, currency depreciation, and economic instability in these markets. Monitoring economic indicators, oil prices, and geopolitical developments will be crucial in navigating the potential fallout from this looming financial risk. Furthermore, while emerging markets may suffer, this crisis could paradoxically trigger euphoria in tech stocks, as investors seek out the growth prospects offered by technology companies.

Thanks for reading,

Guillermo Valencia A

Cofounder Macrowise

NYC, August 4th 2024