🌐 US Treasury Crash: Decoding the Paradigm Shift in the Global Economy 📈

The old order is undergoing a relentless purge, clearing the way for the rise of new, dynamic economic forces.

On one front, developed markets are reimagining and rewiring their intricate supply chains. On another, China is orchestrating an industrial revolution across emerging markets, all at an astonishingly low cost. This paradigm shift demands our keen attention and strategic acumen as we navigate the path forward. #EconomicRevolution #GlobalShift #StrategicInsights

A Declining Model: Since 1990, the world has followed a growth path focused on shifting production to China, where abundant labor and expansive markets existed. But what does the recent drop in global treasury prices tell us about this model?

Debt Dependency: This approach relied on the excess reserves generated by China's trade surplus, which were invested in U.S. treasuries, maintaining low-interest rates and an affordable debt cycle. But this cycle is fading before our eyes.

Changing Economic Rules: The decline in U.S. treasury prices is a clear indicator that the rules of the economic game are changing. The U.S. and China are embroiled in a kind of "cold war," revolutionizing the global economic landscape.

Treasury Crash: As treasury prices plummet, other countries are exploring alternatives to invest their reserves, impacting global borrowing costs. This new landscape presents us with a critical challenge: How can the global economy continue to grow?

New Growth Engines: In this new economic era, two key growth engines are emerging.

Value Chain Reconfiguration: In the developed world, reconfiguring value chains driven by changes in energy prices and interest rates is creating opportunities for countries and companies that adapt to this transformation.

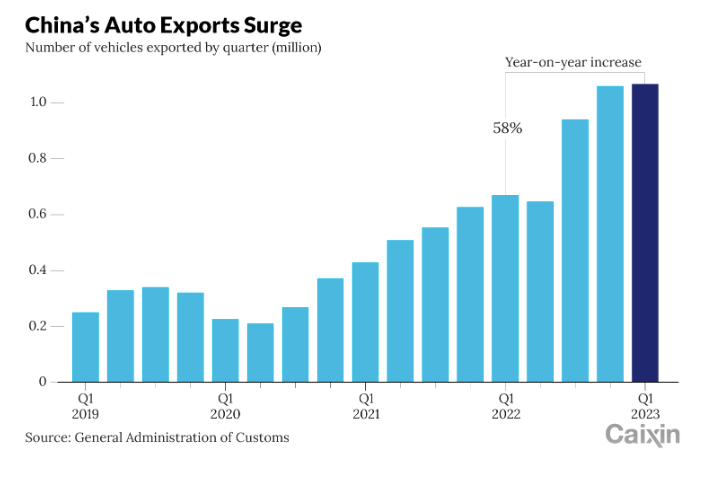

China as Another Growth Pole: China is emerging as the epicenter of growth by industrializing emerging countries. Its focus on long-term stability and infrastructure investment promises a profound impact.

The Great Purge: Higher interest rates threaten to trigger debt crises and inflation in emerging countries, potentially leaving them at the mercy of China. We are in an era of change and transformation. Those who can adapt and build will be the true winners in this new economic landscape.

A World in Transition: The world is moving toward a more localized approach, where resilience and value chains are essential.

The Crossroads of Pension Funds: Conservative assets are no longer as safe. Pension funds are struggling with their traditional investments. This implies an imminent asset rotation, shifting from bonds to stocks and commodities. Despite short-term volatility, stocks offer long-term opportunities, while bonds may lag behind.

Ironically, amid the media noise, this is one of the best investment scenarios!

BE A BULL WHEN EVERYBODY IS EXPECTING A BEAR MARKET.

#GlobalEconomy #EconomicGrowth #Adaptation #Investments 💼📈 (If you find value in these insights, please share!)

Feel the economic transformation and join the conversation. How do you think this new era will impact your investments and business strategies? Share your ideas and perspectives below! 👇