Volatility Isn’t Risk—It’s the Sound of Progress

Here’s the punchline: don’t sweat the volatility. It’s the sound of development—learning, adapting, building. The old economy’s calm? That’s where the cliff waits.

Imagine you’re hiking up a mountain. The path is uneven, with loose rocks shifting under your feet. Every stumble feels like a warning, a jolt that makes your heart race. But those rocks aren’t the danger—they’re just part of the climb. The real risk isn’t in the shifting ground; it’s in the cliff you don’t see coming. In markets, volatility is like those rocks: noisy, unsettling, but not the enemy we’ve been taught to fear.

We’ve got this idea stuck in our heads that volatility equals risk. It’s an easy mistake to make. When risk explodes—like it did in 2008 or 2020—volatility comes along for the ride, screaming loud enough to drown out everything else. Our brains, wired for survival, latch onto that noise. Fear kicks in, panic takes over, and suddenly we’re running on dopamine and heuristics, not reason. Today’s world doesn’t help.

Social media—Instagram, Twitter, you name it—hijacks that same circuitry, amplifying every market dip into a five-alarm fire. Add AI-driven trading bots squeezing overleveraged positions, and you’ve got a recipe for chaos that hits retail investors right where it hurts: the panic button.

But it’s not just trading floors feeling the heat. The media spins narratives faster than you can refresh your feed, exploiting our emotional wiring for clicks. Greed, fear, political tribalism—it’s a sea of noise out there. To navigate it, we need more than gut instinct. We need curated signals, a way to cut through the chaos and see what’s really happening.

The Old Map Doesn’t Work Anymore

For most of the 20th century, we pictured markets like a math problem: a bunch of time series with two dials—returns and volatility. Turn down the volatility, diversify across low-correlation assets, and voilà, risk managed. It’s a comforting story, like a security blanket for investors. But it’s not how markets actually work.

Markets aren’t flat lines on a chart. They’re living, breathing networks—companies tied to consumers, suppliers linked to lenders, all shifting and evolving. Some nodes grow stronger; others fade away. It’s less like a textbook graph and more like a teenager stumbling through puberty: messy, awkward, but full of creative destruction. Right now, that’s exactly what we’re seeing. The old economy—built on debt and yesterday’s industries—is creaking. A new one, powered by tech and innovation, is taking shape. Both are volatile, but for different reasons. The old is shaking because it’s breaking down. The new is trembling because it’s growing up.

So what’s investing really about? It’s not just chasing returns or dodging volatility. It’s about survival—figuring out which companies, which nodes, will still be standing in a decade. The real risk isn’t in the bumpy ride; it’s in betting on the wrong side of history.

Signals Over Noise

To prove it, I’ve built a set of monitors—12 signals plus a few extras—to peek beneath the headlines and see what’s really going on. These aren’t your CNBC talking points. They’re the pulse of the economy, curated to separate signal from noise. Let’s walk through them.

Monitor 1: The Pulse of Today

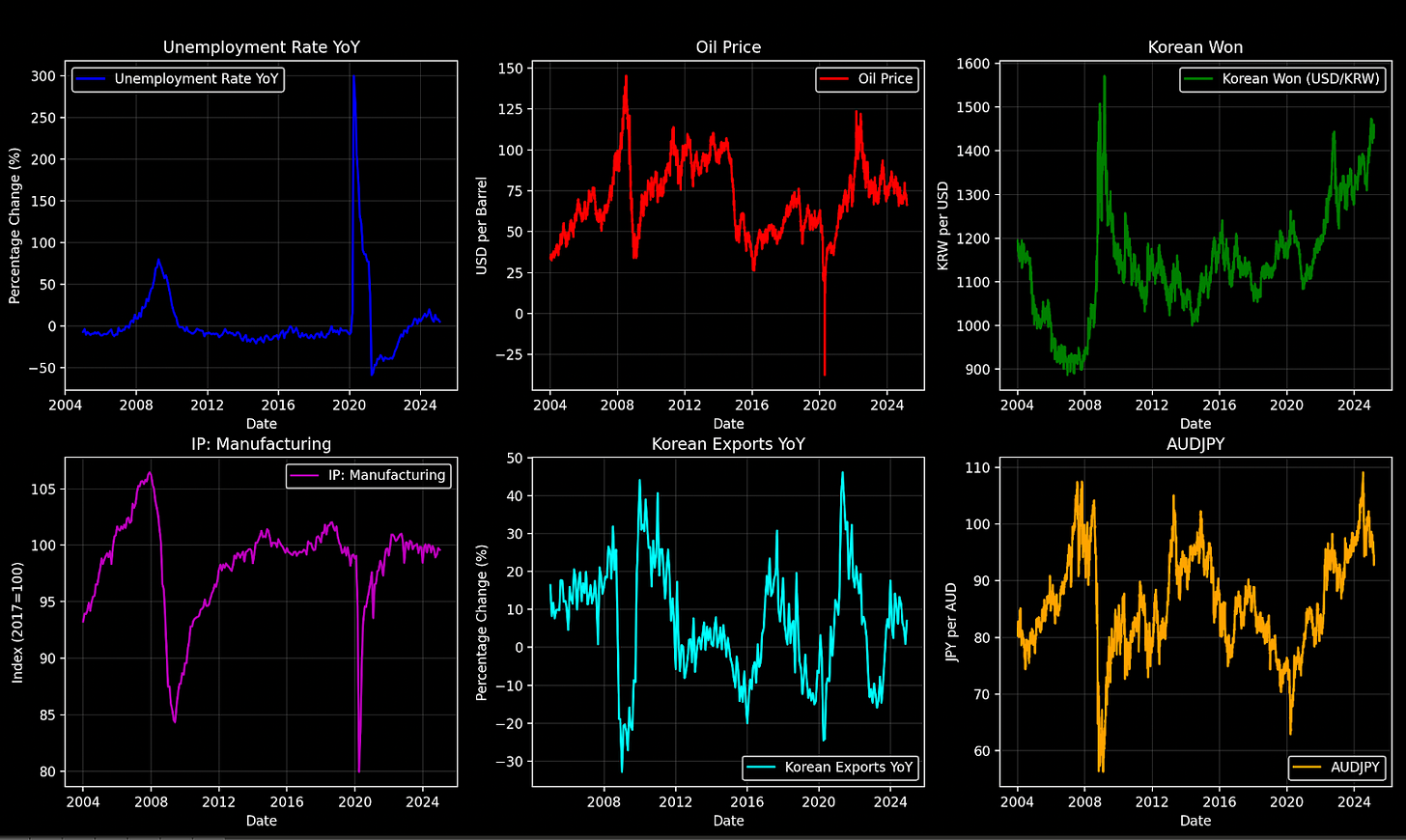

Signal 1: Unemployment Rate YoY VariationA classic recession proxy. When the year-over-year change tops 50%, it’s time to worry. Right now? It’s below that line. Recession? Not today.Unemployment Rate YoY

Signal 2: Oil PricesOil’s at a crossroads—low prices signaling weak demand, with electrification in cars piling on the pressure. This isn’t just about gas stations; it’s a warning for commodity-driven economies.Oil Price

Signal 3: Korean Won and Trade WarsThe Korean Won’s at levels we haven’t seen since 2008. As a net exporter, Korea’s a canary in the global trade coal mine. Pair this with oil’s weakness, and it’s clear: emerging markets might be the real casualties of trade wars.Korean Won

Signal 4: US Industrial ProductionNot stellar, not terrible. If recession were knocking, this would be shouting. It’s not.Industrial Production

Signal 5: Korean Exports YoYA window into global trade. They’re ticking up but flashing a warning—our models see trouble brewing by 2026. For now, it’s a yellow light, not red.Korean Exports YoY

Signal 6: AUDJPY (Carry Trade Proxy)Here’s the big one. The Australian Dollar versus the Japanese Yen tracks the carry trade—where investors borrow cheap yen to buy higher-yielding assets. On August 7, 2024, that trade started unwinding, and the volatility we’re feeling now is its echo. This isn’t noise; it’s a liquidity tremor.AUDJPY

Monitor 2: Old vs. New

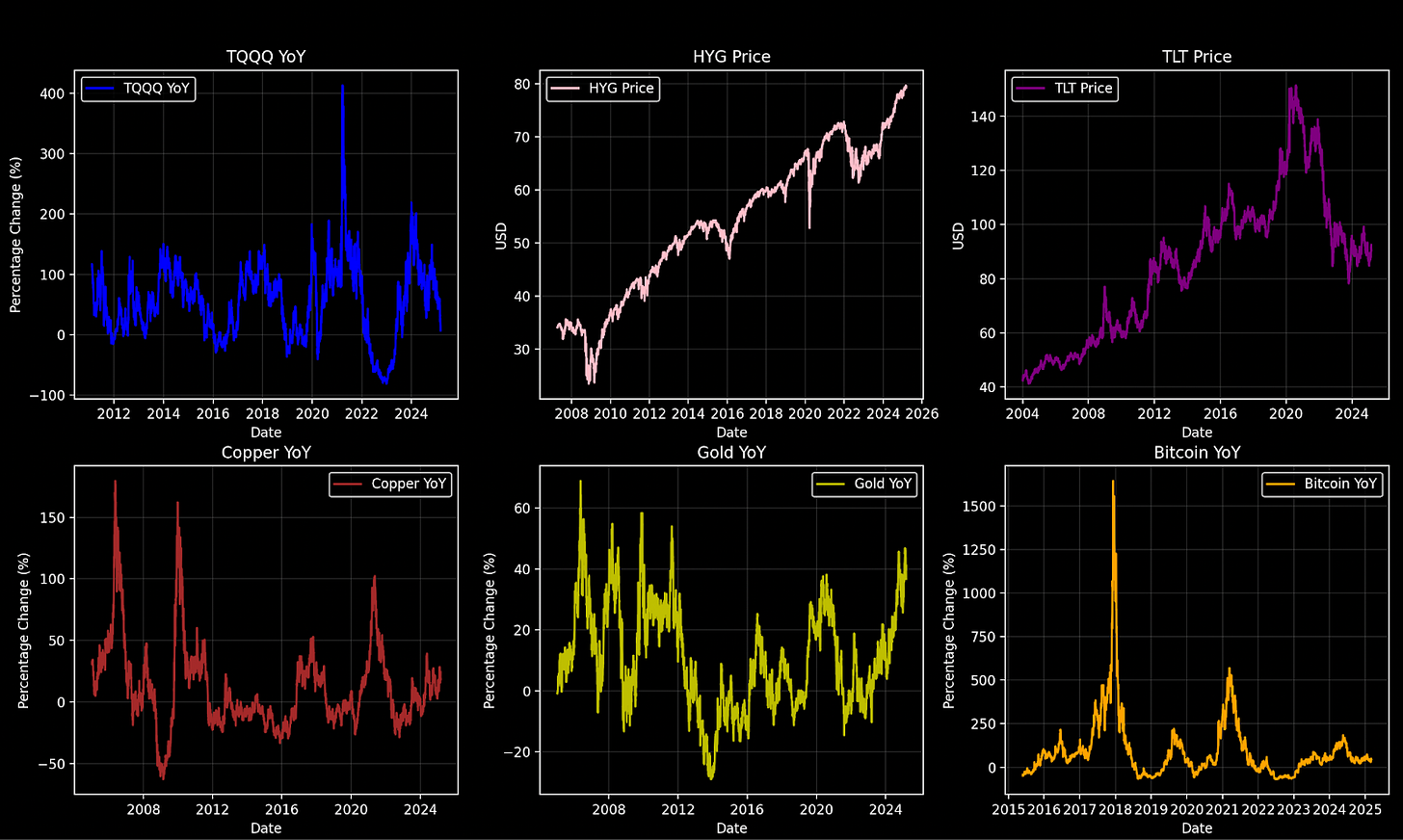

Signal 7: TQQQ (Animal Spirits)TQQQ, a leveraged bet on the NASDAQ-100, captures market momentum. It’s crashed hard at low-momentum points—2016, 2018, 2022—showing the new economy’s growing pains. Volatility here is progress, not peril.TQQQ YoY

Signal 8: HYG (Zombie Land)HYG tracks high-yield corporate bonds—the old economy’s debt-fueled backbone. Markets wobbled yesterday, but HYG stood firm. That’s not strength; it’s a red flag. Think Turkish lira in 2020: rock-solid until it wasn’t. The real risk is in this calm.HYG Price

Signal 9: TLT (Long-Term Yields)TLT, tied to US long-term Treasuries, is down 50% since 2022 with no rebound. Debt markets are screaming trouble—tariffs, supply chain rewiring, and a multipolar world make inflation a beast central banks can’t tame.TLT Price

Signal 10: CopperCopper’s the global economy’s nervous system. Its year-over-year change is postive—no recession signal here.Copper YoY

Signal 11: GoldGold’s climbing, echoing TLT’s unease. It’s pricing a lack of geopolitical trust—maybe even a new cold war.Gold YoY

Signal 12: BitcoinBitcoin’s the wild child of the new economy—hypervolatile but maturing. Web 3.0 is about democratizing value, and Bitcoin’s its monetary heartbeat. Growth hurts, but it’s not risk.Bitcoin YoY

Bonus: Yield Differentials

US-Japan, US-Germany, US-ItalyJapan and Germany are closing the yield gap with the US, fueling that carry trade unwind. Italy’s holding a positive differential—for now. Could Europe replay 2012? Not yet, but stay sharp.Yield Differentials

Where the Real Danger Hides

Here’s the punchline: don’t sweat the volatility. It’s the sound of development—learning, adapting, building. The new economy’s bumps are signs of life. The old economy’s calm? That’s where the cliff waits. When debt-laden giants like HYG look steady while everything else shakes, that’s not safety—it’s a setup for hypervolatility down the road.

Next time the market jolts, take a breath. Look past the noise to the signals. The road’s rocky, but it’s leading somewhere. And if you found this perspective worth a damn, share it with a friend.

Kind regards,

Guillermo Valencia A

Cofounder of Macrowise

March 11, 2025