The World of Bits is Transforming the World of Atoms.

In a changing world, the most frequent event is what matters the least. The outliers are what bring valuable information that will shape our future.

We are in the synergy of two technological revolutions. 80% of the companies in the S&P 500 will be disrupted by the game changers.

The inflation trade is crowded.

Long Semiconductors, Long Uranium, Long Copper, Long Crypto

From any perspective, the 2020 pandemic detonated a chain reaction of many game changing events. Massive fiscal and monetary stimulus, disruptions in the supply chains and massive volatility across many macro signals. In less than 2 years time, oil prices went from negative futures to almost $100. The narrative switched from deflation to inflation. The shale oil industry in the US went from staring down the barrel of bankruptcy to an incredible resurrection.

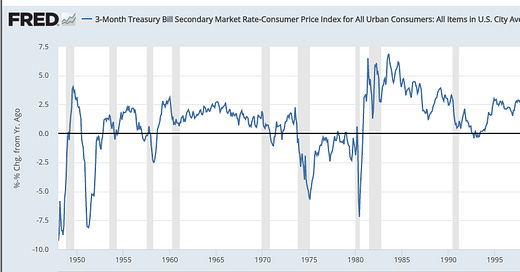

If we look at real interest rates, we are at levels only comparable with 1948, 1951, and 1980. All of them were points of inflection in the markets.

What is the signal here?

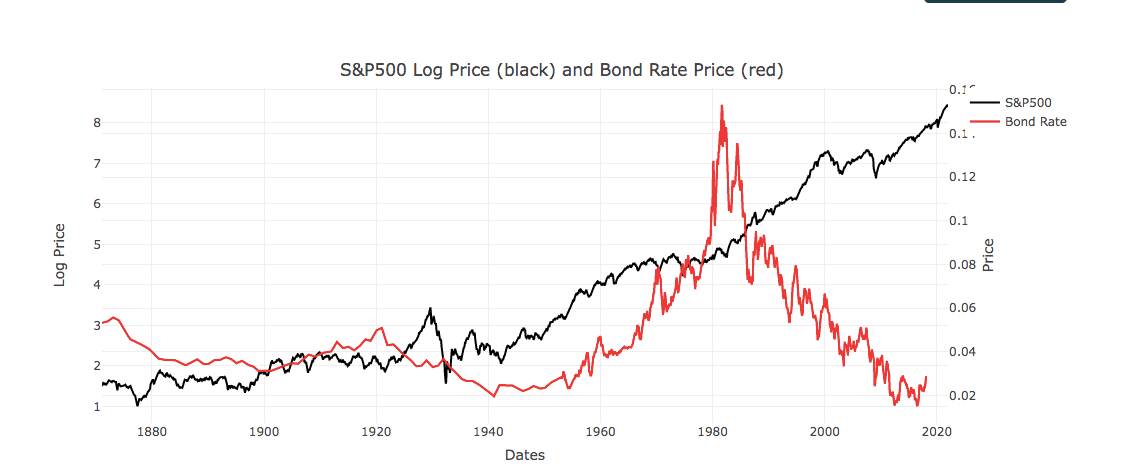

Forget the investment playbook we have been using. The pandemic was a catalyst for the reconfiguration of global supply chains. Globalization makes no sense in a world of intense geopolitical and technological competition. There is a division of trust in the global monetary system. One backed by the US and the other backed by China. That means there is such a thing as a risk free asset. The end of a bull market in US treasuries, which began in 1981 has officially ended. 2020 was the turning point in bond markets. However, history shows that the bust in bond markets is a very slow process. It could take as long as 20 (1900) to 35 years (1951).

I think in the short term the inflation trade will be very crowded.

The inflation trade is already crowded. Oil momentum is decreasing. That could indicate a top in US 10 year rates. (Black US rates, Red Brent Momentum)

There is a kind of resemblance to December 2018, with oil losing momentum.

Oil close to 100 USD is reinvigorating shale oil production. When I compare US shale oil production against the momentum in the Nasdaq it looks very similar to December 2018.

The rebound of momentum in Technology stocks was very strong.

Big Picture

What is the context here?

We are in a synergy of two, big technological revolutions. It happened in 1900, 1950, the 1980s and now again in the 2020s. One era rising and the other slowly declining. There are tremendous opportunities in equity markets however. The S&P 500 is not the best way to capture these opportunities. 80% of the companies at the beginning of the synergy period will be out of the index in due time. S&P 500 incumbents will be disrupted by the new business models and synergies.

When I look at real interest rates, a good reference point is 1951.

The beginning of the Cold War. Now the parallel is USA & China Cold War

Huge expansion of M2 & Fiscal Policy. Post COVID stimulus and China Silk road (equivalent to the Marshall Plan)

Product based innovation, not customer based. Strong focus on hardware.

Geopolitical competition for technological supremacy boosts product-driven innovation and the synergy between the two technological revolutions will have a deep impact on productivity.

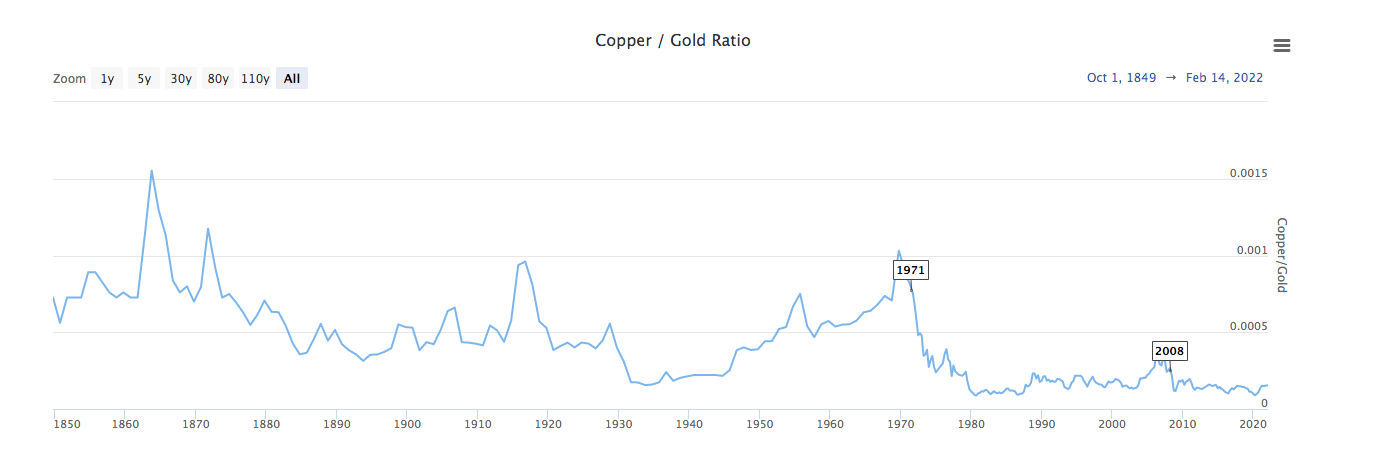

Copper is my favorite trade from the commodity perspective.

The ratio Copper- Gold

The bull market from 1890-1914 and 1949-1970 is a very interesting proxy for productivity.

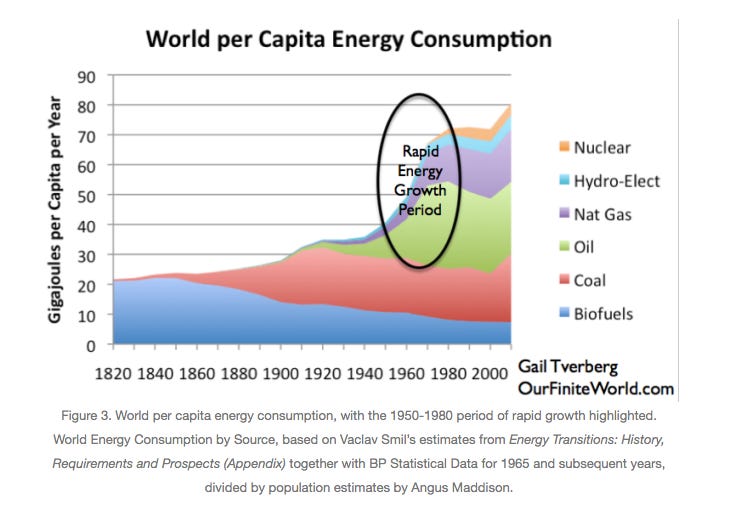

Energy

The synergy of these technologies would increase the demand for energy, in particular electricity. The uranium trade is at least a one decade bull market.

1900 Coal - Oil

1951 Oil, Coal, Gas

2020 Gas, Uranium, Renewables

Deep Mind in Google is Focus on the Right Problem

https://www.wired.com/story/deepmind-ai-nuclear-fusion/

Tech rotation from software to hardware

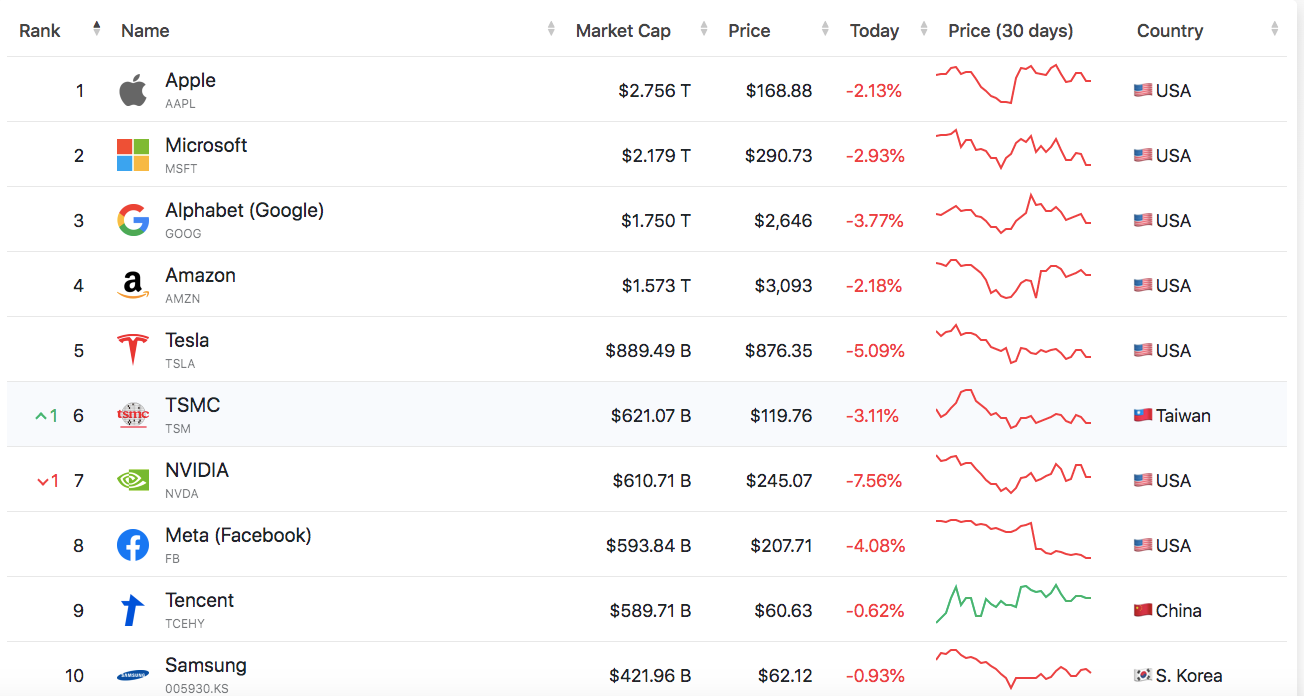

The next in top rankings will be TSM, NVIDIA, ASML…

Crypto

Blockchain is key in the synergy of these technological revolutions. For me, it is the interface between the world of bits and atoms.

Imagine your health provider having access to your genetic information in order to give you better medical treatment. How you ensure that you are a sovereign individual over your genetic information.

Imagine we want to use a common pool resource like quantum computing: State, Research Labs, Companies, Students…how do we create the governance of a common pool resource?

Blockchains are the evolution of Westphalian sovereignty into sovereign digital communities. Blockchains allow us to create a decentralized governance over common pool resources, including money, the Internet, AI, Genomes and Quantum Computing.

I see BTC reaching the market cap of Apple and Ethereum that of Google.

Why are there so many Armageddon predictions?

It makes sense to be pessimistic when we look at the size of corporate debt around the world. 132 Trillion USD of global corporate debt with 35 Trillion in China alone. In a world where there is an extreme fear of an increase in interest rates, this picture looks like Armageddon. For me, it just means that in the end game the Fed cannot increase interest rates as aggressively as some may think.

80% of the companies are zombies. Their protagonism in the S&P will slowly decay as the bear market in bonds evolves. However, the most frequent event is what matters the least. We have to focus on the 20% of the companies that will shape our future.

Demystifying the link between population growth and interest rates.

There is a myth that interest rates can not grow because of the terrible demographic trends. It is not about population, but rather the demand for energy. We have the roaring 20s without a boom in demography as the synergy of two technological revolutions have created a deep impact in productivity.

While the demographic trends are declining, there is a boom in the population of industrial robots.

The world of bits is transforming the world of atoms.

Guillermo Valencia

February 19th, 2022

Florianopololis , Brazil.