The Volatility Fork

The global economy is at a tipping point. Case A: Policy Makers Lengthen the Business Cycle. Case B: Full USA Recession.

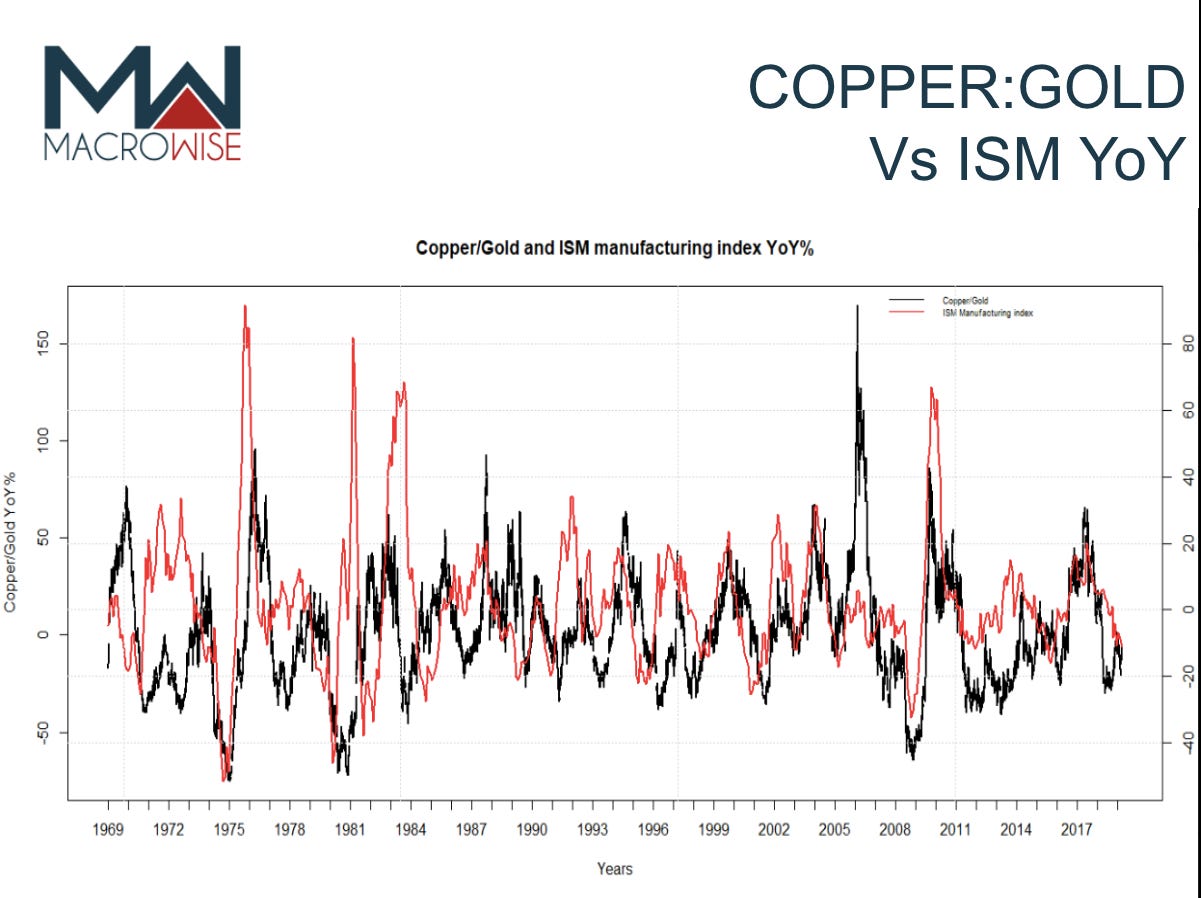

The global economy is at a tipping point. Our favorite leading indicator of the business cycle is the YoY variation between Copper vs. Gold. It is indicating that the global economy is at the bottom of the business cycle.

In attempting to use the predictive power of the business cycle, while not overstating the implied outcome, imagine a game of chess. There is an opening, middle and end game, but each game is different. Some games are very quick, some last ages. The number of players, strategies and tactics can also be immense. Each move determines the next move, while also shaping those further ahead.

Source: Bloomberg.

The global economy, full of ever-increasing players and factors, is not deterministic. However, using the analogy, we can better predict what stage we are at in the business cycle, how the players are expected to act, and play out various scenarios into the future based on a specific strategy that might be employed. By doing so, we aren’t focusing on the final outcome or when it will happen, but rather better understanding the potential tactics and strategies to be used by various policy makers. By doing this, we will be able to provide better insights towards building a portfolio.

In this newsletter we try to identify two main scenarios, the potential consequences and the principal players that could provide or drain liquidity from the market.

The graph below illustrates the ISM manufacturing index over the years. Dropping below 50 indicates a high probability of a recession, while a rebound would likely mean a prolonged bull market. One situation resembles 1984 and the other the recession of 2000.

Source: tradingeconomics.

Case A) Policy Makers Lengthen the Business Cycle

Strong USD → EM Panic→S&P 500 potential drawdown of 20% → Big Fiscal → Rebound in US treasuries yields to 3% level → Tech Bubble continues.

What is interesting is that this implies an extension of the cycle in the US and more fuel for the current tech bubble. It could also mean more weakness in EM currencies. Potential defaults, similar to the Latam debt crisis in 1984 or the Russian default in 1998.

Extrapolating this situation to the current trade war, suppose the scenario where the G20 meeting turns into a prolonged procrastination of a deal. The Trump administration perceives economic weakness inside of Chinese economic policies and escalates the competition not only in terms of trade wars, but tactical tech wars. Hong Kong manifestation continues an the Xi administration surprises the market with a sudden devaluation of the Chinese Yuan. China restructures loads of corporate debt into sovereign debt.

There is a strong reversal of the EM carry trade. The USD skyrockets. Italian bond yields push beyond 3.5%. The tension between Rome and Brussels intensifies. The ECB simulates a scenario of an Italiexit. Volatility increases and there are more potential corporate defaults within some EM corporate bonds. The pressure mounts over the Turkish Lira and the Argentine Peso. Investors get afraid of a default scenario. Latam currencies follow the path of strong devaluations, as well as other EM currencies including the South Korean Won.

Source: Bloomberg.

This scenario makes equity equity investors nervous and US tech stocks suffer a 20% drawdown.

The Trump administration decides to create a big fiscal spending package at the same time the FED cut rates to stimulate the economy and win the 2020 election. These measures lengthen the cycle. The ISM index rebounds, and US treasury yields reach the 3% level again. The equity bull markets continues onward. China also implements a massive fiscal stimulus.

Case B) Full USA Recession

Strong USD → Lower US Yields → Drawdown of 50% in tech stocks.

Source: Bloomberg.

It is the end of the tech bubble. There is a clear signal that the United States will enter into recession. Amazon falls more than 50%. The $5 Trillion ETF complex activates, with their VAR models selling because stocks are falling, which only accelerates and deepens the plunge. The ETF complex are not the only one’s selling. European banks crash more than 20%. The VIX is up and there is blood in the market. A few global macro funds manage to have a record performance.

The democrats blame the Trump administration of the recession, Trump loses political capital and power towards the 2020 election.

The FED considers negative interest rates to stimulate the economy. The US, Europe, Japan, UK and China move towards massive, coordinated fiscal spending. Industrial metals test a minimum and began a very strong rebound.

Our frameworks indicates there is a higher probability case A taking place than case B.

Sao Paulo, June 27Guillermo Valencia AHead of Global Macro Research

Buen articulo, escenarios complejos...Hay posibilidad de un escenario de aterrizaje suave?